The Worst May Be Over As Crypto Market Adds More Than $100 Billion

18 Julio 2022 - 6:00PM

NEWSBTC

The crypto market had suffered a long stretch of downtrend

following the mid-June market crash. This had brought the total

market cap down to yearly lows as large and small cryptocurrencies

alike suffered. However, there is starting to be a turn in the tide

with the new week. The crypto market cap, which had been trending

below $900 for the better part of the week, had put on $100

billion. Crypto Sentiment Begins To Turn The crypto market cap

still remains below $1 trillion but it has recovered to a good

point. With the price of bitcoin above $22,000, it has gotten close

to reclaiming this crucial position. Another thing that has pushed

the crypto market cap has been the recovery of Ethereum, whose

recent bullish tendencies have rubbed off on other smart contract

platforms in the space. Related Reading | Bitcoin Marks One

Month Of Negative Funding Rates, More Decline Incoming? With this,

the sentiment of crypto investors has begun to shift. One of the

ways in which this has happened has been in the reading of the

crypto Fear & Greed Index. This index uses data from five

different metrics to present a figure that represents how investors

are feeling toward the market. Crypto market cap recovers close to

$1 trillion | Source: Crypto Total Market Cap on TradingView.com

For the better part of June, the index had been in the ‘Extreme

Fear’ territory. This was as the bear trend raged on, and investors

had taken a step back from the market due to the losses. This saw

the market close out the month with one of the lowest scores in the

interest of the index with a 6. However, as some cryptocurrencies

in the market have recovered, so has the market sentiment. The Fear

& Greed Index presently sits at a score of 20 at the time of

this writing. So although it still remains in the extreme fear

territory, it is up 14 points from last month’s close. Related

Reading | Mid Cap Crypto Coins Lead In July, Best Way To

Weather The Winter? There is no doubt that bitcoin’s recovery above

$22,000 has a lot to do with this. The pioneer cryptocurrency is a

market mover, and if it continues to grow, it is expected that

market sentiment will recover more. One thing to note, though, is

that such large recoveries in such a short time can lead to

sell-offs. Mainly, investors often see such moves as a ‘bull trap’;

hence they try to get out of the market before the inevitable

retracement. Over the last 24 hours, there have been more BTC going

into centralized exchanges with a positive net flow of 725.2

million. This supports the fact that investors are taking this time

to sell their holdings. Featured image from Kapersky, chart from

TradingView.com Follow Best Owie on Twitter for market insights,

updates, and the occasional funny tweet…

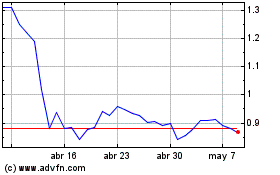

Flow (COIN:FLOWUSD)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Flow (COIN:FLOWUSD)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024