Over the past two years, NFTs, or non-fungible tokens, have taken

over the conversations in the crypto market. These digital assets

are welcoming the general population into the crypto space, with

celebrities, athletes, and billionaires getting an opportunity to

connect with their fans. While the “NFT” buzzword has been overused

across mainstream media and social media platforms, many investors

and holders of NFTs do not understand what NFTs are and why they

were created. I could go as far as assuming that even the experts

in the crypto space today don’t necessarily fully understand what

NFTs are used for (minus digital art and collectible items) and

what the future holds for this budding industry. In this article,

we remove any fog surrounding the space and explain the widespread

use cases for NFTs, the projects working in the NFT space and what

the future holds for the space. Understanding Non-fungible Tokens

(NFTS) Non-fungible tokens, or NFTs, are digital tokens that are

built on the blockchain and used to represent ownership of unique

assets. Via NFTs users can show immutable ownership of assets such

as art, music, videos, collectibles, and even title deeds. The

differentiating factor between NFTs and traditional data records is

that NFTs can only have one owner at a time, secured by the

blockchain, meaning no one can modify the record of ownership, or

create a copy of the NFT. As the name suggests, NFTs are

non-fungible, an economic term that describes uniqueness.

Generally, NFTs are built using the same technology as

cryptocurrencies and are based on the blockchain, but that’s where

the similarities end. Fiat currencies and cryptocurrencies are

“fungible” meaning they can be traded for one another without any

implications. Simply, you trade one US dollar for another US

dollar, or one Bitcoin for another Bitcoin, given they are always

equal. However, NFTs are drastically different from

cryptocurrencies due to their non-fungible properties. Each NFT

includes a unique digital signature that differentiates one NFT

from another. As such, one Bored Ape Yacht Club (BAYC) NFT is not

equal to a CryptoPunk or Azuki NFT, actually, no two BATC NFTs are

the same too. These properties have seen the value for NFTs sore

since coming to light in 2014 as the industry becomes an

increasingly popular avenue for artists to sell and collectors to

buy the artwork. One of the most popular NFT artworks, Everyday’s:

The First 5000 Days by Beeple, sold for a record $69 million at

Christie’s, the 255-year old auction house, last year in

March. Until October, the most Mike Winkelmann — the digital

artist known as Beeple — had ever sold a print for was $100.

Beeple’s $69 million NFT: Everyday’s: The First 5,000 Days by

Beeple (Image: Beeple) Since then, hundreds of NFT pieces

have sold for millions, opening up the market for these digital

artworks. Snoop Dogg, Steph Curry, Lil Wayne, Lionel Messi, Neymar

Jr, Justin Bieber, Paris Hilton, and several other celebrities have

all bought into the NFT space, owning at least one NFT. As such,

the NFT market value has exponentially grown into a $50 billion

market, according to DappRadar, showing potential for future growth

as even more investors buy these digital assets. Despite digital

art and files dominating the NFT space, it only represents only one

way to use these digital assets. NFTs, as explained above, can be

used to represent unique ownership of any asset and file, from land

title deeds, academic certificates, or any item in the digital and

physical realm. Below we look at some of the forgotten use cases of

NFTs that could open up the world to a new digital revolution. The

Wider Use Cases for NFTs It is hard to imagine NFTs as anything

else rather than the wonderful digital pieces of art displayed

across OpenSea and Looksrare marketplaces. Far from it, NFTs have

widespread use cases that can be used to represent any kind of

asset whether it’s your table, title deed, or even intangible

assets such as royalties and intellectual property rights. Apart

from the wide use of NFTs in the gaming world, these digital assets

have more to offer the global financial and economic ecosystems.

Here, we discuss some of the ways that NFTs can be used and the

benefits they offer to the global economic systems.

1. Intellectual Property and Royalties One of the

major reasons Bitcoin (and with respect to the crypto and

blockchain industries) have been so successful till now is to give

users autonomy and control over their own data and creations. NFTs

have more potential in this role, especially for artists,

musicians, and digital creators. NFTs give creators control over

their creations and build a platform to better track music

royalties and intellectual property (IP). Some of the platforms

dealing with music-NFTs include Catalog, the primary marketplace

for single-edition music NFTs; Sound.xyz, which runs almost

daily drops where collectors or traders can mint editions of music

NFTs; and Beats Foundry. NFTs can provide information on ownership

of an IP, especially with blockchain timestamps, and the entire

history of the IP. Simply, the artist mints the IP as an NFT, and

with the information recorded on an immutable network, the NFT

owner could prove they were the original creator of a piece of work

at any point in time. Additionally, NFTs can also be used to track

royalties paid to the creators. For instance, every NFT sold on

Opensea, an NFT marketplace, remits around 2% of the sale (and

every resale) of the NFT to the original creator. Several artists

and musicians have taken the NFT route to monetize their craft.

