Quadient new strategic plan “Elevate to 2030” aims at delivering

more than €1bn of annual subscription-related revenue and €250m of

current EBIT in 2030

Quadient new strategic plan “Elevate to 2030”

aims at delivering more than €1bn of annual subscription-related

revenue and €250m of current EBIT in 2030

Key highlights

-

>€1bn annual subscription-related revenue as financial

ambition for 2030, a €250m+ increase vs 2023 level, and

c.€250m in current EBIT, a €100m increase vs 2023

level

-

Total revenue to reach €1.3bn in

2030 driven by double-digit growth in

both Digital and Lockers and a resilient Mail automation

platform

-

All Solutions to converge to a 20%-30%

EBITDA margin range by 2030

-

Committed to reaching a Net Zero target by 2050,

in line with SBTi methodology

-

With a more customer-centric platform, Quadient

aims to continue to lead in Mail and win

both in Digital and in Lockers with a focus on delivering

sustainable and profitable recurring revenue growth

-

Financial guidance for the next 3-year period

(2024-2026): minimum 1.5% revenue CAGR and

minimum 3% current EBIT CAGR, both on an

organic basis

-

Average capex expected at €100m per year

from 2024 to 2026

-

Further deleveraging expected with leverage ratio excluding

leasing targeted at 1.5x in 2026

-

Dividend policy maintained at minimum 20%

net income payout, while considering share

buybacks to return potential excess cash to

shareholders

-

“Elevate to 2030” will lead to a stronger investment

proposition relying on faster long-term

growth, higher profitability and a

disciplined capital allocation policy over the

period

Paris, 19 June 2024,

Quadient S.A. (Euronext Paris:

QDT), a global automation platform powering secure and sustainable

business connections, holds today its 2024 Capital Markets Day,

during which its management unveils its new strategic plan

entitled: “Elevate to 2030”, including financial guidance for the

next three years as well as ambitions for 2030. The plan aims at

building on the strong foundations laid over the past five years

through the “Back to Growth” strategic plan – which led to a clear

repositioning of Quadient as an intelligent automation platform.

This platform is delivering essential benefits to c.350,000

businesses of all sizes, supporting them in their digital

transformation. Quadient’s Intelligent Automation Platform offering

spans from business communication and financial processes to mail

automation and parcel pick up and drop off applications. Based on a

customer-centric approach and supported by a recurring and

sustainable business model, the new strategic plan “Elevate to

2030” provides a solid financial outlook based on faster long-term

recurring revenue growth, higher profitability and a disciplined

capital allocation policy over the period.

Geoffrey Godet, Chief Executive Officer of

Quadient S.A., stated: “In 2019, after I joined Quadient, we

embarked into a first strategic plan aiming at transforming the

Company and setting it onto a sustainable and profitable growth

trajectory. We successfully closed this plan earlier this year with

the FY 2023 results, turning Quadient into a company focused on

creating shareholders value by leveraging its existing asset base

and delivering growing recurring revenue. Today, I am pleased to

introduce Quadient’s new strategic plan: Elevate to 2030.

Elevate to 2030 is our commitment to accelerate

the existing growth trajectory and propel Quadient as the leader in

intelligent automation. Our strategic plan is built upon four

simple yet powerful key pillars. First, we focus on customers with

a greater value proposition powered by our innovative automation

platform leveraging Artificial Intelligence. Second, we drive

higher recurring revenue through more cross-selling, increased

customer penetration and market share gains. Third, we continue to

raise the bar in terms of sustainability through ambitious ESG

goals and a commitment to achieving Net Zero by 2050. Finally, all

this translates into a strong investment proposition. Our ambition

is to reach, by 2030, more than €1 billion in subscription-related

revenue and more than €250 million in current EBIT, with an

accelerating trend driven by the favorable change in business mix.

Our plan is supported by a disciplined capital allocation policy

over the period. This new journey will give us the opportunity to

grow our Digital and Lockers automation platforms further, in two

rapidly expanding and yet underpenetrated markets, while continuing

to leverage on our Mail customer base to accelerate that growth.

Supported by a long-term history of innovation and global

capabilities, Quadient is now on an attractive sustainable and

profitable growth journey.”

A superior value proposition that meets

powerful market trends

Quadient’s vision is to power the

world’s most trusted connections between businesses, their data and

their customers. The business world is increasingly driven

by the need for more digitalization, the higher use of Artificial

Intelligence (AI) and automation, the constant rise of e-commerce

and greater consideration of ESG criteria. Being at the junction of

these four main business trends, Quadient is supporting businesses

of all sizes in their digital transformation and growth journey to

unlock operating efficiency with reliable, secure and sustainable

automation solutions. Thanks to its scalable, flexible and

reliable Intelligent automation platform, Quadient

provides its customers with a superior value proposition that

positioned the company as a partner of choice for

intelligent, sustainable and compliant digital

transformation. Its intelligent automation platform

accelerates the transition towards digital connections, using

AI-powered automation features to process large volumes of complex

data. The platform also automates mail and parcels management while

providing differentiated and seamless digital customer experience.

