Cardano DeFi Steals The Show, Outperforms The Market With Explosive Transaction Growth

09 Mayo 2023 - 5:30PM

NEWSBTC

Despite the recent market dip, Cardano’s decentralized finance

(DeFi) ecosystem has seen a significant surge in activity, with

transactions on Cardano DeFi apps soaring to 250,000 per epoch from

160,000 transactions during the previous epoch. This remarkable 56%

increase in transaction volume has been attributed to the launch of

new DeFi protocols on the network and the active community of

developers and users driving innovation for the protocol.

Related Reading: Only 6% Left Until Cardano Hits Max Capacity, What

This Means For ADA Cardano DeFi Challenges Market Slump According

to Cardano Ambassador Yevhen, the latest hype around meme coins

like Snek and Pepeblue has also contributed to the transaction

surge. Snek is a crypto asset based on memes of snakes with

interior monologue captioning, while Pepeblue is a recently

introduced crypto asset on the Cardano network and in its

metaverse. Yevhen believes this increased interest in meme coins

has brought new users to the network and boosted transaction

volume. Aside from the hype around meme coins, several crypto

exchanges and liquidity protocols on the Cardano blockchain have

reported significant increases in activity in recent weeks. Per

Yevhen’s analysis, these include Sundaeswap ($SUNDAE), Minswap

($MIN), MuesliSwap ($MILK), Wingriders ($WRT), and Liqwid Finance

($LQ). These protocols have been lauded for their user-friendly

interfaces, low transaction fees, and high liquidity. Sundaeswap,

for example, is a decentralized exchange that allows users to trade

Cardano-based tokens with low slippage and high liquidity. The

platform has seen a surge in activity thanks to its user-friendly

interface and low transaction fees. Minswap, on the other hand, is

a decentralized exchange that allows users to trade Cardano-based

tokens with zero fees. Furthermore, Liqwid Finance, a decentralized

lending protocol on the Cardano network, has already surpassed $50

million in total value locked in just a few months since its

launch. This platform allows users to lend and borrow Cardano-based

tokens with low fees and high liquidity. The recent surge in

Cardano DeFi activity has been attributed to various factors,

including the launch of new DeFi protocols, the active community of

developers and users on the network, and the hype around meme

coins. ADA Follows The Market Trend The recent dip in ADA’s

price can be attributed to the broader market downturn affecting

the cryptocurrency industry. Over the past few days, several major

cryptocurrencies, including Bitcoin and Ethereum, have experienced

significant price declines, dragging down the entire market. The

price of Cardano’s native cryptocurrency, ADA, has experienced a

significant dip in the past 24 hours, reaching the $0.3586 level.

This marks a 40-day low for the cryptocurrency, with the last time

it was at this level being April 28th. However, ADA has managed to

stall a further decline and has reported a slight gain of 0.9% in

the last 24 hours, trading at $0.3630 The decline in Cardano’s

native token, ADA, is further compounded by the fact that it has

lost its 50 and 200-day moving averages (MA) since the onset of its

decline on April 28th. In the event of further drops, ADA must

maintain two critical support levels to prevent a potential decline

to the $0.2 territories, which it has not visited since January

2023. These levels are the $0.3441 level and the $0.3034 floor.

Related Reading: Litecoin (LTC) Falls Under $80, Is It Time To Buy

Now? Featured image from Unsplash, chart from TradingView.com

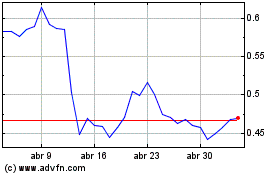

Cardano (COIN:ADAUSD)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

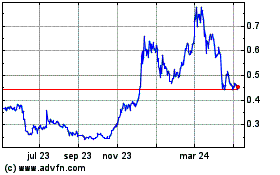

Cardano (COIN:ADAUSD)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024