Bitcoin Price Experiences Correction to $23,000 Support, Can Bulls Push Higher?

27 Febrero 2023 - 1:51PM

NEWSBTC

Bitcoin has experienced a correction down to $23,000 over the

weekend; with the recent downtrend, the Bitcoin price action needs

a significant push above its resistance to confirm a continuation

of the bullish trend that began in early 2023. BTC has recently

held above the $22,700 level, preventing further price declines.

After a full-throttle uptrend since January, BTC has seen a

correction to low levels since last week, dropping to $22,700. BTC

succumbed to the selling pressure. With the current price

action of BTC and the uncertainty of the direction of the next move

of the largest cryptocurrency in the market, the total amount of

liquidations data has increased over the past few days, with almost

$200 million in positions liquidated since February 22nd, according

to Coinglass data. Related Reading: Stacks (STX) Shines With

50% Weekly Gains While Market Drops Is A Bitcoin Bull Trend In Full

Effect? Data and crypto analyst CryptoCon has outlined in a

Twitter post the recent positive correlation between Bitcoin and

the U.S. dollar, as measured by the DXY Index, and how this can

drive the next bull trend for Bitcoin. The analyst states

that the bull market is in full effect, given the high correlation

after the 2022 bear market between the DXY and BTC. Two out of

three times, this correlation has been the precursor to BTC rallies

in 2011 and 2015. The 2019 rally, as seen in the chart below, makes

this the fourth time the correlation hinted at the beginning of a

new, fully formed bull market. It’s well known that crypto price

movements have been correlated with the DXY index since the

inception of the crypto market. The recent correlation has turned

positive, as the DXY index gets a correction below its annual high

of $105, as do Bitcoin and Ethereum on their respective charts.

CryptoCon concluded: Although Bitcoin is correcting, it is still

primed for Bull Market upside. Market structure compared to July

2015 is entirely different, and instead looks just like the Nov

2015 surge before the Bull Market. Bitcoin is in an uptrend, and

these are among the best cycle buying prices. BTC’s recent

reversal of the price action, which was expected to be strong

support at the $23,500 level, has formed a new resistance wall for

the flagship currency. If the Bitcoin price action

continues to wipe out the short and long positions by moving

sideways, BTC could fuel up the liquidity at higher levels. This

liquidity could allow BTC to surpass the nearest resistances of

$23,500 and $24,000 to attempt another breakthrough, the critical

resistance of $25,000, which for analysts, is the last obstacle for

Bitcoin as it seems poised to break the milestone of $30,000 in the

medium term. Related Reading: Crypto Market Crawls To A Standstill

As Investors Remain Neutral Bitcoin is trading at the $23,300

level, below the critical support lost over the weekend with the

retracement to $22,700. With this price drop, Bitcoin has seen a

slight gain of 0.7% over the past 24 hours. In broader time frames,

the price of BTC has noted a decline of -3.9% in its price in the

seven-day time frame but has managed to maintain gains in the

fourteen and thirty-day time frames of 7.1% and 1.1%, respectively.

Featured image from Unsplash, chart from TradingView.

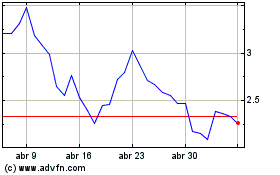

Stacks (COIN:STXUSD)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Stacks (COIN:STXUSD)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024