Decentraland (MANA) Turns Bearish After It Loses This Important Support Level

27 Marzo 2023 - 3:30PM

NEWSBTC

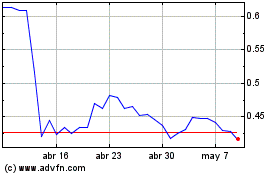

In the past week, MANA has turned bearish, and at press time, the

altcoin continued to show similar trading patterns. On higher time

frames, the coin was negative, with selling strength remaining

considerably higher than buying pressure. The technical outlook

also sided with the bears, as the price still showed that sellers

were in control. Demand for MANA remained low, displaying a decline

in accumulation. Related Reading: Ethereum Price Topside Bias

Vulnerable If It Continues To Struggle Below $1.8K Although in the

previous-to-last week, MANA gained significant strength and dragged

the price from the $0.50 zone to $0.67, it quickly experienced a

retracement met with selling pressure that intensified bearish

price action. The price could continue to move south if the coin

failed to remain above its crucial support level. Additionally,

Bitcoin was trading above the $27,000 mark with an imminent price

correction. In case of dips on the king coin’s chart, MANA is also

likely to decrease in value, so buyers need to be careful. The

coin’s market capitalization has fallen, indicating that selling

strength was building up on the daily chart. MANA Price Analysis:

One-Day Chart At the time of writing, Decentraland’s (MANA)

price was $0.56, but it has since fallen back to the $0.50 price

zone. After dropping below the crucial support zone of $0.62 to

$0.60, MANA continued to decline. Currently, the local support

level for MANA is at $0.51, and if the broader market keeps moving

downward, MANA could fall to $0.47. The overhead resistance for the

coin is at $0.58, and if it surpasses this level, it could reach

$0.60. The recent decrease in MANA trading volume suggests an

increase in selling pressure. Technical Analysis The coin buyers

attempted to recover, but the bears continued to pull the altcoin

down at the time of writing. The Relative Strength Index was below

the half-line, signifying a rise in selling strength for the coin.

Correspondingly, a fall in demand drove the price below the

20-Simple Moving Average line, indicating that sellers were driving

the price momentum in the market. Other technical indicators have

also indicated a fading bullish trend on the daily chart. The

Moving Average Convergence Divergence (MACD) indicates the price

momentum and potential reversal. While the indicator continued to

form green histograms, they were declining in size, reflecting a

decrease in buyers. Related Reading: Bitcoin Price Extends

Consolidation and Might Soon Gear For Fresh Lift-off The

Directional Movement Index (DMI) displays the price direction of

the altcoin, and at the time of writing, the -DI line (orange) was

above the +DI line (blue), indicating a negative trend. The Average

Directional Index (ADX) was below the 20-mark, indicating a

weakening price trend. Image From UnSplash, Charts From

TradingView.com

Decentraland (COIN:MANAUSD)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Decentraland (COIN:MANAUSD)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024