Bitcoin Now Trading 24% Below Realized Price, How Deeper Can It Go?

17 Noviembre 2022 - 10:00AM

NEWSBTC

On-chain data shows Bitcoin is now trading 24% below the realized

price, here’s how much deeper the crypto went during historical

cycles. Bitcoin Has So Far Declined 24% Under The Realized Price As

pointed out by an analyst in a CryptoQuant post, drawdowns below

the realized price have been shrinking with each cycle. A popular

capitalization model for Bitcoin is the “realized cap,” which

measures the cap by weighting each coin in the circulating supply

against the price at which it was last moved. This is different

from the usual market cap, where every coin in circulation is

simply multiplied with the latest BTC price. Now, from this

realized cap, a “realized price” can be derived by dividing the

metric with the total number of coins in circulation. The

usefulness of this price is that it signifies the cost basis of the

average holder in the Bitcoin market. This means that whenever the

normal price dips under this indicator, the average investor enters

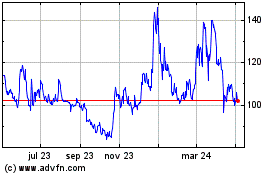

into a state of loss. Here is a chart that shows the percentages

below the realized price BTC has gone during each cycle: Looks like

the value of the metric has plunged in recent days | Source:

CryptoQuant As you can see in the above graph, the latest crash in

the price of Bitcoin has taken the crypto 24% below the realized

price, the deepest value observed in the current cycle so far. It’s

apparent from the chart that the previous bear market of 2018/19

saw an even larger drawdown, as the price had declined about 30%

below the metric at the bottom. Related Reading: Bitcoin 7-Day

Volatility Comes Alive As FTX Collapse Shakes Market Comparing the

two cycles in isolation would suggest the current bear market still

needs to see a notable amount of decline before the same bottom

values are hit. However, things change when the 2015 and 2012

bottoms are also taken into account. In 2012, Bitcoin went as low

as 60% below the realized price, while in 2015 the decline was

around 41%. Related Reading: XRP Whale Withdraws Massive $135M From

Binance, Bullish Signal? There seems to be a pattern here, and it’s

that the percentage of fall below the indicator has been shrinking

with each cycle. If this trend continues to hold this time as well,

then Bitcoin may in fact already be near a bottom for this cycle.

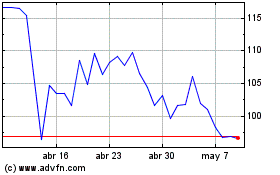

BTC Price At the time of writing, Bitcoin’s price floats around

$16.5k, down 1% in the last week. Over the past month, the crypto

has lost 14% in value. The below chart shows the trend in the price

of the coin over the last five days. The crypto continues to show

stale price movement | Source: BTCUSD on TradingView Featured image

from Traxer on Unsplash.com, charts from TradingView.com,

CryptoQuant.com

Quant (COIN:QNTUSD)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Quant (COIN:QNTUSD)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024