Bitcoin Cash Price: Investors Must Avoid These Levels To Prevent Losses

07 Octubre 2022 - 1:45AM

NEWSBTC

Investors, who are keeping a close eye on Bitcoin Cash and want to

avoid losses, should steer clear of these crucial price points. As

of this writing, Bitcoin is still showing a little bit of

bullishness, despite losing a few digits from its price. BTC

retreated below the $20K mark, and now trades at $19,998, according

to data from Coingecko. Short-term support for the bears came from

rejection wicks at the $20.5k level. Even Bitcoin Cash, the fork of

BTC, isn’t immune to this issue. BCH is in such a jam, despite

Bitcoin losing the $20k psychological support. There have been

recent reports regarding a number of developments with potentially

profound implications for BCH. This report indicates that Bitcoin

Cash’s transaction volume has been below the average of 27,734

daily transactions. Lower transaction volumes are a negative

indicator to both potential and existing investors for BCH, thus

this could be an issue. Related Reading: Hedera: Investors Should

Check Out These Data Before Buying HBAR Bitcoin Cash: Formidable

Wall For The Bulls Bitcoin Cash’s value fell 35.50% between the

July 29 rally and the September 19 low, before rebounding 17.40%.

After that time, however, Bitcoin Cash’s price remains stable.

These days, you can buy Bitcoin Cash for as little as $96.559 and

as much as $166.025. Furthermore, BCH has a support level at

$112.246 and a resistance level at $125,912. Although CCI and Stoch

RSI readings are optimistic, the stated resistance level remains a

formidable obstacle for BCH bulls to overcome. Even though the

Chaikin money flow index is optimistic, it is establishing a

downward trajectory, indicating that the velocity of selling is

increasing. The CMF index’s gloomy prognosis, on the other hand, is

more pronounced on the 4-hour time range. The 4-hour CMF is -0.05,

indicating that sellers are gaining control of the BCH market.

Currently, the question is whether BCH can still recover. Possible

Recuperation? Or Further Decline? The BCH support line stays

unchanged. However, there are two levels of resistance that

investors and traders should target: $125.912 and $138.835. Source:

TradingView The former level was breached twice on August 23

and September 9, but the bulls were unable to sustain the break,

resulting in a price decline to $112.246. A breach of the $125.912

resistance can be interpreted as a psychological buy signal for

investors. Since the fall on September 13, a modest uptrend is

building on the 4-hour time period. A strong closing in today’s

trade could aid the bulls in maintaining momentum and finally

surpassing the indicated resistance levels. Related Reading:

Polkadot Seeing Lots Of Development Activity – But Why Is DOT Stuck

In The Cellar? BCH market cap at $2.28 billion | Featured image

from CriptoFacil, Chart: TradingView.com

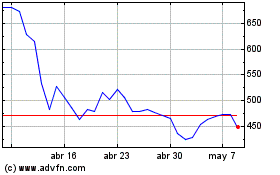

Bitcoin Cash (COIN:BCHUSD)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Bitcoin Cash (COIN:BCHUSD)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024