Glassnode: Bitcoin Long-Term Holders Have Shifted To Distribution Recently

08 Agosto 2022 - 2:00PM

NEWSBTC

Data released by Glassnode suggests Bitcoin long-term holder

behavior has shifted from accumulation to distribution recently.

Bitcoin Long-Term Holders Have Shed 222k Coins Off Their Stack

Since May As per a new report from Glassnode, the BTC long-term

holders have been spending up to 47k BTC per month in recent days.

The “long-term holders” (or LTH in short) refer to the cohort of

Bitcoin investors that have been holding onto their coins since at

least 155 days ago, without selling or moving them. The “LTH net

position change” is an indicator that measures the net number of

coins that these HODLers have been selling or buying recently.

Related Reading: Bitcoin Bullish Signal: Whale Exchange Inflows

Remain Down When the value of this metric is positive, it means

LTHs are accumulating right now. On the other hand, the indicator

being less than zero implies this group is distributing at the

moment. Now, here is a chart that shows the trend in the Bitcoin

LTH net position change over the past year: Looks like the metric's

value has been red in recent days | Source: Glassnode's Market

Pulse, 2022-08-05 As you can see in the above graph, the Bitcoin

long-term holders started showing deep distribution behavior

following the month of May. However, around three weeks ago, the

LTH net position change flipped as these holders began to

accumulate. At the peak of this green phase, these investors were

hodling at a rate of 79k BTC per month. Related Reading: This

On-Chain Indicator Suggests Bitcoin Still Only 1/3rd Into Bear

Market But this buying spree didn’t last too long. Soon after, the

LTHs again shifted back to a trend of distribution, where they sold

at a rate of up to 47k BTC per month. In the past week, the selling

has reduced a lot, but the metric’s values still remain red.

Because of all the selling since May, the long-term holder supply

has lost around 222k BTC (as of three days ago, when the report

released). The below chart shows how the Bitcoin supply held by

LTHs has changed during the last couple of years: The value of the

metric seems to have slid down in recent months | Source:

Glassnode's Market Pulse, 2022-08-05 At their all-time high in May,

the LTHs held 13.559 million BTC. Since then, their supply has come

down by 1.6%. It remains to be seen what consequences the new shift

towards distribution may have for the crypto. The current bullish

momentum may not last too long if the selling trend from LTHs

continues. BTC Price At the time of writing, Bitcoin’s price floats

around $24k, up 4% in the last week. The value of BTC has jumped

over the last day | Source: BTCUSD on TradingView Featured image

from Kanchanara on Unsplash.com, charts from TradingView.com,

Glassnode.com

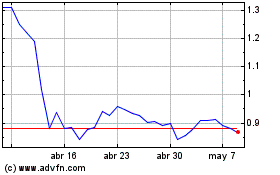

Flow (COIN:FLOWUSD)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Flow (COIN:FLOWUSD)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024