Cardano Whales Record Most Active Week In 9 Months, Bullish?

08 Febrero 2023 - 5:33AM

NEWSBTC

On-chain data shows the Cardano whales have just had their most

active week in nine months. Here’s what it may mean for the asset’s

price. Cardano Whale Transaction Count Has Been Elevated Recently

As per data from the on-chain analytics firm Santiment, the last

time similar whale activity was observed was back in May 2022. The

relevant indicator here is the “whale transaction count,” which

tells us the total number of Cardano transfers taking place on the

network that involved a movement of ADA worth at least $100,000 in

value. When the value of this metric is high, it means whales are

making a large number of transactions on the blockchain currently.

Such a trend suggests these humongous holders have an active

interest in trading the cryptocurrency right now. Generally,

activity from the whales can be something to watch for, as the

sheer scale of this cohort’s movements can carry the power to cause

visible shifts in the market. Therefore, whenever the whale

transaction count has high values, the price of the asset may feel

some high volatility. Now, here is a chart that shows the trend in

this Cardano indicator over the last few months: Looks like the

value of the metric has been pretty high in recent days | Source:

Santiment on Twitter As displayed in the above graph, the Cardano

whale transaction count has been at very high values during the

past week. In fact, the past week was the most active for this

cohort since nine months ago, back between the 11th and 17th of May

2022. Interestingly, in that previous instance, the ADA price

observed a 36% rally between the start of the week of high whale

activity and the local top in early June (which was the next

month). Related Reading: This Bitcoin On-Chain Metric Is At A

Historical Resistance, Will BTC Decline? It’s possible that the

current week of high whale transactions may result in the value of

Cardano feeling a similar constructive effect. However, it’s far

from a certainty. The reason behind that is the indicator doesn’t

distinguish between selling and buying transactions, so the current

high activity could very well be dominated by distribution from the

whales, which might provide a bearish effect on the price. In the

chart, Santiment has also shown data of the “ADA Supply

Distribution” metric for the addresses holding between 1 million

and 100 million ADA. The Supply Distribution measures the total

number of addresses that are currently holding a number of coins

falling inside a range (which, in the current case, is 1 million to

100 million ADA). It seems like overall, 36 new addresses have

popped up in this range since the start of the year, which could

suggest that there has been some accumulation going on in the

market recently. Related Reading: Shiba Inu Takes 3% Hit, Gets

Flipped By Polkadot In Market Cap Earlier during the rally, the

metric’s value saw a plunge, but in the last few days, there has

been some fresh rise, hinting that at least some of the current

high Cardano whale activity could indeed be for accumulation

purposes. ADA Price At the time of writing, Cardano is trading

around $0.3975, up 4% in the last week. ADA seems to have been

trading sideways recently | Source: ADAUSD on TradingView Featured

image from Vivek Kumar on Unsplash.com, charts from

TradingView.com, Santiment.net

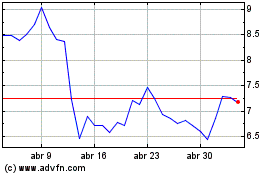

Polkadot (COIN:DOTUSD)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Polkadot (COIN:DOTUSD)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024