Crypto Expert Unveils 15 Surprising Truths About This Bull Run You Need To Know

28 Noviembre 2024 - 2:30PM

NEWSBTC

In a thread on X, crypto researcher Alex Wacy (@wacy_time1) shared

15 eye-opening insights about the current bull cycle with his

183,000 followers. Wacy’s analysis covers a range of topics from

Bitcoin dynamics to emerging technologies like AI and DePIN

(Decentralized Physical Infrastructure Networks). Here’s a detailed

look at his revelations. #1 Bitcoin Season Is Memecoin Season “When

Bitcoin rises, people often buy memecoins en masse, which

positively affects their prices,” Wacy observed. In contrast to the

previous bull run, capital flows directly in the most high-risk

sector of crypto. The surge in Bitcoin’s price tends to trigger a

ripple effect in the memecoin market, leading to significant price

appreciations for these tokens, leaving out more fundamentally

strong altcoins. #2 Long-Term Bitcoin Holders Are Selling

Aggressively Wacy highlighted a notable sell-off among long-term

Bitcoin holders. “They have already sold nearly 730,000 BTC over

the month,” he noted. Interestingly, US spot ETFs are absorbing

about 90% of this selling pressure, playing a crucial role in

stabilizing the market. #3 Solana Above $500 May Be A Reality “Even

when the memecoin era comes to an end, AI and DePIN projects’

developers continue to opt for Solana,” Wacy pointed out. With the

massive attention on memecoins, AI, and DePIN narratives, Solana is

still the leading ecosystem which will eventually push SOL’s price

above $500. Related Reading: 9 Crypto Predictions For 2025: Nansen

CEO Forecasts Biggest Bull Run Ever #4 Blockchain-Based AI Agents

Are Still Undervalued “AI agents are already making their mark in

the real world. However, AI built on blockchain offers greater

decentralization and privacy,” Wacy stated. He suggests that

blockchain-based AI projects have untapped potential and are

currently undervalued in the market. #5 Ethereum Is Set to Rise

Ethereum’s open interest has surpassed its previous all-time high,

exceeding $13 billion—a growth of over 40% in the last four months.

This surge indicates increased investor interest and could signal a

significant upward movement in Ethereum’s price. “Ethereum is set

to rise,” Wacy predicts. #6 Most Ethereum Layer 2s Will Fail Wacy

expresses skepticism about the proliferation of Ethereum Layer 2

solutions. “The most promising L2s at the moment are Base and

Mantle,” he commented. He warned that unless the Ethereum

Foundation develops “a concept of L2 hubs,” 90% of L2 chains might

not survive the next bear cycle. #7 Trendy Technologies Will

Succeed “AI, DePIN, and RWA are the future. At least that’s how

retail sees it, so keep an eye on these trends,” Wacy advised.

According to him, investor’s core capital should only be invested

in these three most powerful narratives in the ongoing bull run.

Related Reading: From Bitcoin to Altcoins: Crypto Inflows Hit

Record $3.1 Billion, Led by Spot ETFs #8 Non-Key Narratives Are

Great For Speculation Wacy highlights the speculative potential in

less mainstream sectors like Decentralized Science (DeSci). “While

it may be less popular, it has been and will continue to be

well-pumped,” he remarked, indicating opportunities for more

high-risk averse investors. #9 Quantum Crypto Is Gaining Attention

“Quantum stocks have surged over 1000% in just one month,” Wacy

noted. He suggests that investors should monitor quantum-related

crypto projects, as this sector may experience significant growth

in the upcoming months. #10 Exercise Caution With Market Sentiment

“Take what people say here with a grain of salt. They’re often too

bearish during dumps and too bullish during pumps,” Wacy warned. He

recommends critical analysis of market sentiment indicators, which

can be misleading during extreme market conditions. #11 Timing Is

Crucial For Offloading Altcoins “When you consider offloading your

altcoins and everyone labels you an absolute idiot, that’s your cue

for the best moment to cash out,” Wacy suggested. Contrarian

strategies might offer optimal exit points for altcoin investors.

#12 Valuing Insights From Crypto Analyst Cobie “I think Cobie knows

something a little more about this market than we do,” Wacy said,

referring to well-known crypto analyst Cobie (@cobie). He advises

listening to Cobie’s who famously stated earlier in this crypto

bull run that investors should focus 70% of their capital in cat

themed memecoins, 20% in other animal memecoins and only 10% in all

other coins for maximum profit. #13 Traditional Market Rules Still

Apply “Even though this cycle differs greatly from previous ones,

altcoin growth remains heavily reliant on Bitcoin dominance,” Wacy

observed. Despite new market dynamics, Bitcoin continues to be the

most important influence over the broader crypto market. #14 Market

Cycles Remain Unchanged “The market is a cycle. Today it’s memes,

tomorrow it’s technology, and the day after, regulations. Cycles

have never been canceled. Remember that,” Wacy emphasized.

Understanding the cyclical nature of markets can help investors

navigate volatility. #15 Strategic Investment Considerations “Some

people might benefit more from seeking dips in alpha plays, rather

than attempting to catch another risky beta play. Reflect on it,”

Wacy concluded. He encourages investors to focus on high-quality

investments with strong fundamentals instead of chasing high-risk

opportunities. At press time, Bitcoin traded at $94,875. Featured

image created with DALL.E, chart from TradingView.com

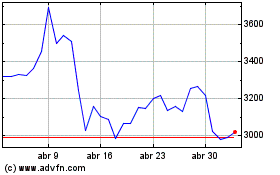

Ethereum (COIN:ETHUSD)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

Ethereum (COIN:ETHUSD)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024