Bitcoin Hits $29,000 But Traders Prepare For More Volatility On Friday, Here’s Why

30 Marzo 2023 - 3:30AM

NEWSBTC

The Bitcoin price saw an eye-catching move today, initially rising

2.8% ($810) in 30 minutes to reach a new yearly high at $29,182,

only to fall to $28,080 in a very short period of time. At press

time, Bitcoin showed renewed strength and was trading at $28,586.

Analyst Skew has several explanations for the puzzling movement of

the BTC price. Aggregate CVDs & Delta show that there was a

quick push into spot selling liquidity that was filled. In

addition, the market showed a high premium under perps, meaning

that perps led the price and the spot market began to sell.

“Reaction is quick rally & sell off as crowded perp longs get

caught on the downside volatility,” explained the analyst, who also

has another explanation in store. Looking at Bitcoin’s Perp CVD

Buckets & Delta Orders, the analyst noted increased whale

movements that likely led to the move. We’re in whale town today it

seems, the push up was cleanly orchestrated by whales & sold by

whales. The odd one out here are the high leverage traders trying

to short to zero & long to 100k lol. $BTC Binance Market CVDs

& Delta: 15 min trend still intact bullish till we lose that

trend. He shared the chart below and added that it was forced

selling and sell orders that drove the price down to meet limit buy

orders. “Someone wants to get filled with size here. Pretty

predatory & risky because other parties will notice this setup

and hunt.” More Volatility To Come For Bitcoin On Friday For

several reasons at once, tomorrow could see even higher volatility.

The first reason are the Bitcoin options, which have enjoyed rising

popularity over the past few weeks. Related Reading: Why Is The

Bitcoin Price Up Today? Tomorrow is the quarterly settlement day,

and the quarterly contracts are currently trading very actively,

with short-term implied volatility continuing to rise, up nearly

10% in one day for the monthly maturity, according to Greeks Live.

A total of 141,000 BTC options are about to expire, with a put-call

ratio of 0.73, a maximum pain point of $24,000 and a notional value

of $3.8 billion, the largest options exchange for Bitcoin, Deribit,

shared via Twitter. Large #options expiry coming this Friday 8 AM

UTC 🚀 141K #Bitcoin options are set to expire on Deribit with a

notional value of $3.8 billion. 🔥 Max pain $24,000, put/call ratio:

0.73#Ethereum max pain $1600, $3 B. notional value, put/call ratio

0.33 🔥#Cryptooptions #ETH pic.twitter.com/JTWSaamY5p — Deribit

(@DeribitExchange) March 28, 2023 From a macroeconomic perspective,

the release of the Personal Consumption Expenditures (PCE) Index by

the Bureau of Economic Analysis at 8:30 am EST will be the most

important event of the week. The PCE is the Fed’s preferred metric

to gauge inflation and is therefore of great importance. Core PCE

is forecasted to rise +0.6% month-over-month and +4.7% on an

annualized basis. February PCE came in at +0.6%, but above the

market forecast of 0.4%. The year-to-year reading was 4.7% in

February (4.6% was expected). As a result, financial markets

corrected southward. Related Reading: Bitcoin Repeating This Price

Pattern Of Late 2019? Watch This A similar scenario is conceivable

tomorrow if the core PCE turns out worse than expected. However, if

the core inflation rate increased less than analysts expect, the

Bitcoin price is likely to receive confirmation for its upward

trend. Last but not least, the monthly candle close is also coming

up tomorrow, Friday. With a close at the current price levels,

Bitcoin would confirm a clear breakout from the macro trend.

Analysts at Rekt Capital shared the chart below and wrote: History

has repeated itself. BTC has broken the macro downtrend. This time,

around 385 days before the Halving. This Saturday, the BTC Monthly

Candle will have closed above the macro downtrend to confirm a new

bull market. Featured image from iStock, chart from TradingView.com

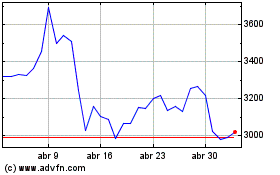

Ethereum (COIN:ETHUSD)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Ethereum (COIN:ETHUSD)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024