Kings of Leon, last year March, became the first band to release

their album titled When You See Yourself, as NFT and raised $2

million in the process. Other popular artists that have also

released NFT projects include Grimes, DJ 3LAU, Steve Aoki, and

Bajan rapper Haleek Maul. 2. Identity

Verification As the world becomes more digital and connected, there

is a growing need for trustless digital ownership, and NFTs (given

their unique features) provide the perfect solution for this

problem. A stable and secure digital identity across the real

world, virtual worlds and the metaverse offers massive advantages

to the digital future. It promises to give people the freedom to

build genuine societies in the metaverse – with social, economic,

even political interaction. The value of NFTs resides in the

ability to capture human’s uniqueness, in a similar way that each

human is unique. This could be beneficial for governments as

individuals’ data (such as the driving license, passport and ID

numbers) can simply be coded into an NFT and this NFT can then be

used to verify the individual’s information digitally. One such

project is Photochromic, which enables people to securely own and

verify their identity and personal information through an NFT.

PhotoChromic aggregates biometric proof of life, with

government-backed identity verification and unique personal

attributes, into an on-chain asset that is utilised for blockchain

based identity verification and Web3 applications.

3. Academic Credentials NFTs are moving from the

art world into academia and theoretically into every other industry

as seen in the examples above. However, none of the industries have

quite embraced NFTs (except entertainment and art) than the

academic world. NFTs are a good way to represent academic

credentials. As units of data are saved onto a blockchain, the

provenance of every NFT is trackable, substantiating ownership and

authenticity, which could translate to tracking academic

credentials. The world of academia is already welcoming blockchain

in the space and NFTs could further impact the record-keeping at

schools, universities and other learning institutions. For

instance, Blockademia, a Cardano-based DApp, is at the forefront of

minimizing document and identity fraud, especially government

documents, education certificates and IDs. Simply, Blockademia is a

decentralized information system that checks the authenticity of

certificates and government documents ensuring they are legal,

legitimate, and authorized by the relevant authorities. By

integrating NFTs, verifying academic credentials will be far much

easier. Today, these credentials are issued manually and often on

physical paper, which makes them easy to fake. Academic

institutions should integrate solutions such as Blockademia,

creating NFTs linked to diplomas or certificates, which are

immutable. NFTs also reduce the cumbersome process of graduates

sending physical (or digital) certificates to employers.

4. Asset Protection/ Crypto Inheritance

Over the past decade or so, digital assets have slowly crept into

investors’ portfolios affording them immense opportunities.

Nonetheless, the complexity of these assets poses risks for most

investors as management and storage of crypto remains a key issue

for investors, especially the newcomers. To ensure total security

of assets, self-custody wallets are preferred to having a third

party holding the assets. Additionally, crypto-asset inheritance

has always presented a pain point for self-custody, as

security-minded users often fail to make provisions in the event of

sudden death. The grieving family members often have no way to

access their relative’s inheritance, permanently locking the assets

away. The consequence of not resolving this issue could leave

billions of dollars worth of crypto locked in cold wallet storage,

removing them permanently from circulation. Serenity Shield, a

crypto inheritance firm, is preparing its users for such an event

by preserving access to the tokens in case the owner passes away.

The company incorporates NFTs allowing the end user to set, store,

and save their unique credentials to the Serenity Shield

application. The system divides a user’s wallet, called the

StrongBox, into three non-transferable NFTs. The NFTs each contain

a third of a secret (based on Shamir’s Secret Sharing) needed to

access the wallet. One NFT is held by the user, another is held by

the nominated heir, and the third is held by Serenity Wallet, a

smart contract that delivers its key to either the heir or the

original user depending on specific Activation Conditions defined

when setting up the StrongBox. The conditions can be based on lack

of activity, or active “pings” requiring action to ensure the

original user still has access to the wallet. 5.

Ticketing for Events Finally, NFTs are also taking over the

ticketing system for events. The current ticketing systems have

shown loopholes such as counterfeiting, faking, and slow entry into

events. The introduction of NFTs enhances the functionalities,

speed, and cost of the ticketing system. Paper tickets present

difficulties in that they may be misplaced, become damp or even

damaged. To this end, most event organizers have turned to the QR

codes, which also presents its challenge such as failure of systems

at the entry of the event, leading to slow verification of the

tickets. Additionally, QR codes are ineffective in terms of

attendees purchasing them. Event organizers can turn to NFTs to

minimize the cases of forging and faking tickets given the

immutability properties that they hold. Simply, organizers can mint

the appropriate amount of NFT tickets using their preferred

blockchain platform. They can customize the NFTs to establish the

sale price, or alternatively conduct the sale as an auction.

Customers can then purchase these tickets and save them on their

blockchain wallets, which will then be scanned and verified upon

their arrival at the event. Apart from verifying the authenticity

of the tickets, NFTs also allow primary buyers to sell/transfer

their tickets to secondary buyers, who can verify that they are

purchasing a genuine ticket to an event. Conclusion The rise of

NFTs in the past half-decade opens up the world to representing any

unique asset on the blockchain. While the industry has flourished

in the art and entertainment sector, there’s still so much

potential that NFT users can tap into to enhance systems across the

global economy. The use cases mentioned above are only the tip of

the iceberg for this massively growing industry!

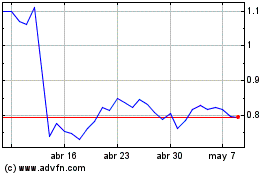

EOS (COIN:EOSUSD)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

EOS (COIN:EOSUSD)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024