- Revenues increased by +10.4% compared to 2020 thanks to all

the Group's businesses and the integration of Prisma Media. 2021

organic growth was +8.6%

- EBITA more than doubled (x2.3) compared to 2020, driven by

the very strong performance of all businesses, in particular Canal+

Group, Havas Group and Editis. EBITA also increased considerably

compared to 2019 (+72%)

- Adjusted net income grew 2.2-fold thanks to the strong

increase in EBITA and income from financial investments

- Earnings attributable to Vivendi SE shareowners of €24.692

billion reflects the capital gain resulting from the

deconsolidation of UMG

- Vivendi is fully supporting its teams in Ukraine by

providing them with significant logistical and financial

assistance

Regulatory News:

Vivendi (Paris:VIV):

2021 KEY FIGURES

(in millions of euros)

% change year- on-year

% change year- on-year at

constant currency and perimeter1

Revenues

€9,572 M

+10.4%

+8.6%

EBITA2,3

€690 M

x2.3

x2.4%

EBIT3

€404 M

+63.2%

Adjusted Net Income3

€649 M

x2.2

Earnings attributable to Vivendi SE

shareowners3

€24,692M

x17.2

This press release contains audited consolidated financial

figures established under IFRS, which were approved by Vivendi’s

Management Board on March 7, 2022, reviewed by the Vivendi Audit

Committee on March 7, 2022, and by Vivendi’s Supervisory Board on

March 9, 2022.

Vivendi's Supervisory Board, which met today under the

chairmanship of Yannick Bolloré, discussed the war in Ukraine at

length. The Group is doing its utmost to provide significant

logistical and financial aid to the Gameloft and Havas Group teams

present in the country. Even though Vivendi's financial exposure in

Ukraine and Russia is very low, the Group remains extremely

vigilant about the direct or indirect impact that the conflict may

have on its business activities and is preparing for any

eventuality.

Following this discussion, the Supervisory Board reviewed the

Group’s Audited Consolidated Financial Statements for the year

ended December 31, 2021, which were approved by the Management

Board on March 7, 2022.

2021 was marked by the listing of the shares of Universal

Music Group (UMG) and the distribution of nearly 60% of its share

capital to Vivendi’s shareholders in September 2021, resulting

in its deconsolidation.

Since the distribution, Vivendi accounts for its remaining

interest in UMG under the equity method.

The capital gain on the deconsolidation of UMG amounted

to €24,840 million (after taxes of €894 million) and, in accordance

with IFRS 5, is reported in the Consolidated Statement of Earnings

under Earnings attributable to Vivendi SE shareholders on the line

Earnings from discontinued operations.

Comments on earnings

In 2021, Vivendi’s revenues were €9,572 million, up €904

million (+10.4%) compared to 2020. This increase is mainly due to

the growth of Canal+ Group, Havas Group and Editis. It also

included the impact of the consolidation of Prisma Media as from

June 1, 2021.

At constant currency and perimeter1, Vivendi’s revenues grew by

8.6% compared to 2020. This increase was mainly due to the growth

of Canal+ Group (+5.2%), as well as the strong recovery of Havas

Group (+10.8%) and Editis (+18.1%).

For the second half of 2021, Vivendi’s revenues were

€5,178 million, up €631 million (+13,9 %) compared to the second

half of 2020. This increase was mainly due to the growth of Canal+

Group, Havas Group and Vivendi Village. It also included the impact

of the consolidation of Prisma Media.

At constant currency and perimeter1, Vivendi’s revenues grew by

9.5%, compared to the second half of 2020. This increase was mainly

due to the growth of Canal+ Group (+5.7%), as well as the strong

recovery of Havas Group (+13.9%) and Vivendi Village (x5.4).

For the fourth quarter of 2021, Vivendi’s revenues were

€2,702 million, up €325 million (+13.7%) compared to the fourth

quarter of 2021. At constant currency and perimeter1, Vivendi’s

revenues grew by 8.7%, compared to the fourth quarter of 2020.

In 2021, EBITA was €690 million, up €392 million compared

to 2020 (x2.3). This increase is mainly due to the growth of Havas

Group (+€118 million), thanks to the strong recovery in business

momentum in 2021 and the cost adjustment plan implemented during

the Covid-19 pandemic outbreak. The improvement is also due to

Canal+ Group (+€45 million), mainly thanks to international

activities, particularly in Africa, and to Editis (+€12 million),

as well as the recovery of other businesses, most notably Vivendi

Village (+€39 million) and Gameloft (+€32 million).

In addition, EBITA included the contribution of Prisma Media

(+€20 million), consolidated since June 1, 2021, as well as

Vivendi’s share of the net earnings of UMG (+€33 million),

accounted for under the equity method as from September 23, 2021,

and Lagardère (+€19 million), accounted for under the equity method

as from July 1, 2021.

At constant currency and perimeter1, EBITA increased by €402

million (x2.4). Excluding Vivendi’s share of UMG and Lagardère’s

net earnings, EBITA would increase by 93.9%.

EBIT was €404 million in 2021, up €156 million (+63.2%).

It includes amortization and depreciation of intangible assets

acquired through business combinations for €286 million, compared

to €50 million in 2020. In 2021, it included the goodwill

impairment loss related to Gameloft for €200 million, which

reflected the decline in Gameloft’s past operating performance.

Income from equity affiliates non-operational was a

charge of -€13 million in 2021, compared to a profit of +€126

million in 2020. The change corresponds to Vivendi’s share of

Telecom Italia’s net earnings. In 2020, this amount notably

included Vivendi’s share (+€77 million) of the capital gain

recognized by Telecom Italia on the Inwit transaction.

Income from investments was €150 million in 2021, an

increase of €115 million. In 2021, it mainly included dividends

received from Mediaset (+€102 million); as well as from Multichoice

(+€21 million) and Telefonica (+€20 million).

Other financial charges and income were a net charge of

-€827 million in 2021. They notably included a €728 million

write-down of the Telecom Italia shares accounted for under the

equity method (-€0.20 per share) in particular to account for the

economic uncertainties and strategic changes that could affect

Telecom Italia’s outlook.

Provision for income taxes reported to net income was a

net charge of -€218 million in 2021, compared to a net charge of

-€163 million in 2020.

Earnings attributable to non-controlling interests were

€183 million in 2021, compared to €167 million in 2020. Earnings

from continuing operations attributable to non-controlling

interests amounted to €62 million (compared to €38 million in 2020)

and for UMG, as a discontinued operation, these earnings amounted

to €121 million (compared to €130 million in 2020).

Earnings attributable to Vivendi SE shareowners amounted

to a profit of €24,692 million (or €22.94 per share - basic) in

2021, compared to €1,440 million (or €1.26 per share - basic) in

2020. It notably included the capital gain on the deconsolidation

of the 70% interest (including 59.87% distributed and 10.03%

retained and accounted for under the equity method) in UMG (€24,840

million, after tax). This capital gain is reported on the line

"Earnings from discontinued operations", in accordance with IFRS

5.

