Blockchain Firm Says Bitcoin Price Might Be Headed For $60,000 – Here’s Why

22 Junio 2024 - 5:30AM

NEWSBTC

The Bitcoin price performance over the past week failed to bring

glory to the crypto market, as the leading cryptocurrency struggled

once again. This trend was mirrored across almost all large-cap

assets, many of which experienced significant losses.

Unfortunately, recent price action data suggests that the Bitcoin

price is not safe yet, as there is potential for further downside

over the coming days. Is $60,000 The Next Stop? In a new report,

blockchain intelligence firm CryptoQuant put forward an interesting

prognosis for the price of Bitcoin based on its recent movement.

According to the analytics platform, the premier cryptocurrency

could be headed for the $60,000 price mark after losing a

significant support level. Related Reading: Survival of the

Fittest: Here’s How Bitcoin’s Next Rally Hangs on Miner

Capitulation On Tuesday, June 18, the Bitcoin price fell below

65,000 for the first time in over a month. The price of BTC didn’t

stay beneath this level for too long, as it quickly climbed back to

$66,000 by Thursday. However, the premier cryptocurrency succumbed

to the bearish pressure, falling as low as $63,500 on Friday, June

21. In its analysis, CryptoQuant postulates that the

price of Bitcoin is currently beneath the vital $65,800 level,

which is the trader’s on-chain realized price. This price indicator

can act as a support level, signaling an impending decline if the

BTC price breaks it to the downside. According to CryptoQuant,

every time the Bitcoin price crosses beneath the on-chain realized

price, it undergoes an 8-12% correction, which explains the $60,000

price target. Interestingly, the waning on-chain metrics of the

market leader support this bearish projection. As explained by

CryptoQuant, traders’ demand for Bitcoin has continued to decline,

as the short-term holders are not purchasing BTC but rather

decreasing their holdings. Meanwhile, the demand from large

investors (whales) currently lacks the strength often associated

with bullish momentum. Furthermore, stablecoin liquidity has

been on a steady decline, putting a strain on the Bitcoin bull run.

For instance, the 60-day growth in Tether USD’s (USDT) market

capitalization has slowed down from $12.6 billion in late April to

$3.7 billion as of now — the slowest growth rate since

November 2023. Naturally, higher stablecoin liquidity is

required to kickstart price rallies in the crypto market.

Bitcoin Price At A Glance As of this writing, the Bitcoin price

continues to hover around $64,000, with a 1.2% decline in the last

24 hours. In the past two weeks, the premier cryptocurrency has

decreased in value by nearly 8%, according to data from CoinGecko.

Related Reading: Bitcoin Spot ETFs Effect: Bernstein Analysts

Revise BTC Target To $200,000, Here’s When Featured image from

iStock, chart from TradingView

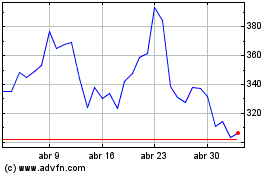

Gnosis (COIN:GNOUSD)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

Gnosis (COIN:GNOUSD)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024