Glassnode’s RHODL Ratio May Suggest Bitcoin Market Is Near Capitulation

29 Marzo 2022 - 1:00PM

NEWSBTC

Glassnode data shows the RHODL Ratio’s current trend suggests that

the Bitcoin market could be near capitulation. Data Shows Bitcoin

RHODL Ratio Has Observed Decline Recently As per the latest weekly

report from Glassnode, the supply of coins older than one year has

significantly risen recently. To understand the RHODL ratio, you

first need to have a look at the “realized cap HODL waves.” This

indicator measures the USD-dominated amount of Bitcoin held by

investors hodling since different periods of time. For example, the

wave band for coin age more than 1+ year shows the total amount of

coins all investors hodling since at least a year currently own.

The “realized HODL” (or RHODL in short) ratio is a metric that

tells us the ratio between the wave bands of 1-week old and 1-year

old Bitcoin supplies. When the value of this indicator reaches a

high, it means new holders hold a majority of the supply at the

moment. Such values usually occur during price tops. Related

Reading | Research Explains Bitcoin Mining Could Be Helpful

For US Energy Independence On the other hand, low values of the

metric suggest 1+ year old age bands currently own a larger part of

the total Bitcoin supply. These values of the indicator have

historically been observed near market bottoms. Now, here is a

chart that shows the trend in the BTC RHODL Ratio over the history

of the crypto: Looks like the value of the indicator has seen

decline recently | Source: Glassnode's The Week Onchain - Week 13,

2022 As you can see in the above graph, the Bitcoin RHODL Ratio has

observed some sharp downtrend in recent months. This trend means

that the supply of 1+ year old holders is going up, while that of

one-week old coins is declining. Related Reading | Bitcoin

Likely To Continue Upward Trajectory, Is $50K Its Next Target?

Also, as the chart shows, such a trend with the Bitcoin RHODL ratio

heading down after a bull run has historically signaled that the

market is near capitulation. Back in 2012, however, it was rather a

sign of the early bull market rather than an approach to the late

stages of the bear market. So, the current trend can go both ways,

but the near capitulation phase is when these values of the

indicator were observed the last two times. BTC Price At the time

of writing, Bitcoin’s price floats around $47.8k, up 11% in the

last seven days. Over the past month, the crypto has gained 27% in

value. The below chart shows the trend in the price of the coin

over the last five days. BTC's price seems to have surged up over

the last couple of days | Source: BTCUSD on TradingView Featured

image from Unsplash.com, charts from TradingView.com, Glassnode.com

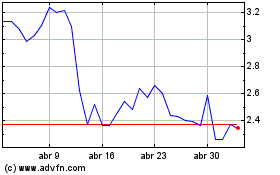

Waves (COIN:WAVESUSD)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Waves (COIN:WAVESUSD)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024

Real-Time news about Waves (Criptodivisas): 0 recent articles

Más de Waves Artículos de Noticias