Why This Economics Professor Thinks Bitcoin Is Worthless

27 Marzo 2023 - 4:02AM

NEWSBTC

Steve Hanke, a professor of Applied Economics at Johns Hopkins

University, is the latest scholar to trash Bitcoin. Bitcoin Has No

Fundamental Value, Says Professor In a tweet on March 26, Hanke

said Bitcoin is not a currency but a speculative asset whose

fundamental value is zero. He appeared to back fiat, including the

Japanese Yen and the USD, two of the world’s reserve currencies, as

appropriate hedges in economic turmoil. Bitcoin is not a currency.

It's just a highly speculative asset with a fundamental value of

zero. pic.twitter.com/leA4Fe9Ixz — Steve Hanke (@steve_hanke) March

26, 2023 Considering the role of the USD in the world’s market, the

currency minted by the Federal Reserve has been historically used

to hedge against economic crises. The USD remains as a store value,

explaining the currency’s spike in valuation whenever the equities

market tank. Related Reading: Elon Musk Points Out ‘Most Serious

Looming Issue’ In Banking, Bitcoin To Moon? Hanke’s comments come

when Bitcoin and cryptocurrencies have been outperforming

traditional assets, expanding amid the banking crisis in the United

States. Following the bank run on Silicon Valley Bank (SVB) and the

subsequent intervention by the United States government, where the

Federal Reserve had to inject liquidity, averting a crisis, Bitcoin

prices have been rallying. Last week, BTC peaked at around $28,800,

the highest in over nine months. The expansion of Bitcoin prices

while banking stocks were under pressure, observers note, was

enough to justify the digital gold’s role as a store of value.

Hanke is pessimistic about Bitcoin, dismissing its use as a hedge.

Specifically, he mentions the coin’s speculative nature, a trait

also linked to the asset’s volatility. In another tweet, the

economist lauded the United States Securities and Exchange

Commission (SEC) for getting serious about going after Coinbase, a

cryptocurrency exchange. The regulator says Coinbase has violated a

range of investor protection rules. 1/ Today Coinbase

received a Wells notice from the SEC focused on staking and asset

listings. A Wells notice typically precedes an enforcement action.

— Brian Armstrong (@brian_armstrong) March 22, 2023 The Wells

Notice would possibly be the beginning of a legal showdown between

the SEC, that’s been, in recent months, clamping down hard on

crypto businesses, and Coinbase, the largest crypto exchange in the

country. Dr. Doom Celebrated The Failure Of Crypto-Friendly Banks

Hanke joins the likes of Nouriel Roubini, often known as “Dr.

Doom”, who has been very vocal about his disdain for crypto.

Roubini is a New York University professor emeritus and a Bitcoin

critic. The professor celebrated the collapse of Silicon Valley

Bank (SVB) and Signature Bank of New York in mid-March, slamming

them for getting involved in cryptocurrencies. Related

Reading: Bitcoin Price Extends Consolidation and Might Soon Gear

For Fresh Lift-off In a tweet, Roubini said all banks

supporting cryptocurrencies would collapse and that it was good

riddance. He added that there was no logic in protecting

depositors of Signature Bank, an institution that “recklessly

decided to jump into the crappy crypto cesspool and bet the house

on shitcoins biz.” Earlier, Roubini said crypto is risky,

and the entire industry will go extinct. Feature Image From

Canva, Chart From TradingView

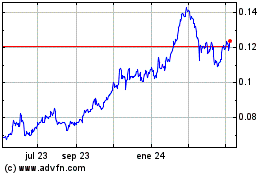

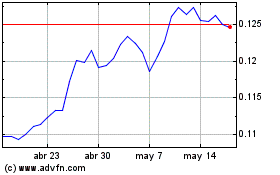

TRON (COIN:TRXUSD)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

TRON (COIN:TRXUSD)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024