Ethereum Classic (ETC) Price Muffled In Last 2 Months – Will ‘Uptober’ Any Different?

15 Octubre 2022 - 8:40AM

NEWSBTC

There was a 5% loss in value for ETC over the past day. The

Ethereum Classic coin has continued its fall on longer time

frames since the July spike. Ethereum Classic bears were

unable to withstand the selling pressure after the fork attempted

to maintain a price above the $27 support line. As of this writing,

ETC is trading at $23.08, down 16 percent in the last seven days,

data by Coingecko show, Saturday. Although Proof-of-Stake has

rendered Ethereum’s mining obsolete, renewed interest in the coin

has resulted from the Merge. The day the Merge was made public, the

hashrate increased as a result. However, ETC’s long-term prospects

remain bleak as weekly, biweekly, and monthly time periods are all

in the red. The present value of 0.80 between Ethereum and its hard

fork indicates that Ethereum Classic will enthusiastically follow

wherever ETH goes. The data points to a positive expansion. Related

Reading: Uniswap (UNI) Likely To Reach $7 – If Token Overcomes This

Resistance Level Ethereum Classic: Technical Analysis From

September 19 to now, ETC has fluctuated in price between $20.73 and

$31.13. The coin’s current moving average (CMF) is currently -0.09,

which indicates that bears are gaining dominance. Nonetheless, the

Stoch RSI is in the oversold region, which represents an excellent

buying opportunity for investors and traders. The increasing ascent

of the bull-bear power indicator suggests a likely trend reversal.

However, the Bollinger band’s central line is exerting greater

downward pressure on the coin. The 20-day to 100-day exponential

moving averages (EMAs) also operate as dynamic barrier for the

token, making a rebound conceivable. ETC: Possible Recuperation?

Although it will be tough to produce a price reversal, bulls can

yet defend the $23 support level. This will serve as a springboard

for them to try the $27 resistance level. Traders and investors can

also utilize the Stoch RSI numbers. As previously stated, the Stoch

RSI is in the oversold bottom half. This indicates that the coin is

now undervalued and extremely inexpensive to purchase. Speculators

and investors can purchase ETC at the current market price with a

loss stop of $18.76. However, this carries considerable risk

because other indicators hint to a short- and long-term pessimistic

outlook for ETC. But if the bulls can maintain the $23 support

line, October will be an excellent starting place for a further

rise to $29.71. We anticipate a strong bearish or bullish price

movement in the following days and weeks. Related Reading: Who

Shines Brighter? Solana Beats Altcoin King Ethereum In This Key

Area ETC total market cap at $3.17 billion on the daily chart |

Featured image from Investing.com, Chart: TradingView.com

Disclaimer: The analysis represents the author's personal views and

should not be construed as investment advice.

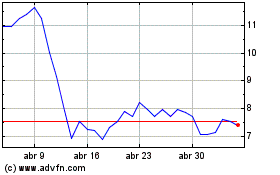

Uniswap (COIN:UNIUSD)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Uniswap (COIN:UNIUSD)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024