Mango Madness: Exploiter Could Walk Away With Unparalleled ~$50M Bug Bounty

15 Octubre 2022 - 1:43PM

NEWSBTC

Forget March Madness, Mango Madness is in season this time of year.

The Solana-based lending protocol has been a spectacle unlike any

other throughout this week, and that’s certainly saying something

considering the amount of antics crypto brings to the table on

frequent occasion. Since our first covering of Mango’s exploit that

led to a full-fledged drain of the protocol, things have only

gotten more twisted and convoluted. Let’s take a look at how things

have developed this week and where things go for Mango Markets

moving forward. A Mango Monstrosity Mango’s exploiter has generally

been seen in the crypto community as less “hacker” and more

“manipulator,” if we’re being frank. Regardless, things got

interesting after Tuesday’s exploit when the attacker initiated a

governance proposal; that proposal is said to have closed. However,

a subsequently-created proposal by Mango Markets (which has now

passed, as of Saturday morning) is phrased as a bug bounty to make

users whole, but it settles Mango with just shy of $70M of their

existing $114M balance. That leaves the exploiter with a nearly

$50M ‘bug bounty,’ a strikingly large number compared to any

previous bug bounty in crypto and one that has led to a large

degree of criticism (look no further than the governance proposal’s

comment section for evidence of this). The exploiter quickly

deployed the MNGO tokens that they seized (roughly 30M tokens) to

vote in favor of their own initial proposal, but did not seem to

vote on the subsequent and closing proposal – which nonetheless

closed at a tally of 473M in favor and 16.6M against. The exploiter

has seemingly gained protection through the proposal as well, as

the protocol “will not pursue any criminal investigations or

freezing of funds once the tokens are sent back as described,”

according to the proposal’s language. Mango Markets (MNGO) is

looking for stable ground to see if recovery is possible following

Tuesday's exploit. | Source: MNGO-USD on TradingView.com Related

Reading: Cosmos Detects Major System Weak Point – Will ATOM Price

Be In Trouble? What’s Next It’s hard to say where we go from here,

and what degree of protection that attacker will actually see. The

exploiter has reportedly funded attacking accounts with an FTX

wallet, and their degree of protection is up for speculation.

Regardless, even when you deduct the initial $10M balance that the

exploiter introduced into Mango, the protocol is generally giving

up a heftier sum then usually seen in these scenarios – one of the

largest in crypto’s history, in fact. We’ll see if the protocol can

keep the heartbeat alive and shut down critics in the long run.

Related Reading: Uniswap (UNI) Likely To Reach $7 – If Token

Overcomes This Resistance Level Featured image from Pixabay, Charts

from TradingView.com The writer of this content is not associated

or affiliated with any of the parties mentioned in this article.

This is not financial advice. This op-ed represents the views of

the author, and may not necessarily reflect the views of

Bitcoinist. Bitcoinist is an advocate of creative and financial

freedom alike.

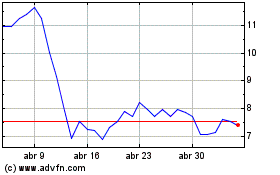

Uniswap (COIN:UNIUSD)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Uniswap (COIN:UNIUSD)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024