Prior to the listing of UMG and the distribution of 59.87% of

its share capital to Vivendi’s shareholders, Vivendi sold 30% of

UMG’s share capital for total cash proceeds in excess of €9

billion. As a reminder, net capital gains (after tax) realized on

the sale of 20% of UMG’s share capital to a Tencent-led consortium

(€2,236 million in 2021 and €2,315 million in 2020) and 10% to the

Pershing Square investment fund (€2,738 million in 2021) were

directly recorded as an increase in equity, accounted for as sales

of non-controlling interests, in accordance with IFRS 10, and

therefore did not impact the consolidated earnings.

Adjusted net income was a profit of €649 million (or

€0.60 per share - basic) in 2021, compared to €292 million (or

€0.26 per share - basic) in 2020, an increase of €357 million

(x2.2). This increase mainly included the growth in EBITA (+€392

million) and income from investments (+€115 million), partially

offset by the decline in Vivendi’s share of Telecom Italia’s

earnings, accounted for under the equity method.

As of December 31, 2021, Vivendi’s net cash position

amounted to €348 million compared to a financial net debt of €4,953

million as of December 31, 2020.

In addition, Vivendi has significant financing capacity. As of

December 31, 2021, €2.8 billion of the group’s committed credit

facilities were available. The average “economic” term of the

group’s gross financial debt calculated based on the assumption

that the available medium-term credit lines may be used to redeem

the group’s shortest-term borrowings, was 4.2 years (compared to

4.8 years as of December 31, 2020).

Vivendi’s consolidated equity amounted to €19.194 billion

as of December 31, 2021.

Lagardère

On February 21, 2022, Vivendi's Management Board approved the

terms of its tender offer for the shares of Lagardère and filed its

draft tender offer document (note d’information) with the French

securities regulator (Autorité des marchés financiers) on the same

day.

This public tender offer stems from the completion on December

16, 2021, of the acquisition by Vivendi of the Lagardère shares

sold to it by Amber Capital at a price of €24.10 per share. Since

this date, Vivendi has held 63,693,239 Lagardère shares

representing 45.13% of the share capital.

As Lagardère's 2021 financial statements were made public on

February 17, 2022, and were deemed encouraging, Vivendi decided to

increase the price of its tender offer (the principal offer) to

€25.50 per share, from which the 2021 Lagardère dividend would be

deducted, for those shareholders wishing to sell their shares

immediately.

In addition, shareholders wishing to retain their shares may

request, by opting for the subsidiary offer, to receive a transfer

right which would allow them to sell their Lagardère shares to

Vivendi, at a price of €24.10 per share, as from the end of the

offer until December 15, 2023.

If the number of shares tendered into the principal offer during

the initial offer period is insufficient to enable Vivendi to reach

the validity threshold, Vivendi will acquire for cash at the price

of the principal offer the number of shares tendered to the

subsidiary offer necessary to reach 51% of the share capital of

Lagardère outstanding as of the closing date of the initial offer

period.

As indicated, Vivendi does not intend to apply to the AMF for a

squeeze-out of Lagardère's shares or to request the delisting of

Lagardère's shares from Euronext Paris.

If this offer is successful and the required regulatory

approvals are obtained, Vivendi would like Arnaud Lagardère to

remain as Chairman and Chief Executive Officer of Lagardère and

intends to continue to rely on the skills of his management

team.

The indicative timetable envisages the opening of the offer on

April 14, 2022, for a period of 25 market days.

Return to shareholders

In 2021 and 2022, Vivendi made a significant return to

shareholders with:

- 45,1 million shares repurchased between August 2, 2021, and

March 7, 2022, i.e., 4.1% of the share capital;

- 78.7 million shares cancelled between June 18 and July 26,

2021, i.e., 3.2% and 3.6% of the share capital, respectively;

- €652.5 million in cash dividends distributed in June 2021;

and

- €27,412.3 million distributed in the form of UMG shares,

representing 59.87% of UMG's share capital, including €5,312.5

million as a special dividend in kind and €22,100 million as a

special interim dividend in kind.

As of March 7, 2022, Vivendi SE directly held 65.5 million of

its own shares, representing 5.9% of the share capital.

This program will run until May 6, 2022, for the remaining

balance of 45.1 million shares, i.e., 4.1% of the share capital,

that could be repurchased at a maximum price of €29 per share.

Shareholders' meeting on April 25, 2022

At the General Shareholders’ Meeting to be held on April 25,

2022, shareholders will be asked to renew two share repurchase

authorizations, granted in June 2021 and set to expire in December

2022. If approved, the new authorizations will run from December

2022 to October 2023:

- One resolution will propose the renewal of the authorization

given to the Management Board by the General Shareholders’ Meeting

of June 22, 2021, to repurchase shares at a maximum price of €16

per share, up to a limit of 10% of the share capital (2022-2023

program), with the option of cancelling the shares acquired up to a

limit of 10% of the capital.

- The other will concern the renewal of the authorizations

granted to the Management Board to purchase shares of the company

pursuant to a Public Share Buyback Offer (OPRA) of up to 50% of

Vivendi’s share capital at a maximum price of €16 per share (or 40%

depending on repurchases made under the new share repurchase

program that are deducted from this 50% limit), and to cancel the

shares acquired.

The General Shareholders' Meeting will also vote on the proposal

of an ordinary dividend of €0.25 per share in respect of fiscal

year 2021. This amount represents a yield of 2.1 % compared to the

closing price of Vivendi shares on December 31, 2021. The

ex-dividend date would be April 26, 2022, and payment would occur

as from April 28, 2022.

Overall, Vivendi shareholders who received Universal Music Group

(UMG) shares in September 2021 will have received a cumulative

dividend of €0.65 per share in respect of 2021 (compared to €0.60

per share in respect of 2020), consisting of a dividend of €0.25

per share paid by Vivendi, and a combined dividend of €0.40 per

share paid by UMG, including the interim dividend of €0.20 per

share paid in October 2021, and a dividend of €0.20 per share to be

paid as from May 2022 (for shareholders holding their UMG shares on

the relevant record dates).

Shareholders will also be asked to renew the terms of office of

Cathia Lawson-Hall, Michèle Reiser, Katie Stanton and Philippe

Bénacin as members of the Supervisory Board, and to appoint Maud

Fontenoy as a new member of the Supervisory Board (biography

presented before the annexes). To maintain an independent status

Aliza Jabès, an independent member of the Board since 2010, did not

seek a renewal of her term of office pursuant to the

recommendations of the AFEP-MEDEF Code.

CSR and ESG actions

Vivendi's new Corporate Social Responsibility (CSR) program,

Creation for the Future, was rolled out Group wide in 2021. The

Group has strengthened its CSR commitments and has set a course and

a framework for action common to all its businesses. The program

has three main focuses: reducing the Group's carbon footprint,

making culture and education accessible to as many people as

possible, and working for a more inclusive world.

In the fight against climate change, Vivendi has set the

objective of contributing to a net zero carbon world by adopting an

approach in line with the 2015 Paris Agreements. As a first step,

by 2025, Vivendi aims to reduce its emissions by 30%4 and to offset

its residual emissions. Vivendi's low-carbon trajectory has been

submitted to the Science Based Targets Initiative in December

2021.

