What Does Puell Multiple Say About Current Bitcoin Bear?

04 Octubre 2022 - 2:00PM

NEWSBTC

Puell multiple is an indicator that has historically given hints

about previous Bitcoin cycles, here’s what it says about the

current bear market. Bitcoin Puell Multiple Has Been Going Up

During The Last Couple Of Months According to the latest weekly

report from Glassnode, miners are currently raking in just 63% of

the revenues of last year. The “puell multiple” is a metric that

measures the ratio between the current Bitcoin miner revenues, and

the 365-day moving average of the same. What this indicator tell us

is how the miner revenues right now compare with the average during

the last year. When the value of the multiple is greater than 1, it

means miners are earning more currently than the average for the

past 365 days. Related Reading: Quant Explains How US Stock Market

Volumes Influence Bitcoin Price On the other hand, the metric

having values lesser than the threshold suggests miner incomes are

lower at the moment. Now, here is a chart that shows the trend in

the Bitcoin puell multiple over the last few years: Looks like the

value of the metric has been showing a rise in recent weeks |

Source: Glassnode's The Week Onchain - Week 40, 2022 As you can see

in the above graph, the historical zones for the Bitcoin puell

multiple are highlighted. It seems like during the past cycles, the

indicator dipping below the 0.5 value resulted in bottom formation.

After the metric hit the low during the previous bear markets and

subsequently recovered out of the zone, the crypto also observed

the end of the bear and the start of a fresh bull run. The likely

reason behind this trend is that when miners reach very low

revenues, they go through a capitulation phase and once it ends,

the selling pressure from them subsides, thus the price observes

some growth. Related Reading: Bitcoin Price Starts Uptober With

Record Open Interest Increase, BTC Rally Will Be Short lived? It

looks like back in June of this year, the metric hit a low of just

0.33, implying that miners were earning only 33% of the average for

past year at that point. Since then, however, the multiple has

enjoyed an overall trend and has escaped out of the historical

bottom zone as its value is now 0.63. This means that miners are

under much less stress now compared to just a few months ago. If

history is anything to go by, the current uptrend in the Bitcoin

puell multiple could spell the end of the bear market. BTC Price At

the time of writing, Bitcoin’s price floats around $20k, up 4% in

the past week. The value of the crypto seems to have spiked up over

the past day or so | Source: BTCUSD on TradingView Featured image

from Maxim Hopman on Unsplash.com, charts from TradingView.com,

Glassnode.com

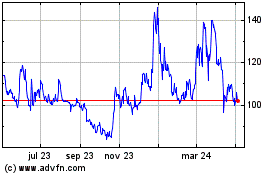

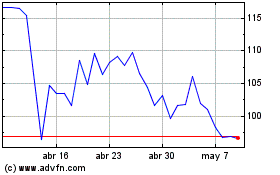

Quant (COIN:QNTUSD)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Quant (COIN:QNTUSD)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024