SUSHI Down 45%: What’s Driving the Decline?

17 Mayo 2023 - 6:30PM

NEWSBTC

The price of SUSHI, the native token of SushiSwap, a decentralized

exchange, is down 45% from February 2023, when prices peaked at

$1.63, the highest level in six months. SushiSwap Token Redesign

This contraction is despite the successful implementation of a

proposal to redesign SUSHI’s tokenomics, making SUSHI, a governance

token, more deflationary. The proposal was first made in December

2022 by Chief Chef Jeremy Grey and was voted on and agreed on by

the community early this year. Related Reading: SushiSwap To

Redirect 100% Trading Fees To Treasury The proposal passed with a

majority vote and will seek to reduce the SUSHI supply over the

years. At the same time, it will increase the rewards for liquidity

providers while encouraging users to stake SUSHI for longer. Grey

argued that this implementation would promote decentralization

while making the protocol have “more equitable governance with

sustainable economics.” Eventually, by redesigning SUSHI’s

tokenomics, the goal will be to keep annual inflation between 1% to

3%. The latest data from MoneyPrinter shows that SUSHI’s annual

inflation stands at 1.23%, aligning with SushiSwap’s tokenomics

redesign. If anything, this inflation rate is lower than Bitcoin,

which has an annual issuance rate of 1.82%. SUSHI’s inflation is

also lower than Cardano, which has an annual emission of 1.79%.

While analysts expect low inflation to support prices in the long

haul, the performance of SUSHI in the first half of 2023 has been

dismal. SUSHI is down 45% from 2023 highs and 99% from 2021 peaks

when the token changed hands at around $22. Blame The Winter, Hack,

And Regulators While the markets have recovered, some, including

SUSHI, could still be reeling from the effects of the crypto

winter. Last year, Bitcoin, the largest coin by market cap, crashed

by over 70% after peaking at over $69,000 in November 2021. The

collapse of BTC dragged the altcoin market with it, forcing the

more volatile assets even lower, adversely affecting SUSHI. Related

Reading: SushiSwap Burns $5 Million Per Year, But Will It Rebrand

In 2023? As an illustration, SUSHI is trending at 2022 lows at

around $0.89, retesting a critical multi-month support level.

Prices are also capped as investor confidence took a hit following

SushiSwap’s RouterProcessor2 contract exploit in early April 2023.

Hackers ended up with $3.3 million. Although the flaw has since

been patched, the reputational damage associated with the

vulnerability dents investor confidence. It remains to be seen how

SushiSwap will navigate potential new regulations, particularly

those from the United States. Some policymakers have taken a

negative stance towards cryptocurrency, causing users in the

country to hesitate to engage with DeFi protocols due to potential

legal consequences. Feature Image From Canva, Chart From

TradingView

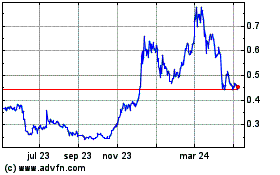

Cardano (COIN:ADAUSD)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

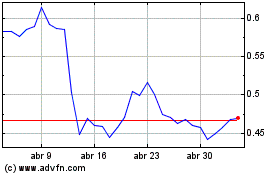

Cardano (COIN:ADAUSD)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024