Additionally, Quadient’s solutions bring positive ESG impact

through the reduction of CO2 emissions, thanks notably to the

remanufacturing of mailing equipment, the digitalization of

documents and connections, as well as the greater efficiency of

parcel pick-up and delivery.

With three automation platforms

(Digital, Mail and Lockers) built on a common subscription business

model, Quadient aims at delivering growth through a

two-pronged go-to-market approach based on acquisition of new

customers and expansion within the existing base. Operating in

attractive markets, Quadient targets to add c.16,000 additional

customers and locker installations every year continuing to build

on an already at-scale customer base. The Company is also committed

to leveraging this large existing base of c.350,000 customers by

cross-selling and up-selling its wide range of applications.

Indeed, the uniqueness and key differentiator of Quadient lies in

that ability to sell several applications to an existing customer

whether it is cross-selling (sale of an additional application from

a second business line) or upselling (sale of a second application

within the same business line). Successfully penetrating a customer

account boosts its lifetime value and Quadient anticipates that

c.70% of the 2030 growth ambition will originate from its expansion

strategy.

This growth strategy is supported by global

capabilities at Company level, combining years of expertise

in R&D and innovation with an

integrated supply chain and support organization allowing for a

sustainable approach to product manufacturing and costs savings.

With over 550 engineers and developers and 6 R&D

centers worldwide, Quadient is well equipped to further

develop new innovative services and continue to improve its

existing applications. From a supply chain and support standpoint,

Quadient’s integrated approach optimizes logistics flows and

customer support functions by sharing these capabilities across the

Company and on a global scale.

Digital Quadient’s Digital

automation platform offers an array of high value cloud-based

software applications available through SaaS subscriptions. These

applications include customer journey mapping, invoice-to-cash,

procure-to-pay, communication management, document automation,

intelligent forms, and hybrid mail. They are delivered through an

integrated cloud platform featuring services such as a centralized

control panel, value-added services, add-on capabilities,

AI-powered digital interactions, and integrated support, also

enabling access to other applications. By addressing many business

pain points, Quadient’s digital automation offering brings

unquestionable customer benefits, from cost benefits to greater

convenience and strictest compliance.

In the core geographies where Quadient operates,

the addressable demand for its Digital automation platform is set

to grow from c.€6 billion in 2023 to c.€9 billion in 2027,

providing significant growth opportunities, both in communication

automation and financial automation. Particularly, Quadient is

uniquely positioned to drive compelling value from new regulatory

e-invoicing initiatives within the European Union. Quadient is

leveraging the innovation of its Digital automation platform and

building on the strong invoice generation, delivery and information

ingestion capabilities that already exist across its applications.

Managing e-invoicing is core to the Quadient

offering and common service delivered by the platform,

extensible to all Quadient Digital customers. In addition, Quadient

participates in several alliances that are working on defining the

standards for e-invoicing. This enables Quadient to remain an

active participant in this evolving field and adapt over time to

potential change, in order to continue to bring the best and most

efficient invoice-to-cash and procure-to-pay solutions to its

customers.

To capture this growth, Quadient will be relying

on an efficient go-to-market to solicit both new customers through

direct sales and partners, and existing mail customers through

cross-selling.

For the 2024-2026 period, Quadient provides an

indicative trajectory of c.10% organic CAGR in Digital

revenue and targets an EBITDA margin greater than

20% in 2026. Quadient’s 2030 ambition for its Digital

business is to reach more than €500 million in

revenue, with over 90% of subscription-related revenue,

and an EBITDA margin of c.30%.

Mail Quadient’s Mail automation

platform combines both hardware equipment (franking machines,

folder-inserters, letter openers, addressing systems, rating

scales) and its associated software and digital printing

functionalities. In most cases, the equipment is placed through

rental or leasing contracts. The highly automated services provided

by Quadient’s Mail automation platform deliver tangible customer

benefits, including labor cost savings associated with greater

efficiency, cost benefits generated by access to the best and most

accurate postage rates, higher convenience thanks to in-house mail

creation and better compliance with proof of mailing integrity,

audit trails and tracking.

