Stacks (STX) Stumbles As Bulls Fail To Remain Intact

05 Mayo 2023 - 10:40AM

NEWSBTC

On March 20, 2023, Stacks (STX) hit an all-time high of $1.30. But

the price declined below the $1 mark on March 25 as the bears

increased momentum. The asset has remained under the mark from

March until May 5. The 4-hour time frame chart today indicates that

the STX token is trading on a downtrend movement due to high

selling pressure. The token is also in a long-term downtrend, with

the bears increasing its selling pressure forming lower highs and

higher lows. Will The Bulls Dethrone The Bears From The Market? The

overall structure of the STX market is bearish, with the bears

battling with the bulls to take full control. The 4-hour chart

shows that the STACK token is trading at $0.7276, with a decrease

of -6.47% within the last 24 hours. Related Reading: This Meme Coin

Created By GPT-4 Is Now Worth $40 Million, Here’s Why STX’s 24-hour

trading volume is down by 56.76%, with a total market cap of $1

billion. This also shows that STX is not experiencing many

activities at the moment. Despite the increased selling momentum

resulting from the investor’s sentiment, the bulls are attempting

to regain control by taking advantage of the support level at

$0.67. Stacks (STX) Price Analysis Currently, STX is trading within

the range of the 200-day simple moving average and the 50-day

simple moving average, suggesting a neutral market position or

consolidation phase. Related Reading: Pro-XRP Attorney Shares

Information That Could Be Bullish For Ripple Consequently, traders

and investors may use the 50-day and 200-day SMAs as reliable

support and resistance levels while trading. Notably, a

breach above the 50-day SMA may signal a potential short-term

uptrend, presenting a buying opportunity for traders. The fact that

STX lacks an obvious trend, either upward or downward, suggests

that the price is stable. Currently, the RSI level of STX is 41,

which shows that the STX market is heading towards the neutral

zone, and there’s indecision. The Moving Average Convergence

Divergence (MACD) line is below the signal line, which suggests a

potential sell opportunity. Moreover, the histogram, which

measures the distance between the MACD line and the signal line, is

below the zero line, indicating that the security is trading below

its long-term trend. Additionally, the histogram is

increasing, implying that the bearish momentum is gaining strength.

This situation suggests that STX is facing downward pressure, which

could continue for some time, allowing traders to short the token.

STX trades between the $0.6666 and $0.8275 primary support and

resistance levels. Stack’s first important resistance level is

$0.8275. If the price rises above this level, the next significant

resistance levels are $1.0212 and 1.3103. Conversely, with high

selling pressure, the price of STX may fall below its important

support levels of $0.5220 & $0.2684. Featured image from

Pixabay and chart from Tradingview

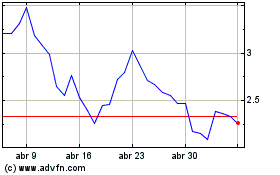

Stacks (COIN:STXUSD)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Stacks (COIN:STXUSD)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024