At the end of December 2021, the proportion of women in the

Group's workforce5 had risen 1 point to 53% and the proportion of

women in management positions5 rose 2 points to 52%. Within

Vivendi's management bodies6, women now represent 35%. Vivendi met

its objective one year ahead of schedule. Its objectives have been

increased to 38% for December 2022 and 40% for December 2023.

A proposal will be made to the General Shareholders’ Meeting to

be held on April 25, 2022, to increase the weighting of ESG

criteria in the annual short-term variable compensation of the

Management Board members to 15% (compared to 12% in 2020 and 5% in

2019), illustrating the Group's determination to continue its

gender equality efforts.

In addition, Vivendi was included in Euronext's national CAC40

ESG Index in March 2021. This index is designed to identify the 40

companies within the CAC Large 60 Index (CAC40 + Next 20) that

demonstrate the best ESG practices.

Comments on the Businesses Key Financials

Canal+ Group

At the end of December 2021, Canal+ Group’s total subscriber

portfolio (individual and collective) reached 23.7 million,

compared to 22.1 million at the end of December 2020 on a pro forma

basis.

In 2021, Canal+ Group's revenues were €5,770 million, up 5.2% at

constant currency and perimeter compared to 2020.

Revenues from television operations in mainland France increased

by 2.9% at constant currency and perimeter compared to 2020. The

total subscriber base in mainland France recorded a net increase in

subscribers of 373,000 over the past 12 months and reached 9.05

million subscribers.

Revenues from international operations increased by 4.7% at

constant currency and perimeter compared to 2020, thanks again to

the significant growth in the number of subscribers (+1.2 million

year-on-year). The total subscriber portfolio outside mainland

France stood at 14.7 million subscribers at the end of December

2021.

With movie theaters reopening and its TV series and catalogue

performing well, Studiocanal’s revenues rose sharply by 31.5%

(+27.5% at constant currency and perimeter) compared to 2020.

Studiocanal is particularly buoyed by several box office hits, such

as The Stronghold, Black Box and The Wolf and the Lion in France,

Wrath of Man in Australia, New Zealand and Germany, and Drunk in

the United Kingdom.

In 2021, Canal+ Group’s profitability improved compared to 2020.

EBITA amounted to €480 million, compared to €435 million in 2020,

an increase of 10.4% (+9.5% at constant currency and

perimeter).

These results were supported by major developments across all

the group's strategic pillars.

On the international development pillar, Canal+ Group launched

in Ethiopia and increased its stake in the South African company

MultiChoice, crossing the threshold of 15% of capital.

On the digital pillar, myCanal deployed in Africa in 2021 and is

now present in 29 countries in Europe and Africa.

Finally, on the content pillar, Canal+ Group announced the

planned acquisition of 70% of SPI International and Studiocanal

acquired new production companies (Urban Myth Films and Lailaps

Films). In addition, on December 2, 2021, Canal+ Group announced

the signing of an agreement with French cinema organisations,

extending, at least until 2024, a partnership of more than 30

years. This agreement provides in particular:

- A guaranteed investment of more than €600 million for the next

three years in French and European cinema for Canal+ and

Ciné+;

- An earlier position in the media chronology for Canal+,

providing it with access to titles six months after their

theatrical release, in line with its renewed status as the leading

contributor to French and European cinema;

- A window of exclusive rights for Canal+ of at least nine

months, which can rise to 16 months with the second window;

and

- Better ability to exhibit and circulate works on Canal+ Group

cinema channels and on myCanal.

Following this agreement, Canal+ Group signed the new media

chronology on January 24, 2022. Canal+ is now entitled to broadcast

movies six months after their theatrical release, compared to 12

months in 2018.

After Netflix and Disney+, Starzplay joined Canal+ offers in

2021. In line with this, on February 15, 2022, Canal+ Group and

ViacomCBS Networks International announced a long-term strategic

partnership based on two pillars:

- The distribution of Paramount+ by the end of the year and nine

ViacomCBS channels by Canal+ Group, in France and Switzerland.

Canal+ Group will be the only market player in France able to

integrate Paramount+ into its commercial offers (in “hard

bundle”);

- The acquisition of exclusive premium content for Canal+ Group

channels and services, covering more than 30 territories. Canal+

Group will notably air Paramount films in exclusive premiere on

Canal+ in France and Switzerland six months after their theatrical

release.

Havas Group

In 2021, Havas Group’s revenues were €2,341 million, up by 10.8%

at constant currency and perimeter compared to 2020.

Net revenues7 were €2,238 million in 2021, up 9.2% compared to

2020. Organic growth was +10.4% compared to 2020. Currency effects

were negative at -2.3% and acquisitions contributed +1.1%.

During the fourth quarter of 2021, Havas Group again recorded

strong business growth compared to the same period in 2020 and

achieved organic growth in net revenues of +9.3%.

All the geographical regions delivered excellent organic

performances in 2021, with positive contributions from all

divisions: Creative, Media and Health communications. North America

and Europe were the biggest contributors, enjoying solid organic

growth. Asia-Pacific and Latin America also reported highly

satisfactory performances.

At the end of December 2021, EBITA was €239 million, compared to

€121 million in 2020 (and €225 million in 2019). This near doubling

of EBITA (after restructuring charges) is attributable to the

strong momentum of organic growth in net revenues and to the

savings achieved through the cost adjustment plan introduced in

2020, the positive benefits of which were felt in 2021.

Havas Group pursued its targeted acquisitions policy and

acquired four majority stakes in 2021: BLKJ (a Singapore-based

creative agency), Agence Verte (CSR communications in France),

Nohup (Customer Experience in Italy) and Raison de Santé (a

healthcare communications agency in France).

2021 was a record year for Havas Group in terms of both new

client wins and creative awards given to its agencies around the

world (please refer to Appendix VI).

Editis

In 2021, book sales sharply increased compared to both 2020 and

2019. The market reached a historic level, notably driven by the

Comics-Mangas segment. In this exceptional context, Editis achieved

a record performance. In 2021, Editis’ revenues reached €856

million, an increase of 18.1% at constant currency and perimeter

compared to the same period in 2020 and 16.5% compared to 2019,

even though school reform has less of an impact in 2021 than it had

in the two previous years.

In 2021, 10 of Editis’ authors ranked in the Top 30 of the most

purchased French-speaking authors in modern fiction8 (compared to 9

in 2020), with most of them showing an increase compared to

previous years.The Youth and Comics segments were not outdone, with

Editis' growth compared to 2019 exceeding that of the market. In

addition, at the end of 2021, Editis was among the Top 3 in

Illustrated Books9, with a strong presence in the cooking segment

and among influencer authors. To cite a few examples: Volume 5 of

Fait maison by Cyril Lignac and Mes desserts faits maison by

Roxane.

In terms of its third-party publishers, Editis can be proud not

only of the Prix Goncourt awarded to La plus secrète mémoire des

hommes by M. Mbougar at Philippe Rey, but also of best-selling

publications such as Familia Grande by Camille Kouchner or Les

aventures de Vincent Lacoste by Riad Sattouf.

In 2021, Editis' EBITA rose sharply by 32.2%, at €51 million,

compared to 2020.