Against the backdrop of a steady decline in mail

volumes, Quadient’s addressable demand for its Mail automation core

market segments should drop from c. €2.4 billion in 2023 to c. €2.0

billion in 2027. Quadient, however, believes that its Mail revenue

will continue to show resilience, declining only slowly and

gradually thanks to a continuous investment effort in innovation to

upgrade its offering and its ability to gain market share. Quadient

is also best positioned to support its customers with both

their digital mail and parcel automation needs through effective

cross-selling, allowing for an extension of the customer

relationship beyond mail and an increase in revenue per

customer.

Quadient’s indicative trajectory for the

2024-2026 period is of c.-3% organic CAGR in Mail

revenue and a targeted EBITDA margin greater than

25% in 2026. Quadient’s 2030 ambitions for Mail is to have

more c.€600 million in revenue, including

more than 65% subscription-related revenue, and an EBITDA

margin between 20% and 25%.

Lockers Quadient’s Lockers

automation platform provides a series of applications dedicated to

parcel pick up and returns. Parcel lockers and drop boxes are set

either indoors or outdoors, equipped with security cameras and

available on a 24/7 basis. Quadient’s Lockers automation platform

has two main categories: open network infrastructure and sales

& rentals of lockers for private use. Regarding open networks,

Quadient deploys and operates an infrastructure of lockers

in selected countries (France, Japan, the UK). This

infrastructure of lockers is used on a fee per parcel model by

large international and domestic carriers. Typical locations for

these parcel lockers include train stations, gas stations, car

parks or supermarkets. On the other hand, in the same countries as

well as in the United States, Quadient equips targeted verticals

including residences, universities, retailers and distributors with

parcel lockers for the specific needs of residents, students,

retail consumers and shoppers. Customer benefits range from reduced

delivery and collection costs to 24/7 availability, greater

convenience and experience, improved security of parcel delivery

and reduced CO2 emissions in city centers.

The expansion of e-commerce is the main driving

force supporting automated lockers’ demand growth. In the core

geographies where Quadient operates, the addressable market for its

Lockers automation platform is set to grow at a pace of over 10%

p.a. on average from c.€400m in 2023 to c.€600m in 2027. Together

with the rise in online retail, parcel volumes growth is also

boosted by the increase in the level of returns as well as the

growing C2C market. To capture this growth, Quadient is looking at

expanding its footprint, securing new sites to install more

lockers. Indeed, together with innovative features, density of the

lockers network to reach critical proximity is a key driver to

foster adoption and increase usage. Quadient also continues to

innovate, with services being added to its locker services such as

the award-winning drop box to consolidate returns.

For the 2024-2026 period, Quadient provides an

indicative trajectory of more than 10% organic CAGR in

Lockers revenue and targets an EBITDA margin

greater than 10% in 2026, with EBITDA breakeven point

being reached as soon as FY 2024. Quadient’s 2030 ambition for

Lockers is to reach an installed base of more than 40,000

lockers, more than €200 million in revenue, and an

EBITDA margin of c.20%.

Stronger ESG commitments

To fulfill Quadient’s long-term sustainable

growth ambition, the “Elevate to 2030” strategic plan includes

strong ESG commitments towards its

customers, its people and communities, and the

environment.

Towards its customers, Quadient aims at building

trust through market-leading applications, i.e. applications

helping customers to reduce the environmental impact of each

transaction and ensuring security and data protection. It also

involves relying on an ethical and responsible supply chain.

Targets set for 2026 include notably: 95% customer

satisfaction, life-cycle assessments covering 80% of the

applications portfolio, ISO 27001 certification extension from

Digital to Lockers R&D centers, 85% code of conduct endorsement

by strategic business partners, with 30% of them committed to

reduce their carbon footprint.

Towards its people and communities, Quadient

aims at providing its team with career opportunities based on a

competitive rewards program, assessing gender pay gap and adequate

wage, nurturing a diverse, equitable and inclusive workforce, and

forging meaningful partnerships that positively impact the

company’s communities. Targets set for 2026 include: 35% of

women representation within management, 75% inclusion

index score, and 5,000 volunteering hours dedicated to communities

every year by 2026.

Towards the environment, Quadient seeks to

reduce its impact on the planet with a climate strategy designed to

achieve zero carbon emissions by 2050, implying

the decarbonation of its applications all along their lifecycle as

well as responsible manufacturing and recycling. Targets set for

2026 include: at least 50% of placement of mail products

stemming from remanufacturing, and at least 90% of the

company’s industrial waste recycled. Regarding GHG emissions, the

scope 1 & 2 targets for 2030 were initially set at -50% vs.

2018; considering the -55% reached in 2023, Quadient is now

targeting -64% by 2030 in line with SBTi targets, with an

intermediary target of -59% set for 2026 (targets yet to be

approved by SBTi). The scope 3 target for 2030 remains at -30% vs

2018.

