Stablecoin Lender Liquity (LQTY) Surprises With 132% Rally As Most Cryptos Slide

01 Marzo 2023 - 5:57AM

NEWSBTC

Cryptocurrencies can lose value for a variety of reasons. One of

the main reasons is market sentiment, which is driven by the

perception of investors and traders about the future prospects of a

particular digital currency. Negative news, such as regulatory

crackdowns or security breaches, can erode confidence in a

particular cryptocurrency and lead to a sell-off. Additionally,

cryptocurrencies are subject to the same economic forces that

affect other assets, such as supply and demand, inflation, and

geopolitical events. In the face of challenges besetting the

current crypto landscape, one crypto proves its resilience and

stands out. Liquity Registers Unexpected 132% Gain LQTY, the native

token of stablecoin lender Liquity, was the only cryptocurrency

that brushed off all the negativity by registering a commanding

132% rally Tuesday. At the time of writing, LQTY was flashing all

green in the weekly up to the monthly timeframe, trading at $2.28,

data from Coingecko show. The price ascent was the highest by LQTY

since April last year, and it comes after it was listed on crypto

exchange Binance’s Innovation Zone. According to Binance’s website,

the Innovation Zone is a venue where users can trade new tokens

that are anticipated to be more volatile and risky than other

tokens. LQTY Sustains Momentum With 183% Monthly Increase In the

last 30 days, LQTY has increased by 183%. Its market cap soared to

more than $260 million, data from CoinMarketCap indicate. The

overall cryptocurrency market cap now stands at $1.058 trillion,

latest data shows. Liquity is a decentralized system for borrowing

LUSD stablecoin and LQTY. As collateral, users can obtain

interest-free loans using Ethereum (ETH). No one can modify the

system’s existing rules since the project has no admin key. It is

totally governed by its immutable and self-sustaining smart

contract code. Related Reading: Bitcoin Price Tries To Reclaim

$24,000 As Crypto Market Trades Sideways As the New York State

Department of Financial Services directed Paxos to cease minting

its centralized dollar-pegged cryptocurrency BUSD earlier this

month, the price of the Liquity token jumped by 45%. Liquity does

not offer its own loan platform. Instead, it delivers the

technology that others can utilize to develop their own

applications. DeFi Saver and Instaapp are two of the most popular

apps that provide financing solutions. According to DefiLlama,

Liquity has a total value locked (TVL) of about $600

million. Crypto total market cap at $1 trillion on the weekend

chart | Chart: TradingView.com Related Reading: Stacks (STX)

Survives Market Massacre Of Top 100 Cryptos With 40% Rally Market’s

Improved Outlook For LQTY Binance, the largest exchange in the

cryptocurrency sector, has millions of customers around the globe.

Thus, the listing of a cryptocurrency on the company’s platform is

always significant. This explains why Liquity’s price rallied on

Tuesday. Indeed, any positive boost for this coin and its

fundamental objective is likely to be healthy for its price.

The increase for LQTY’s price today represents the

market’s improved outlook on this project. -Featured image from

Currency.com

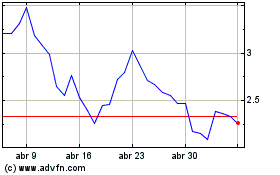

Stacks (COIN:STXUSD)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Stacks (COIN:STXUSD)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024