Other businesses

Prisma Media

In 2021, Prisma Media’s revenues were €309 million, up 11.2%

compared to the same period in 2020 (pro forma). Since June 1,

2021, the date of Vivendi’s consolidation of Prisma Media, Prisma

Media’s revenues were €194 million, up 6.4% at constant currency

and perimeter10 compared to the same period in 2020. Digital

revenues reached a record level, up 42.4% compared to 2020, and

represented more than 30% of Prisma Media’s total revenues.

In 2021, Prisma Media’s pro forma EBITA was €30 million, an

increase of €16 million compared to 2020. This growth is mainly due

to a €3 million improvement in operating performance and a decrease

in restructuring charges.

Prisma Media reinforced its leading position on the TV Print

magazine market with the acquisition of Télé Z in September 2021,

adding a new brand to its TV portfolio which includes Télé Loisirs,

TV Grandes Chaînes and Télé 2 semaines.

Digital audiences reached record levels, and Prisma Media brands

confirmed their leading positions: Télé Loisirs is No.1 in the

Entertainment segment with 22.3 million unique visitors (UVs -

average monthly UVs); Capital is No. 1 in the Economic segment with

10.8 million UVs; Femme Actuelle, Voici and Gala are No. 2, No. 3

and No. 4, respectively, in the Women’s segment; Géo is No. 2 in

the Travel segment with 3.9 million UVs.

Traffic (in page views) on Prisma Media’s websites increased by

more than 40% compared to 2019 and 10% compared to 2020.

Prisma Media’s social media audiences grew strongly compared to

2020 with the number of followers up 17% and the video audience up

35%. The growth has been particularly driven by the increase in

followers on Tiktok +73% and Instagram +28%. In 2021, Gala became

the European media leader on Tiktok, with the number of followers

up by more than 20% compared to 2020. In 2021, audio audiences were

up 60% compared to 2020 supported by the launch of 60 podcasts with

more than 4,000 episodes.

In 2021, Gameloft’s revenues reached €265 million.

Asphalt 9: Legends, Disney Magic Kingdoms, Dragon Mania Legends,

March of Empires, and Asphalt 8: Airborne generated 47% of

Gameloft’s total revenues and were the five-best-selling-games in

2021.

Gameloft’s gross margin11 increased by 15.1% and reached €189

million in 2021. This solid growth was driven by the success of its

OTT12 and Gameloft for brands13 businesses, which represent 87% of

Gameloft’s gross margin. Its OTT business grew by 17% thanks to the

success of Apple Arcade games, to the resilience of the catalogue

and to the diversification on new platforms (Netflix, Facebook,

etc.). Gameloft also benefited in the last few months of 2021 from

the success of newly launched titles such as Heroes of the Dark and

Sniper Champions. The excellent performance of Gameloft for brands,

whose gross margin increased by 22%, also enabled Gameloft to

achieve this strong business growth in 2021.

In 2021, Gameloft’s EBITA was €8 million, up €32 million

year-on-year.

In 2021, Vivendi Village’s revenues were €104 million

compared to €40 million in 2020 (x2.6 at constant currency and

perimeter), thanks to a significant rebound of its activities in

the second half of 2021. This rebound results from less stringent

sanitary constraints and a pronounced and even reinforced public

appetite for live events. Vivendi Village allocates more than €10

million to solidarity actions and cultural access.

See Tickets, the ticketing company present in nine European

countries and the United States, sold 27 million tickets in 2021,

including to Winter Wonderland, the traditional Christmas event in

Hyde Park in London which attracts several million visitors. Some

of the summer festivals produced by Olympia Production and U-Live

were able to be held in France and the UK, sometimes with reduced

attendance capacity, while several new festivals for 2022 and 2023

were announced, including Inversion Fest in Lyons and the Kite

Festival in Oxfordshire. L’Olympia resumed its activities in early

September 2021 with 95 public and private events scheduled.

In 2021, New Initiatives, which brings together

Dailymotion and the GVA entities, recorded revenues

of €89 million, an increase of €24 million (+37.0% at constant

currency and perimeter).

Dailymotion’s audience for premium content is still

growing strongly, with +32% growth in 2021 compared to 2020, and

represents more than four-fifths of the overall audience (82%).

This growth has been driven by the signing of new partners with

Prisma Media, Webedia (in France, Germany, Spain and South

America), Unify (in France, the UK, Italy and Germany) and Monrif

(in Italy).

In 2021, programmatic video advertising sales on Dailymotion

grew by +43% compared to 2020, to represent nearly half of sales,

thanks in particular to the strengthening of the partnership with

Google.

GVA is an FTTH (Fiber To The Home) operator specialized

in the provision of very high-speed Internet access and established

in the cities of Sub-Saharan Africa.

GVA’s general public and business offers, under the brands

Canalbox and Canalbox Business, respectively, are revolutionizing

Internet access and usage in Africa by offering the best quality of

service, the best speeds and unlimited usage at very competitive

rates.

At the end of 2021, GVA covered a potential market of more than

one million homes and businesses in Africa with its FTTH networks

deployed in Libreville (Gabon), Lomé (Togo), Pointe Noire (Congo

Brazzaville), Abidjan (Ivory Coast), and Kigali (Rwanda) and

supplemented in 2021 by the launch of operations in three new

cities: Brazzaville (Congo Brazzaville) in April, Ouagadougou

(Burkina Faso) in June, and Kinshasa (DRC) in December.

Calendar

April 25, 2022: Publication of first quarter 2022 revenues April

25, 2022: Annual General Shareholders' Meeting

For additional information, please refer to the “Financial

Report and Audited Consolidated Financial Statements for the year

ended December 31, 2021” to be released later on Vivendi’s website

(www.vivendi.com).

About Vivendi

Since 2014, Vivendi has built a world-class media, content and

communications group. The Group owns leading, strongly

complementary assets in television and movies (Canal+ Group),

communications (Havas Group), publishing (Editis), magazines

(Prisma Media), video games (Gameloft), live entertainment and

ticketing (Vivendi Village). It also owns a global digital content

distribution platform (Dailymotion). Vivendi’s various businesses

cohesively work together as an integrated industrial group to

create greater value. Vivendi is committed to the environment and

aims at being carbon neutral by 2025. In addition, the Group is

helping to build more open, inclusive and responsible societies by

supporting diverse and inventive creative works, promoting broader

access to culture, education and its businesses, and by increasing

awareness of 21st-century challenges and opportunities.

www.vivendi.com

Important Disclaimers

Cautionary Note Regarding Forward-Looking Statements. This press

release contains forward-looking statements with respect to

Vivendi’s financial condition, results of operations, business,

strategy, plans and outlook, including the impact of certain

transactions and the payment of dividends and distributions, as

well as share repurchases. Although Vivendi believes that such

forward-looking statements are based on reasonable assumptions,

such statements are not guarantees of future performance. Actual

results may differ materially from the forward-looking statements

as a result of a number of risks and uncertainties, many of which

are outside our control, including, but not limited to, the risks

related to antitrust and other regulatory approvals as well as any

other approvals which may be required in connection with certain

transactions and the risks described in the documents of the Group

filed by Vivendi with the Autorité des Marchés Financiers (the

French securities regulator), which are also available in English

on Vivendi's website (www.vivendi.com). Investors and security

holders may obtain a free copy of documents filed by Vivendi with

the Autorité des Marchés Financiers at www.amf-france.org, or

directly from Vivendi. Accordingly, we caution readers against

relying on such forward-looking statements. These forward-looking

statements are made as of the date of this press release. Vivendi

disclaims any intention or obligation to provide, update or revise

any forward-looking statements, whether as a result of new

information, future events or otherwise.