A strong investment

proposition

While further deploying cross-selling

opportunities and value-creation synergies across its businesses,

Quadient will continue to leverage its leadership positions.

Additional growth and higher profitability will stem from the solid

recurring revenue generated by its automation platforms and the

ability to drive innovative applications. Quadient is therefore

guiding for a greater than 1.5% organic revenue

CAGR over 2024-2026, and a twice-as-fast organic

current EBIT CAGR with a minimum of 3%

for the period 2024-2026. The 2024 financial guidance is confirmed

with organic growth expected at revenue and current EBIT

levels.

The dynamics at play within Quadient’s portfolio

of businesses, i.e. a double-digit growth in Digital and Lockers

revenues and an only moderate decline in Mail revenue will

mechanically generate a year after year acceleration in Quadient’s

total revenue growth.

Quadient’s ambitions for 2030

are to have more than €1.3 billion of total

revenue, including more than €1 billion of

subscription-related revenue (an increase of more than

€250 million vs. 2023), and a current EBIT of c.€250

million (an increase of c.€100 million vs. 2023).

In the meantime, Quadient will maintain a

disciplined capital allocation policy. Quadient’s strategic

approach will continue to be based on an ongoing assessment of its

invested capital to maximize long-term value for its

shareholders.

Capital expenditure (capex) is expected to

average at c. €100 million per year for the 2024-2026 period, to be

compared with an average of €93 million over the 2021-2023 period.

The slight increase will be due in part to Digital R&D

activities for its platform development and – to a higher extent –

to the deployment of the parcel lockers open network in the UK and

France. Mail capex is expected to remain stable and mostly linked

to new rented equipment.

In addition to organic investments, potential

opportunistic acquisitions may be considered to strengthen the

platforms, while Quadient will also continue to keep a flexible

approach to its portfolio.

Thanks to continuously strong and recurring free

cash-flow generation, Quadient aims at maintaining a healthy, yet

efficient balance sheet by bringing further down its net

debt excluding leasing/EBITDA excluding leasing ratio to 1.5x in

2026.

Finally, Quadient’s shareholder return policy

will continue to be based on a dividend pay-out ratio of

minimum 20% of net income while considering the use of

excess cash to perform share buybacks, subject to value-creation

criteria.

_________

To know more about Quadient’s news flow,

previous press releases are available on our website at the

following address: https://invest.quadient.com/en/newsroom.

Appendix

Digital: New name for Intelligent Communication

Automation

Mail: New name for Mail-Related Solutions

Lockers: New name for Parcel Locker Solutions

CONFERENCE CALL & WEBCAST

Quadient will host its

Capital Markets Day in Paris today at 9:00 am CET.

A livestream webcast

and a replay will be accessible at the following address:

Webcast

A replay of the

webcast will also be available on Quadient’s Investor Relations

website for 12 months.

Calendar

- 23 September

2024: H1 2024 results and Q2 2024 revenue

- 27 November

2024: Q3 2024 revenue

About Quadient®

Quadient is a global

automation platform provider powering secure and sustainable

business connections through digital and physical channels.

Quadient supports businesses of all sizes in their

digital transformation and growth journey,

unlocking operational efficiency and creating meaningful customer

experiences. Listed in compartment B of Euronext Paris (QDT)

and part of the CAC® Mid & Small and EnterNext® Tech 40

indices, Quadient shares are eligible for PEA-PME

investing.

For more information about Quadient, visit

https://invest.quadient.com/en/.

Contacts

|

Catherine Hubert-Dorel, Quadient+33 (0)1 45 36 30

56c.hubert-dorel@quadient.comfinancial-communication@quadient.com |

OPRG FinancialIsabelle Laurent / Fabrice Baron+33

(0)6 42 37 54 17 /+33 (0)6 14 08 29

81isabelle.laurent@omnicomprgroup.comfabrice.baron@

omnicomprgroup.com |

|

Caroline Baude, Quadient+33 (0)1 45 36 31

82c.baude@quadient.com |

|

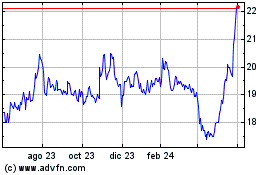

QUADIENT (EU:QDT)

Gráfica de Acción Histórica

De Ene 2025 a Feb 2025

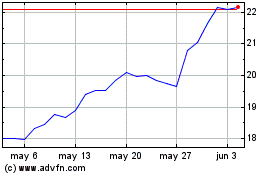

QUADIENT (EU:QDT)

Gráfica de Acción Histórica

De Feb 2024 a Feb 2025