Does The U.S. Dollar Rally Poses A Danger To Bitcoin? BTC Loses $20,000 Levels

01 Septiembre 2022 - 10:57AM

NEWSBTC

Bitcoin continues to trade in a tight range with low volatility

between the high area north of $19,000 and $20,000. The

cryptocurrency is moving about critical support, but macroeconomic

factors threaten to push it into previous lows. Related Reading:

Lightning Speed: 5 Ways To Make Money/ Earn Sats Using The

Lightning Network At the time of writing, Bitcoin (BTC) trades at

$19,700 with a 1% and 8% loss in the last 24 hours and 7 days,

respectively. The cryptocurrency’s performance has been affecting

the entire sector as Ethereum (ETH), Binance Coin (BNB), and

another retrace to early August levels. At these low volatile

levels, the battle between bulls and bears seems more evident.

Bitcoin was able to close its August monthly candle about critical

support which could contribute to a potential relief. However, the

U.S. dollar presents a potential short-term hurdle for risk-on

assets. Data from a crypto analyst indicates that the currency

broke about an important resistance and might make a fresh run into

levels last seen in 2003. As seen below, the U.S. dollar, as

measured by the DXY Index, breach the resistance at 109 and could

move into a multi-year high of 111 before re-testing previous

levels. This breakout must be confirmed by a daily candle close but

seems likely to extend as the dollar consolidated below resistance

before running higher. According to crypto analyst Justin Bennett,

this U.S. dollar rally poses a risk for digital assets: The

argument against a rally for risk assets is the $DXY, which is

breaking above 109.30 today. Need the dollar to cool off for crypto

to rally. Remember, though, that the daily close is what matters.

Everything in between is noise. The U.S. dollar has been a constant

obstacle for risk-on assets, such as Bitcoin. The cryptocurrency is

displaying a negative correlation with the currency as investors

flee into it to protect themselves from financial uncertainty.

Bitcoin And Equities On The Ropes In that sense, traditional

equities, positively correlated with Bitcoin and crypto, have been

re-testing local support over today’s trading session. The S&P

500 is testing the 3,900-support presenting a falling wedge pattern

that Bennett believes could provide room for crypto and stock

relief bounce. The expert expects a spike in volatility, a

potential decompression from this week’s slow price action, as the

U.S. will publish its Non-Farm Payrolls (NFP). As NewsBTC reported

yesterday, this metric and the Consumer Price Index (CPI) will

dictate a lot of the upcoming Fed decisions. Related Reading: TRON

Volume And Market Cap Down Despite Social Media Hype If the NFP

misses market expectations, as analysis from trading firm QCP

Capital suggests, the U.S. financial institution might be able to

hint at a less aggressive monetary policy. This could support

further bullish momentum for Bitcoin and the crypto market.

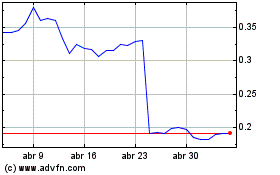

MIS (COIN:MISSUSD)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

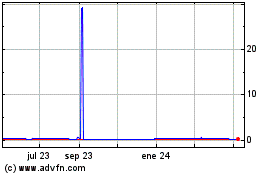

MIS (COIN:MISSUSD)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024

Real-Time news about MIS (Criptodivisas): 0 recent articles

Más de MIS Artículos de Noticias