Unsponsored ADRs. Vivendi does not sponsor an American

Depositary Receipt (ADR) facility in respect of its shares. Any ADR

facility currently in existence is “unsponsored” and has no ties

whatsoever to Vivendi. Vivendi disclaims any liability in respect

of any such facility.

In 2021, notwithstanding the uncertainties created by the

COVID-19 pandemic and although its impacts were more significant in

certain countries or on certain businesses than others, Vivendi

showed resilience in adapting its business activities to continue

to best serve and entertain its customers, while reducing costs to

preserve its margins. The business activities showed good

resilience, in particular pay television services, as well as Havas

Group and Editis. However, as expected, the pandemic’s effects

continued to slow down certain businesses such as Vivendi Village

(in particular live entertainment).

Vivendi continually monitors the current and potential

consequences of the health crisis. To date, it is difficult to

determine how it will impact Vivendi’s results in 2022.

Nevertheless, the Group remains confident in the resilience of its

main businesses. It continues to make every effort to ensure the

continuity of its business activities, as well as to best serve and

entertain its customers and audiences while complying with the

health guidelines of authorities in each country where it

operates.

Russia's invasion of Ukraine in February 2022 is having a

significant impact on the financial markets and the prices of

certain commodities and will have repercussions on the entire world

economy. Vivendi is mainly present in Ukraine through Gameloft,

which is doing everything possible to support its teams in the

country and limit the impact of the events on the delivery of its

content. The Group also has communications activities in Ukraine

through companies affiliated with Havas Group and is fully

mobilized to help them as much as possible. At this time, it is not

possible for Vivendi to assess the indirect consequences that the

Ukraine crisis could have on its business activities.

In 2021, Vivendi tested the value of goodwill allocated to its

Cash-Generating Units (CGU) or groups of CGU by applying valuation

methods consistent with previous years. Vivendi ensured that the

recoverable amount of CGU or groups of CGU tested exceeded their

carrying value (including goodwill).

ANALYST CONFERENCE CALL Speakers: Arnaud de

Puyfontaine Chief Executive Officer Hervé Philippe

Member of the Management Board and Chief Financial Officer

Date: March 9, 2022 6:15pm Paris time – 5:15pm London

time – 12:15pm New York time

Media invited on a listen-only basis.

The conference will be held in English.

Internet: The conference can be followed on the Internet

at: www.vivendi.com (audiocast)

Numbers to dial:

- USA: +1 212 999 6659

- France: +33 (0) 1 7037 7166

- UK (Standard International Access) : +44 (0) 33 0551 0200

- Password: Vivendi

An audio webcast and the slides of the presentation will be

available on the company’s website www.vivendi.com.

Biography of Maud Fontenoy (picture available on

request)

A sailor with multiple achievements and firsts in solo, rowing

and sailing, Ambassador to the French Ministry of Education and

Youth for education about the sea and sea classes, President of the

Maud Fontenoy Foundation, former spokesperson for the UNESCO

Oceanographic Commission, expert in sustainable development,

lecturer as well as author of committed books and documentaries,

Ms. Maud Fontenoy fights for the protection of the environment and

more specifically of the oceans and the coastline. For more than 20

years, she has been fighting to inform and raise awareness of the

need to protect the planet.

Having spent more time of her life on the seas than on land, she

never stops talking about the visible effects of pollution and

global warming on the oceans she knows well. With the support of

scientists, and in particular through the actions she carries out

within the framework of her foundation, in partnership with the

French Ministry of Education, Mrs. Maud Fontenoy is committed to

educating the young generation, to give them a simple instruction

manual so that "sustainable development" becomes accessible to all,

and that ecology also rhymes with economy. She currently advises

various companies on this theme and advocates a realistic and

pragmatic ecology.

Since 2007, she is a Knight of the National Order of Merit and

Knight of the Order of Maritime Merit

APPENDIX I

VIVENDI

CONSOLIDATED STATEMENT OF EARNINGS

(IFRS, audited)

Year ended December 31,

% Change

2021

2020

REVENUES

9,572

8,668

+ 10.4%

Cost of revenues

(5,360)

(4,904)

Selling, general and administrative

expenses excluding amortization of intangible assets acquired

through business combinations

(3,563)

(3,371)

Restructuring charges

(49)

(86)

Income from equity affiliates -

operational

90

(9)

Adjusted earnings before interest and

income taxes (EBITA)*

690

298

x 2.3

Amortization and depreciation of

intangible assets acquired through business combinations

(286)

(50)

EARNINGS BEFORE INTEREST AND INCOME

TAXES (EBIT)

404

248

+ 63.2%

Income from equity affiliates -

non-operational

(13)

126

Interest

(34)

(22)

Income from investments

150

35

Other financial charges and income

(827)

12

(711)

25

Earnings before provision for income

taxes

(320)

399

na

Provision for income taxes

(218)

(163)

Earnings from continuing

operations

(538)

236

na

Earnings from discontinued operations

25,413

1,371

Earnings

24,875

1,607

x 15.5

Non-controlling interests

(183)

(167)

EARNINGS ATTRIBUTABLE TO VIVENDI SE

SHAREOWNERS

24,692

1,440

x 17.2

of which earnings from continuing

operations attributable to Vivendi SE shareowners

(600)

199

earnings from discontinued operations

attributable to Vivendi SE shareowners

25,292

1,241

Earnings attributable to Vivendi SE

shareowners per share - basic (in euros)

22.94

1.26

Earnings attributable to Vivendi SE

shareowners per share - diluted (in euros)

22.87

1.26

Adjusted net income*

649

292

x 2.2

Adjusted net income per share - basic (in

euros)*

0.60

0.26

Adjusted net income per share - diluted

(in euros)*

0.60

0.26

In millions of euros, except per share amounts.

na: not applicable.

NOTA: As from September 14, 2021, in accordance with IFRS

5 - Non-current assets held for sale and discontinued operations,

Universal Music Group (UMG) was presented as a discontinued

operation in Vivendi’s Consolidated Statement of Earnings. On

September 23, 2021, the payment date of the distribution in kind of

UMG shares to Vivendi’s shareholders, Vivendi ceded control of UMG

and deconsolidated its 70% interest in UMG.

Income and charges from Universal Music Group have been reported

as follows:

- their contribution until September 22,

2021, if any, to each line of Vivendi’s Consolidated Statement of

Earnings (before non-controlling interests) has been reported on

the line “Earnings from discontinued operations”;

- in accordance with IFRS 5, these

adjustments have been applied to all periods presented to ensure

consistency of information; and

- the share of net income has been excluded

from Vivendi’s adjusted net income.

The adjustments to previously published data are presented in

the appendix to the Financial Report for the year ended December

31, 2021, and in Note 31 to the Consolidated Financial Statements

for the year ended December 31, 2021.

