Following FTX’s Collapse, These Exchanges Are Rumored To Be In Trouble

15 Noviembre 2022 - 4:58AM

NEWSBTC

Amidst the FTX drama, it is still not clear what contagion effects

the collapse of the world’s second largest crypto exchange will

have on the industry as a whole. In addition to numerous hedge

funds that have already spoken out about their exposure to FTX and

Alameda, several exchanges are currently in the spotlight. The

crypto community is currently evolving into on-chain detectives who

want to discover if and which crypto exchanges are also mishandling

their customer funds, trading with them, and thus not holding

enough reserves. If a bank run like the one on FTX were to happen,

they would not be able to withstand it. Binance CEO CZ warned a few

days ago, “If an exchange have to move large amounts of crypto

before or after they demonstrate their wallet addresses, it is a

clear sign of problems. Stay away.” Related Reading: Bitcoin Shows

Strength As Price Holds Above $16,500; Is This A Bear Trap? With

that in mind, the crypto community is currently focused on three

crypto exchanges. As Glassnode’s lead on-chain analyst “Checkmate”

explained, Huobi, Gate(.)io, and Crypto(.)com have been exhibiting

“particularly weird BTC balance patterns” lately. All three have

large jumps, drops, or oscillations on the order of 10k $BTC to

$40k $BTC. The same can be said for $ETH Balances, noting the weird

‘I accidentally transferred from crypto(.)com to Gate(.)io’ event.

In contrast, the analyst notes that Binance, Coinbase, Kraken,

Gemini, Bitfinex, and Bittrex “look fairly vanilla” across BTC and

ETH and do not trigger a red flag warning. The Next FTX? The rumors

surrounding a collapse of Crypto(.)com are partly the exchange’s

own fault. On-chain analysts found that Crypto(.)com shipped $500

million in ETH of users’ assets to Gate(.)io, by its own account

“by accident.” The exchange’s ETH and stablecoin reserves have

massively decreased since the uncertainty evolved. CryptoQuant CEO

Ki Young-Ju stated that 25-80% of ETH reserves have moved four

times since September 2022. Stablecoins reserve dropped from $2.9B

to $292M, -90% in the last 7 months. ETH & stablecoins reserve

on https://t.co/FmNiPK88vZ : • 25-80% of ETH reserve moved four

times since Sep 2022. • Stablecoins reserve decreased from $2.9B to

$292M, -90% over the past 7 months.https://t.co/sljiJZbXuv

pic.twitter.com/UiVw0a0Nmw — Ki Young Ju (@ki_young_ju) November

14, 2022 CEO Kris Marszalek was quick to respond, clarifying that

the ETH transfer was made accidentally over three weeks ago, on

October 21, while the funds were withdrawn to a cold wallet in the

days that followed. Yesterday, Marszalek assured that all

withdrawals will be processed regularly. Allegedly, the

withdrawal queue is down 98% within the last 24 hours. Withdrawals

are being processed as usual. No FUD please. — Kris | Crypto.com

(@kris) November 14, 2022 What About Gate(.)io and Huobi? The

mysterious transfer from Crypto(.)com ironically took place on

October 21, just before the release of Gate(.)io’s

‘proof-of-reserve’, which is why the exchange has also been

targeted by the crypto community. The snapshot for the PoR audit

reportedly occurred as early as October 19. However, the report was

not published until October 28, which makes critics suspicious. The

crypto community also distrusts Hong Kong-listed Huobi. The

exchange announced that $18.1 million in crypto could not be

withdrawn on FTX, of which $13.2 million was customer funds.

Afterwards, biggest shareholder Li Lin declared that he will

provide additional unsecured funding of up to $14 million, which

will cover customers’ balances. Related Reading: Bitcoin Moves

Differently From US Stock Market, Correlation Weakening? In

addition, Huobi seems to have irregularities in its balance. After

Huobi published the asset snapshot, 10,000 ETH were transferred to

Binance and OKX deposit wallets. Subsequently, Huobi’s vacant ETH

wallet had only 4,044 ETH left. Glassnode’s lead on-chain analyst

discussed that all three exchanges show relatively active deposits

from FTX, “usually after major sell-offs.” This is where

cryptodotcom shows up as having 6-8% of their inflows sourced from

FTX in May and Nov 2021. Furthermore, Huobi and Gateio regularly

sent some 5-8% of their entire BTC balance to FTX during the crash.

On the Ethereum front, all three exchanges saw large deposits of

between 5% to 10% of their $ETH balance through 2022, with Huobi

standing out the most. After the June sell-off, FTX deposited 20%

of the Huobi ETH balance in a week! According to Checkmate, this is

remarkable in that their flows are very large compared to the

balance held of BTC and ETH. At presstime, the BTC price was once

again rejected at the $17.000 mark.

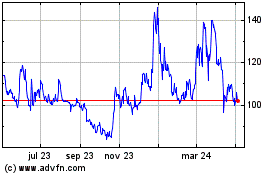

Quant (COIN:QNTUSD)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

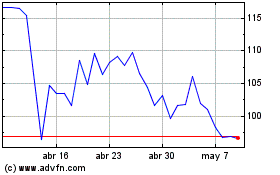

Quant (COIN:QNTUSD)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024