nFLARE Technology Shines a Spotlight on a Unique Model of NFT Marketplaces

03 Mayo 2022 - 2:57AM

NEWSBTC

We are at a point in time where “NFT” is a household term.

According to DappRadar, NFT market capitalization has passed $22

billion, a 22,000% growth compared to the same period a year ago.

So as digital asset ownership seems to be reaching a peak, the

question now is – what’s the next big thing for NFTs? In the

immediate future, the leasing and borrowing of NFTs as a source for

generating passive income for owners and gaining added value for

borrowers will take the center stage in the industry. NFT leasing

has been already starting to gain traction, mainly via closed

environment scholarships on P2E games such as Axie or virtual land

within specific metaworlds such as The Sandbox. These initial

examples of NFT leasing functionalities, pushed by some of the top

crypto projects in the industry, help solidify and direct the rise

of an upcoming robust economy revolving around broader NFT use

cases and utilities. While these closed-environment NFT leasing

protocols introduce a viable business model that provides appealing

passive revenue streams, there is a bigger picture and a much

higher potential for massive gains generated through leasing of NFT

ownership rights, and this is where nFLARE DAO enters the frame: a

self-governed marketplace for NFT asset rentals. A ®evolutionary

new model of NFT marketplaces As social creatures, humans care

about where they stand in the social hierarchy and how others

perceive them, so when you give someone the impression that you

have a lot of money, most likely they will have a different opinion

of you. In the real world, some individuals hire a Ferrari for the

weekend so that they can appear more affluent, which in turn opens

opportunities and broadens their connections. On social media, this

form of “peacocking” is very common. People pay a lot to have a

high-priced NFT as their profile picture for a week, especially now

that Twitter NFT validation has made it more relevant than ever

before, or simply as a marketing ploy to boost the credibility of

their commercial profile. But if we step aside the digital social

ladder, the pure financial logic of making leasing NFT rights

available on a large scale is outstanding in its potential for

generating value, financial or otherwise, and has a wide reach

across niches. The use cases Unlike most assets in crypto that

don’t fulfill a real utility, if used as intended, NFTs offer real

valuable use cases for gamers, investors, content creators/artists,

and of course, traders looking to generate passive income deriving

from their specific niche of interest or work. Some of the

examples of NFT leasing we will see include: In-game leveled up

characters, assets, gear, and future skins Metaverse real estate

investments Copyrighted collectibles available as online and

offline merchandise Copyrighted content that can be used as

creative in audio and video for royalties or as consignment

inventory in galleries and exhibitions DeFi instruments Limited

access to venues Gaming Play-to-Earn (P2E) gaming is and will be a

vertical operating independently of market sentiment, as it doesn’t

matter if the crypto market as a whole is bullish or bearish,

gamers will do what they do – play games and earn rewards while

doing it. Making this niche of the industry, which is already huge,

an easy target for borrowing NFTs in P2E gaming. Some stats to

understand the market share: There are roughly 3.1 billion gamers

across the globe, with around 1.42 billion in Asia, 383 million in

Latin America, 261 million in North America, and approximately 668

million across Europe. Oh, and the Gaming industry revenue reached

$175.8 billion in 2021. Today, there are farms where NFT gaming

characters and gear are professionally built, leveled up, and sold.

The problem is that the owner of the NFT is losing on the

appreciation value of the asset in the long run. Leasing NFTs on

the other hand, which also function as a multiplier of the

potential yield on the original investment, solves this problem and

introduces a win-win scenario for both the lessor and the lessee of

the NFT asset. Through NFT leasing, gamers, as borrowers, can rent

NFTs they can’t afford to buy or that are already leveled-up and

use them to access restricted areas or as tools for boosting their

in-game rewards. Lenders (the NFT owners leasing out the asset)

will receive a cut, through a revenue-share model, of whatever

cryptocurrency the borrower earns while playing, similar to

scholarships, but across different projects and different assets.

Looking to collect royalties? NFTs as authenticated reflections of

artwork are already appreciated by galleries, museums, and

exhibition venues. Undoubtedly, the next step in the adoption of

NFT backed artwork will revolve around individuals leasing out

their copyrighted NFT content (visual artwork, audio pieces,

trending characters, and collectibles) as merchandise across

commerce and ecommerce channels, dividing the profits from the sale

between the lender of the NFT and the borrower. Alternatively,

artists can generate passive income by leasing the rights to their

NFT backed content to creators and KOLs in exchange for royalties

paid from using the assets in videos and audio across social

channels. The real estate boom The possibilities of

generating revenue from NFTs in real use case applications and not

only in the current speculative nature of chasing price pumps are

growing independently of market trends. With mega-corporations such

as Meta (Facebook) and Microsoft heavily investing in the future of

the metaverse and driving its adoption into their massive user

bases, demand for virtual land will only increase. As smaller

companies start to follow large corporations into this space,

seeking virtual prime location real estate for marketing, savvy

investors (in crypto, finance, and real estate) that have already

started to understand that the demand for leasing virtual real

estate will exponentially shoot in the coming years, will identify

lucrative investment opportunities in the form of virtual real

estate for commercial leasing purposes, generating high yields. As

people spend more time online, more organizations will draw into

this space, and much like real-world properties, virtual real

estate is and will be sought after for its value in online

promotions, as prime location HQs by corporations, and as priceless

land for eCommerce by enterprises varying from VR casinos to

technology events, online shops, and everything in between. A

hybrid of Technology & Community nFLARE is not “another NFT

marketplace”. It’s not another way for whales to practice wash

trading or about chasing hype. nFLARE is about commercializing

actual use-cases of NFTs as tools for generating a passive income

for lessors and added value to borrowers, or in other words – it’s

about opening up a secondary economy in the NFT industry. P2E,

DeFi, copyrights, virtual real estate, and open access to

restricted events are just a few of the types of utilities that

will see increased demand through opening up the NFT space to

multiple leasing possibilities. As the functionalities of NFT

leasing become more widely available, the value of NFT projects

will soar and the assets’ lifetime value will rise considerably

through generating fixed income from leasing fees, which will

increase as the value of the NFT itself is leveled up over time.

While the development of collateralized smart contracts or an

uncollateralized NFT leasing multisig wallet is fairly

straightforward, the real power driving a utility project is its

community and the way it harnesses its members’ drive and reaches

to propel the project forward. This is the reason nFLARE is built

up as a DAO-managed marketplace, rather than a centralized one,

combining modern shared-rewards tokenomics to incentivize members.

NFT leasing is projected to be the next big thing in the crypto

space. A DAO harnessing the power of a vast community to influence

the marketplace itself and how it interacts with third-party

metaverse initiatives will set the standard for a next-generation

model of community-managed NFT marketplaces.

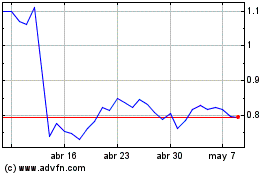

EOS (COIN:EOSUSD)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

EOS (COIN:EOSUSD)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024