*The non-GAAP measures of EBITA and Adjusted net income should

be considered in addition to, and not as a substitute for, other

GAAP measures of operating and financial performance. Vivendi

considers these to be relevant indicators of the group’s operating

and financial performance. Vivendi Management uses EBITA and

adjusted net income for reporting, management and planning purposes

because they exclude most non-recurring and non-operating items

from the measurement of the business segments’ performances.

For any additional information, please refer to the “Financial

Report and Audited Consolidated Financial Statements for the year

ended December 31, 2021“, which will be released online later on

Vivendi’s website (www.vivendi.com).

APPENDIX I (Cont’d)

VIVENDI

CONSOLIDATED STATEMENT OF EARNINGS

(IFRS, audited)

Reconciliation of earnings attributable to Vivendi SE

shareowners to adjusted net income

Year ended December 31,

(in millions of euros)

2021

2020

Earnings attributable to Vivendi SE

shareowners (a)

24,692

1,440

Adjustments

Amortization and depreciation of

intangible assets acquired through business combinations (a)

286

50

Amortization of intangible assets related

to equity affiliates – non-operational

60

60

Other financial charges and income (a)

827

(12)

Earnings from discontinued operations

(a)

(25,413)

(1,371)

Provision for income taxes on

adjustments

78

3

Impact of adjustments on non-controlling

interests

119

122

Adjusted net income

649

292

- As reported in the Consolidated Statement of Earnings.

Adjusted Statement of Earnings

Year ended December 31,

% Change

(in millions of euros)

2021

2020

Revenues

9,572

8,668

+ 10.4%

EBITA

690

298

x 2.3

Income from equity affiliates -

non-operational

47

186

Interest

(34)

(22)

Income from investments

150

35

Adjusted earnings from continuing

operations before provision for income taxes

853

497

+ 71,6%

Provision for income taxes

(140)

(160)

Adjusted net income before non-controlling

interests

713

337

Non-controlling interests

(64)

(45)

Adjusted net income

649

292

x 2.2

APPENDIX II

VIVENDI

REVENUES AND EBITA BY BUSINESS SEGMENT

(IFRS, audited)

Year ended December 31,

(in millions of euros)

2021

2020

% Change

% Change at constant currency

% Change at constant currency and

perimeter (a)

Revenues

Canal+ Group

5,770

5,498

+4.9%

+5.5%

+5.2%

Havas Group

2,341

2,137

+9.6%

+11.8%

+10.8%

Editis

856

725

+18.1%

+18.1%

+18.1%

Prisma Media (from 06/01/2021)

194

na

na

na

+6.4%

Gameloft

265

253

+4.5%

+5.4%

+2.7%

Vivendi Village

104

40

x 2.6

x 2.6

x 2.6

New Initiatives

89

65

+37.0%

+37.0%

+37.0%

Elimination of intersegment

transactions

(47)

(50)

Total Vivendi

9,572

8,668

+10.4%

+11.4%

+8.6%

EBITA

Canal+ Group

480

435

+10.4%

+10.1%

+9.5%

Havas Group

239

121

+97.0%

x 2.0

+96.9%

Editis

51

38

+32.2%

+32.2%

+32.2%

Prisma Media (from 06/01/2021)

20

na

na

na

-24.3%

Gameloft

8

(24)

na

na

na

Vivendi Village

(20)

(59)

+66.8%

+66.7%

+66.7%

New Initiatives

(30)

(75)

+60.0%

+60.0%

+60.0%

Corporate

(110)

(138)

+20.1%

+19.6%

+19.6%

Subtotal

638

298

x 2.1

x 2.2

+93.9%

Vivendi's share of Universal Music Group's

earnings (a)

33

na

Vivendi's share of Lagardère's earnings

(a)

19

na

Total Vivendi

690

298

x 2.3

x 2.3

x 2.4

na: not applicable.

- Constant perimeter notably reflects the impact of the

acquisition of Prisma Media on May 31, 2021, as well as the equity

accounting of Lagardère since July 1, 2021, and Universal Music

Group since September 23, 2021.

APPENDIX II (Cont’d)

VIVENDI

QUARTERLY REVENUES BY BUSINESS SEGMENT

(IFRS, audited)

2021

(in millions of euros)

Three months ended March 31,

Three months ended June 30,

Three months ended September

30,

Three months ended December

31,

Revenues

Canal+ Group

1,357

1,425

1,467

1,521

Havas Group

502

546

590

703

Editis

163

209

230

254

Prisma Media (a)

-

29

75

90

Gameloft

55

65

64

81

Vivendi Village

8

16

37

43

New Initiatives

17

21

22

29

Elimination of intersegment

transactions

(7)

(12)

(9)

(19)

Total Vivendi

2,095

2,299

2,476

2,702

2020

(in millions of euros)

Three months ended March 31,

Three months ended June 30,

Three months ended September

30,

Three months ended December

31,

Revenues

Canal+ Group

1,372

1,302

1,380

1,444

Havas Group

524

495

484

634

Editis

116

146

232

231

Gameloft

61

69

63

60

Vivendi Village

23

3

8

6

New Initiatives

15

13

16

21

Elimination of intersegment

transactions

(7)

(11)

(13)

(19)

Total Vivendi

2,104

2,017

2,170

2,377

- Vivendi has fully consolidated Prisma Media since June 1,

2021.

APPENDIX III

VIVENDI

CONSOLIDATED STATEMENT OF FINANCIAL

POSITION (IFRS, audited)

(in millions of euros)

December 31, 2021

December 31, 2020

ASSETS

Goodwill

9,447

14,183

Non-current content assets

336

3,902

Other intangible assets

777

848

Property, plant and equipment

961

1,125

Rights-of-use relating to leases

766

1,068

Investments in equity affiliates

8,398

3,542

Non-current financial assets

1,727

4,285

Deferred tax assets

234

736

Non-current assets

22,646

29,689

Inventories

256

366

Current tax receivables

101

128

Current content assets

861

1,346

Trade accounts receivable and other

5,039

5,482

Current financial assets

1,136

135

Cash and cash equivalents

3,328

976

Current assets

10,721

8,433

TOTAL ASSETS

33,367

38,122

EQUITY AND LIABILITIES

Share capital

6,097

6,523

Additional paid-in capital

865

2,368

Treasury shares

(971)

(2,441)

Retained earnings and other

12,990

9,309

Vivendi SE shareowners' equity

18,981

15,759

Non-controlling interests

213

672

Total equity

19,194

16,431

Non-current provisions

678

1,060

Long-term borrowings and other financial

liabilities

3,496

4,171

Deferred tax liabilities

395

1,166

Long-term lease liabilities

758

1,070

Other non-current liabilities

48

916

Non-current liabilities

5,375

8,383

Current provisions

467

670

Short-term borrowings and other financial

liabilities

783

2,230

Trade accounts payable and other

7,363

10,095

Short-term lease liabilities

125

221

Current tax payables

61

92

Current liabilities

8,798

13,308

Total liabilities

14,173

21,692

TOTAL EQUITY AND LIABILITIES

33,367

38,122

APPENDIX IV

VIVENDI

CONSOLIDATED STATEMENT OF CASH FLOWS

(IFRS, audited)

