Stacks (STX) Survives Market Massacre Of Top 100 Cryptos With 40% Rally

28 Febrero 2023 - 6:59AM

NEWSBTC

STX, the native token of the Stacks network, is the only

cryptocurrency that has resisted the assault that has devastated

the broader crypto market on February 28. The majority of

currencies have been covered in red. At the time of writing, STX

was the leading gainer, up 40% among the top 100 cryptocurrencies

tracked by Coingecko and CoinMarketCap. STX was trading at $0.8634,

up 0.5% from the previous day’s close. The token’s price has risen

by 191% in the last 30 days, according to the most recent data.

Monday marked a market capitalization of $1.1 billion for STX.

Source: Coingecko Related Reading: Bitcoin Price Tries To

Reclaim $24,000 As Crypto Market Trades Sideways Stacks Riding

Ordinals Popularity? Since the Ordinals protocol went online on

January 21 and allowed users to embed references to digital art

into minor Bitcoin blockchain transactions, demand for the

STX has skyrocketed. Bitcoin non-fungible tokens, also known

as Ordinals, are the newest development in cryptocurrency,

attracting investor interest. The technology has effectively

increased network usage, transaction volume, and block size, since

more than 200,000 Ordinals have been added to the Bitcoin

blockchain. Image: Cryptopolitan Muneeb Ali, co-founder of Stacks,

recently acknowledged that the Ordinals mania and growing interest

in protocols were not coincidental. “What has been missing is that

young and enthusiastic developer community that is actually

building things and shipping stuff,” he said. Bringing DeFi To

Bitcoin & All That Buzz Excitingly, Stacks’ emphasis on

bringing DeFi to Bitcoin has added to the buzz surrounding Ordinals

as investors anticipate the arrival of smart contracts on Bitcoin.

On February 27, the price of the project’s token increased by 25.0%

in 24 hours to $0.9614, building on the token’s continuous run over

the past week. Despite these enormous gains, STX remains in the

depths of a bear market. The token is down 77% from its all-time

high of $3.39 in December 2021. The Stacks blockchain employs the

Proof-of-Transfer (PoX) consensus method and is a Layer 1

blockchain. It enables users to validate Bitcoin transactions by

retaining and staking the cryptocurrency. The user is allowed to

mine Stacks blocks and earn STX tokens once BTC has been

transferred. Crypto total market cap at $1 trillion on the weekend

chart | Chart: TradingView.com Related Reading: APE Price: Bears

Spark Jitters As Crypto Sell Pressure Mounts STX Gets SEC Thumbs Up

A recently released investment strategy by North Rock Digital

highlighted Stacks’ emphasis on decentralized finance (DeFi), its

novel use of smart contracts, and its interoperability with Bitcoin

as distinguishing characteristics among blockchain initiatives.

Stack augments Bitcoin’s functionality by introducing smart

contracts and decentralized applications (dApps) to the Bitcoin

blockchain. Since this was the case, it was impossible not to link

the growth of Bitcoin Ordinals to the gains in STX. STX is the

first token whose offering has been approved by the US Securities

and Exchange Commission. -Featured image from ArtStation

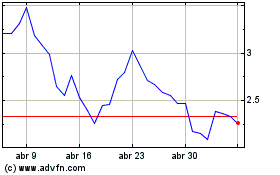

Stacks (COIN:STXUSD)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Stacks (COIN:STXUSD)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024