Cardano TVL Jumps 30% In 24 Hours As It Recovers To $155 Million

31 Mayo 2022 - 6:00PM

NEWSBTC

Cardano has been making waves in decentralized finance (DeFi) ever

since it debuted smart contract capabilities on the network.

Development has ramped up, making it the network with the most

developments going on. This activity has translated to a rise in

the total value locked (TVL) on the network. And although this

value has been declining for a whole, it recently recorded a

recovery that saw it jump 30% in a single day. Cardano TVL On The

Rise Shortly after multiple decentralized exchanges (DEXes) had

been launched on the Cardano network, the TVL had quickly climbed.

This was a result of the accelerated adoption that came with

notable personalities such as Snoop Dogg taking to the platform and

bringing their enormous fanbases with them. At its peak, Cardano’s

TVL had grown as large as $326 locked back in March. Related

Reading | Billionaire Tim Draper On What Will Trigger The Next

Bitcoin Bull Market However, just as the market had declined, the

DeFi space had taken a big hit too. The result of this was that TVL

had fallen more than 50% from its all-time high and the Cardano

network, just like other networks, had watched its TVL decline. On

Monday, the network’s TVL had dropped to $118 million, its lowest

in a two-month period. However, this would prove to be short-lived

given that a surge bumped it back above $150 million in TVL. In a

24-hour period, Cardano’s TVL had added more than 30.96% to its

value bringing it to its current position of $155.24 million locked

on the network. ADA price on the rise following surge in activity |

Source: ADAUSD on TradingView.com Minswap (MIN) continues to

dominate on the network, while newcomer WingRiders (WRT) has beat

out OG protocol SundaeSwap (SUNDAE) to claim the second position in

terms of TVL. SundaeSwap now places third with a total of $36.51

million locked. DeFi TVL Still Struggling 2021 was no doubt the

year of decentralized finance (DeFi) given how much TVL was added

in the span of a year. From trending at $21 billion in January

2021, DeFi TVL peaked at $230 billion in the same year. This would

set the tone for the rest of the year. That is until eh December

4th crash rocked the crypto market to its core. Related Reading

| Negative Sentiment Deepens In Crypto, Why Recovery May Not

Last The decline that would begin from this point outward would be

very apparent. In a matter of six months, the DeFi space has now

lost more than $115 billion, culminating in more than half of its

TVL being shaved off. Currently, the crypto market is on a recovery

trend as bitcoin has recovered above $30,000. This recovery has had

an impact on the DeFi TVL but not much. TVL is up 4.87% in the last

24 hours, bringing the total value locked to $112.39 billion as at

the time of this writing. Featured image from Young Platform, chart

from TradingView.com Follow Best Owie on Twitter for market

insights, updates, and the occasional funny tweet…

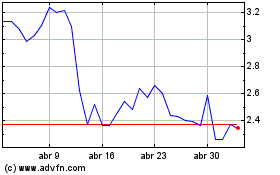

Waves (COIN:WAVESUSD)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Waves (COIN:WAVESUSD)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024

Real-Time news about Waves (Criptodivisas): 0 recent articles

Más de Waves Artículos de Noticias