Year ended December 31,

(in millions of euros)

2021

2020

Operating activities

EBIT

404

248

Adjustments

640

821

Content investments, net

22

36

Gross cash provided by operating

activities before income tax paid

1,066

1,105

Other changes in net working capital

75

7

Net cash provided by operating

activities before income tax paid

1,141

1,112

Income tax (paid)/received, net

(107)

117

Net cash provided by operating

activities of continuing operations

1,034

1,229

Net cash provided by operating activities

of discontinued operations

603

(3)

Net cash provided by operating

activities

1,637

1,226

Investing activities

Capital expenditures

(460)

(373)

Purchases of consolidated companies, after

acquired cash

(254)

(92)

Investments in equity affiliates

(612)

(118)

Increase in financial assets

(1,258)

(1,425)

Investments

(2,584)

(2,008)

Proceeds from sales of property, plant,

equipment and intangible assets

4

3

Proceeds from sales of consolidated

companies, after divested cash

-

64

Disposal of equity affiliates

-

9

Decrease in financial assets

76

249

Divestitures

80

325

Dividends received from equity

affiliates

74

39

Dividends received from unconsolidated

companies

144

30

Net cash provided by/(used for)

investing activities of continuing operations

(2,286)

(1,614)

Net cash provided by/(used for) investing

activities of discontinued operations

(1,466)

(31)

Net cash provided by/(used for)

investing activities

(3,752)

(1,645)

Financing activities

Net proceeds from issuance of common

shares in connection with Vivendi SE's share-based compensation

plans

18

153

Sales/(purchases) of Vivendi SE's treasury

shares

(693)

(2,157)

Distributions to Vivendi SE's

shareowners

(653)

(690)

Other transactions with shareowners

5,943

2,784

Dividends paid by consolidated companies

to their non-controlling interests

(40)

(65)

Transactions with shareowners

4,575

25

Setting up of long-term borrowings and

increase in other long-term financial liabilities

5

5

Principal payment on long-term borrowings

and decrease in other long-term financial liabilities

(3)

(1)

Principal payment on short-term

borrowings

(1,375)

(1,061)

Other changes in short-term borrowings and

other financial liabilities

93

35

Interest paid, net

(34)

(22)

Other cash items related to financial

activities

(28)

(18)

Transactions on borrowings and other

financial liabilities

(1,342)

(1,062)

Repayment of lease liabilities and related

interest expenses

(155)

(165)

Net cash provided by/(used for)

financing activities of continuing operations

3,078

(1,202)

Net cash provided by/(used for) financing

activities of discontinued operations

1,356

527

Net cash provided by/(used for)

financing activities

4,434

(675)

Foreign currency translation adjustments

of continuing operations

14

(24)

Foreign currency translation adjustments

of discontinued operations

19

(36)

Change in cash and cash

equivalents

2,352

(1,154)

Cash and cash equivalents

At beginning of the period

976

2,130

At end of the period

3,328

976

NOTA: As from September 14, 2021, in accordance with IFRS

5 - Non-current assets held for sale and discontinued operations,

Universal Music Group (UMG) was presented as a discontinued

operation in Vivendi’s Consolidated Statement of Cash Flows. On

September 23, 2021, the payment date of the distribution in kind of

UMG shares to Vivendi’s shareholders, Vivendi ceded control of UMG

and deconsolidated its 70% interest in UMG. The adjustments to

previously published data are presented in Note 31 to the

Consolidated Financial Statements for the year ended December 31,

2021.

APPENDIX V

VIVENDI

KEY CONSOLIDATED FINANCIAL DATA FOR THE LAST

FIVE YEARS

(IFRS, audited)

As from September 14, 2021, in accordance with IFRS 5 -

Non-current assets held for sale and discontinued operations,

Universal Music Group (UMG) was presented as a discontinued

operation in Vivendi’s Consolidated Financial Statements. On

September 23, 2021, the payment date of the distribution in kind of

UMG shares to Vivendi’s shareholders, Vivendi ceded control of UMG

and deconsolidated its 70% interest in UMG. These adjustments were

made to all periods, as set out in the table of selected key

consolidated financial data below, in respect of data from the

Consolidated Statements of Earnings and Cash Flows. As a reminder,

in 2019, Vivendi applied a new accounting standard:

- IFRS 16 – Leases: in accordance with IFRS 16, the impact of the

change of accounting standard was recorded in the opening balance

sheet as of January 1, 2019. In addition, Vivendi applied this

change of accounting standard to the Statement of Financial

Position, Statement of Earnings and Statement of Cash Flows for the

year ended December 31, 2019; therefore, the data relative to prior

years is not comparable.

As a reminder, in 2018, Vivendi applied two new accounting

standards:

- IFRS 15 – Revenues from Contracts with Customers: in accordance

with IFRS 15, Vivendi applied this change of accounting standard to

revenues as from January 1, 2017; and

- IFRS 9 – Financial Instruments: in accordance with IFRS 9,

Vivendi applied this change of accounting standard to the Statement

of Earnings and Statement of Comprehensive Income for the year

ended December 31, 2018, restating its opening balance sheet as of

January 1, 2018; therefore, the data in this report relative to

prior years is not comparable.

Year ended December 31,

2021

2020

2019

2018

2017

Consolidated

data

Revenues

9,572

8,668

8,747

7,916

6,849

Adjusted earnings before interest and

income taxes (EBITA) (a)

690

298

402

386

207

Earnings before interest and income taxes

(EBIT)

404

248

343

361

343

Earnings attributable to Vivendi SE

shareowners

24,692

1,440

1,583

127

1,216

Adjusted net income (a)

649

292

778

482

688

Net Cash Position/(Financial Net Debt)

(a)

348

(4,953)

(4,064)

176

(2,340)

Total equity

19,194

16,431

15,575

17,534

17,866

of which Vivendi SE shareowners'

equity

18,981

15,759

15,353

17,313

17,644

Cash flow from operations (CFFO) (a)

748

646

199

288

344

Cash flow from operations after interest

and income tax paid (CFAIT) (a)

579

723

22

208

800

Financial investments

(2,124)

(1,634)

(2,221)

(670)

(3,635)

Financial divestments

76

323

1,062

2,283

970

Dividends paid by Vivendi SE to its

shareholders

653

690

636

568

499

Special distribution in kind of 59.87% of

UMG to Vivendi SE shareowners

25,284

Purchases/(sales) of Vivendi SE's treasury

shares

693

2,157

2,673

-

203

Per share

data

Weighted average number of shares

outstanding

1,076.3

1,140.7

1,233.5

1,263.5

1,252.7

Earnings attributable to Vivendi SE

shareowners per share

22.94

1.26

1.28

0.10

0.97

Adjusted net income per share

0.60

0.26

0.63

0.38

0.55

Number of shares outstanding at the end of

the period (excluding treasury shares)

1,045.4

1,092.8

1,170.6

1,268.0

1,256.7

Equity per share, attributable to Vivendi

SE shareowners

18.16

14.42

13.12

13.65

14.04

Dividends per share paid

0.60

0.60

0.50

0.45

0.40

In millions of euros, number of shares in millions, data per

share in euros.

