The Level To Beat For Bitcoin To Register Another Bull Rally

25 Marzo 2022 - 5:00PM

NEWSBTC

Bitcoin remains on a positive recovery trend. One that could very

well see it beat the coveted $45,000 resistance point. This price

level remains the level to beat for the digital asset as this is

where bears continue to mount the most resistance. Bitcoin had

tested this level in the early hours of Friday but like always, met

significant push that caused it to crash back down below it. In the

wake of this crash, the market saw bitcoin lose almost $1,000 in

the space of two hours. However, this dip would be defined by a

higher low as bitcoin had been able to find support above $44,000

and continue on its recovery. This demonstration at $45,000 shows

that until the digital asset can successfully beat and settle above

this level, it can never truly be said to have begun another bull

run. Related Reading | Quant Explains How Stablecoin Ratio Can

Give Bitcoin Buy Or Sell Signals The market is now turning

favorable for buyers although sellers still maintain a majority

hold on the market. If bitcoin is to beat $45,000 and register on

another bull run, then buyers would have to turn up their support.

Otherwise, bitcoin will continue to fail in its quest to beat this

level. Thus leaving the market in what is threatening to be another

long stretch of bear market. In the short term, the indicators are

turning bullish in favor of bitcoin. This comes after the digital

asset cemented its position above the 50-day simple moving average,

an important milestone for an asset looking to break out of a bear

trend. This has successfully moved sentiment out of fear in regards

to the asset and buying pressures are on the rise. But Why $45,000

For Bitcoin? The $45,000 level is important for bitcoin due to its

trading trends in the last few months. Since the December crash,

the digital asset has traded between the $36,000 and $44,000 level,

never once successfully breaking above $45,000. This shows that

this is where bears are taking their stand and a breach of this

point would mean another resettlement into the bull territory. In

the same vein, $36,000 remains the point to beat for bears. As was

witnessed the last four times bitcoin had broken above $40,000 and

trended downwards again, significant support showed between

$36,000-$38,000. A break below this point would be good news for

bears as it would very well put the digital asset on a path down

below $30,000. BTC seeing significant support around the $36k-$38k

level | Source: BTCUSD on TradingView.com Both these points have

now become important make or break points for both camps, leading

to a serious tug of war between the two. Related Reading

| Bitcoin Miner Revenue Grows By 7%. Here’s How Much They Made

Bitcoin is trading above $44,000 at the time of this writing.

Indicators point towards another test of the $45,000 level but only

if the asset can pick up enough buying momentum to recover above

$44,600. Featured image from BBC, chart from TradingView.com

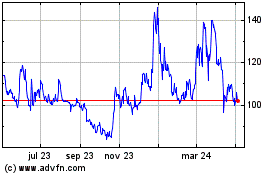

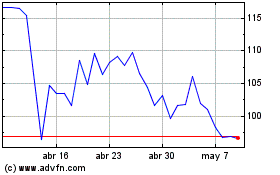

Quant (COIN:QNTUSD)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Quant (COIN:QNTUSD)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024