- The non-GAAP measures of EBITA, Adjusted net income, Net Cash

Position (or Financial Net Debt), Cash flow from operations (CFFO)

and Cash flow from operations after interest and income tax paid

(CFAIT) should be considered in addition to, and not as a

substitute for, other GAAP measures of operating and financial

performance as presented in the Consolidated Financial Statements

and the related Notes, or as described in this Financial Report.

Vivendi considers these to be relevant indicators of the group’s

operating and financial performance. Each of these indicators is

defined in the appropriate section of this Financial Report. In

addition, it should be noted that other companies may have

definitions and calculations for these indicators that differ from

those used by Vivendi, thereby affecting comparability.

APPENDIX VI VIVENDI HAVAS GROUP: SIGNIFICANT

AWARDS AND WINS

Main accounts won In 2021, Havas continued its global

development by winning numerous new clients in creative, media

expertise and healthcare communications, both locally and

globally:

Havas Creative ASDA, COX Communications, Easyjet, JLL,

Nestlé, New York Presbyterian, Petropolis, Telecom Italia, VW,

World Bank x IMF.

Havas Health & You AbbVie, Amgen, Genentech,

Hutchison, Medipharma, Ipsen, Myovant, New York Presbyterian,

Novartis Otsuka, Pfizer, Sanofi, Trevana, Vifor

Havas Media Boiron, Dolce & Gabbana, Forevermark

& DeBeers, IAG Group International Airlines Group (Iberia,

Vuelig and IAG Cargo), Land O' Lakes, Ola Group, PEPCO, Pernod

Ricard, Red Bull, Sears, Unilever (Western Europe), Weleda.

Key awards won Fiscal year 2021 was a record year for

Havas, which received more than 1,300 awards and distinctions for

its work and agencies around the world.

The creativity of the agencies was rewarded at the most

prestigious festivals and ceremonies. Starting with the Cannes

Lions International Advertising Festival in June, which this year

included the 2020 and 2021 editions. The group's agencies won no

fewer than 38 Lions (one Grand Prix, five Golds, nine Silvers and

23 Bronzes), led by the "Crocodile Inside" campaign by BETC Paris

for Lacoste, which won the coveted Grand Prix in the Film category

as well as a Gold, two Silvers and a Bronze, the Arnold Boston

campaign for Red Cross, which won two Golds, a Silver and a Bronze,

and the "Undercover Avatar" campaign by Havas Sports &

Entertainment Paris for L'Enfant Bleu, which won a Gold and a

Bronze.

At the One Show, another major ceremony, the group's agencies

walked away with 30 awards, including four Golds, five Silvers and

ten Bronzes, as well as the prestigious Green Pencil, the top prize

in the Sustainable category, awarded to the "Water Index" campaign

by Havas Turkey for the Reckitt Finish brand. The most awarded

campaigns were "Undercover Avatar" by Havas Sports &

Entertainment Paris for L'Enfant Bleu with a Gold and a Silver,

"Black Plaque Project" by Havas London for Nubian Jack Community

Trust with a Gold and a Bronze as well as "Migrants on Amazon" by

BETC Paris for L'Auberge des Migrants which won three Silvers and a

Bronze.

At the prestigious D&AD 21 ceremony, agencies received 16

awards, including a Gold for Rosa Paris' "Just a wall" campaign for

Innocence in Danger and five Silvers, including two for "HerShe" by

BETC/Havas Sao Paulo for Hershey's. Havas London's "Black Plaque

Project" campaign for Nubian Jak Community Trust won one Silver and

two Bronze.

At the LIA Awards ceremony, agencies won 53 awards, including

the Grand Prix in the Film category, two Gold and three Silver for

BETC's "Crocodile Inside" campaign for Lacoste, three Gold and five

Bronze for Havas London's "Black Plaque" campaign for Nubian Jak

Community Trust, with the other campaigns taking four Gold, 15

Silver and 19 Bronze. Finally, the British agency Havas Lynx was

awarded the title of "Pharma Agency of the Year Europe".

At the Effie Europe awards, Havas Group won the title of

"European Agency of the Year", while Havas Sports &

Entertainment won a Gold and a Silver for its "Undercover Avatar"

campaign for L'Enfant Bleu and Havas Turkey a Gold for its

"Tomorrow's Water" campaign for Reckitt's Finish.

At the Epica Awards ceremony, the Group's agencies won 18

awards, including four Gold, five Silver and nine Bronze, led by

Havas Dubai's "Liquid Billboard" campaign for Adidas (two Gold, one

Silver and one Bronze).

Finally, Havas Creative and Havas Media respectively took first

place in their category in the R3 Europe ranking, which

distinguishes the new business performance of industry players.

1 Constant perimeter notably reflects the impacts of the

acquisition of Prisma Media on May 31, 2021, and the equity

accounting of Lagardère since July 1, 2021, and Universal Music

Group since September 23, 2021. 2 Non-GAAP measures. 3

Reconciliations of EBIT to EBITA, as well as earnings attributable

to Vivendi SE shareowners to adjusted net income, are presented in

Appendix I. 4 Scope 1 (direct energy-related emissions) and Scope 2

(indirect energy-related emissions). The targets for Scope 3,

including business travel, energy consumption not accounted for in

Scopes 1 and 2, upstream and downstream freight and waste

generated, as well as set-top boxes in France for Canal+, are

aligned with the SBTi’s Well-below 2°C & 2°C trajectory. 5

Based on the scope of consolidation excluding UMG and including

Prisma Media, and social reporting methodology. 6 As a percentage

of women on our businesses’ executive committees and the Vivendi SE

Executive committee. 7 Net revenues correspond to Havas Group

revenues after deduction of costs rebilled to clients. 8 Top GfK

authors - Modern Fiction in French - at the end of December 2021 -

in volumes - pocket + large format - 111 Editis publishing houses +

third-party publishers distributed out of 3,673 audited. 9 Source:

GFK data, s40 to s52 2021 vs. 2019, all channels, Internal analysis

on Top 300 Adult Illustrated Books. 10 Constant perimeter notably

reflects the impact of the acquisition of Prisma Media on May 31,

2021. 11 Gross margin corresponds to Gameloft’s revenues after

deduction of costs of sales. 12 OTT: Over-The-Top sales of video

games on distribution platforms such as Apple, Google, Nintendo,

Microsoft, etc. 13 Gameloft for brands offers cutting-edge gamified

solutions to help brands reconnect with their audience.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220309005809/en/

Media Paris Jean-Louis

Erneux +33 (0)1 71 71 15 84 Solange Maulini +33 (0) 1 71 71 11

73

Investor Relations Paris Xavier Le Roy +33 (0)1 71 71 18 77

Nathalie Pellet +33 (0) 1 71 71 11 24 Delphine Maillet +33 (0)1 71

71 17 20

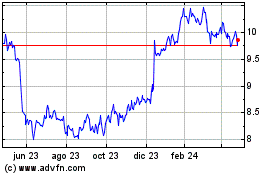

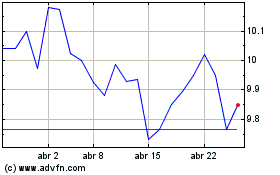

Vivendi (EU:VIV)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Vivendi (EU:VIV)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024