MARKET WRAPS

Stocks:

European stocks struggled for momentum on Friday, as concerns

remained about consumer sentiment and economic growth, with

investors clinging to hopes that central banks will turn towards

less aggressive rate hikes.

Trading volumes were lighter again, with a shortened session on

Wall Street as Black Friday shopping swings into focus.

Stocks to Watch

Lloyds Banking's better cost control and asset quality compared

with peers is expected to be rewarded by the market, RBC Capital

Markets said.

As deposit betas--the rates that banks have to pass onto their

customers--are likely to start increasing, LLoyds should be able to

keep betas lower for longer given its better digital banking and

branch offering, RBC add.

"We prefer banks like Lloyds Banking that have prioritized

absolute cost control over jaws progression," RBC said.

It has upgraded its rating on the stock to outperform from

underperform and raised the price target to 57 pence from 44

pence.

---

The U.K. retail sector is braced for a challenging Christmas

period as consumer confidence is at record lows and budget pressure

is unlikely to ease, CMC Markets said.

"There will be many consumers forgoing high ticket food items

and prioritizing basic food items over turkeys, stuffing, Christmas

puddings and all of the other trimmings", CMC said.

Another important factor will be where they buy from, which

could potentially benefit seasonal sales at Tesco and Sainsbury's,

given that consumers of premium supermarkets such as Marks &

Spencer may switch to budget retailers and discounters.

Economic Insight

A core eurozone HICP reading of 0.4% month-on-month and 5.4%

year-on-year in November would be high enough for the European

Central Bank's "hawks" to make a strong case for another 75 basis

point interest rate rise in December, SEB said.

However, a m/m 0.1% or below print "would be an indication that

the pace of price changes has slowed down and would probably be too

low for hawks to make a serious attempt for 75bps," SEB said.

"Given our November core HICP forecast of 0.1% [m/m], 5.1% y/y,

we think that the current market pricing with a 60% probability for

50bps vs. 40% for 75bps correctly reflects the slightly higher odds

for a smaller rate hike."

U.S. Markets:

Stock futures were indicating a slightly higher start with

attention expected to focus on the start of the holiday shopping

season and whether consumer resilience is holding up.

There is no data planned for Friday, which will mark a shortened

session for Wall Street, but investors are facing a busy week

ahead, with a large batch of data including third-quarter gross

domestic product, the Fed's favored inflation gauge, the PCE price

index, home prices, manufacturing updates and November payrolls

data.

The post-Thanksgiving trading day also kicks off the start of

annual holiday shopping, which could put shares of Amazon.com,

Walmart and Target, among others, in focus.

Forex:

The dollar "remains sluggish" though moves are likely to be

limited as trade remains quiet with a long weekend in the U.S.,

UniCredit Research said.

"Range-bound activity is...likely to prevail again today given

the very light daily agenda."

Investors could be "taking a breather" following the rally in

the euro against the dollar in recent days while the U.S. holiday

"might also be calling for some position paring."

---

Commerzbank said monetary policy has turned into a supportive

factor for the euro but that doesn't mean the currency will

appreciate considerably.

With recent data suggesting a eurozone recession won't be as bad

as previously feared, concerns that the ECB might not raise

interest rates sufficiently in view of economic risks are likely to

ease, Commerzbank said.

"However, we urge caution against excessive EUR euphoria as the

risk of an energy crisis has not yet been overcome. As a result, a

limited risk premium seems justified."

---

Investor position adjustments have played a key role in

sterling's recent recovery but further gains may be limited, ING

said, adding that GBP/USD could see some further temporary

appreciation to 1.22-1.23 but these would be the best levels before

year-end.

"Equally, EUR/GBP has good support in the 0.8550/0.8600 area,

and given our view of a difficult risk environment into year-end

and early 2023 as central banks raise rates into recessions,

sterling should remain vulnerable."

Read UK Seeking Swiss-Style Ties With EU Wouldn't Necessarily

Support Pound

Bonds:

Commerzbank has forecast 10-year German Bund yields to reach

levels close to 2.5% again in the first quarter of 2023 which

should be used to scale into long-duration positions. Thereafter,

yields should ease to 1.70% by the end of next year.

The 10-year German Bund yield hit 2.5% in October, now it trades

at 1.873%, up about 3 basis points, according to Tradeweb.

Commerzbank expects Treasurys to outperform throughout next

year, with the 10-year UST-Bund spread falling to 130 basis points.

The 10-year UST-Bund spread was last at 180bps, according to

Tradeweb.

---

Amundi Asset Management said the revival of portfolio allocation

of 60% in stocks and 40% in bonds is expected in 2023.

"As bonds regain diversification qualities after the surge in

yields in 2022 and looming recession risks next year, a revival of

the 60-40 portfolio allocation is in sight," it said.

The asset manager sees the outlook for Treasurys as well as

European core and peripheral government bonds as "improving" in the

first half of 2023. Amundi also sees "improving" outlook for U.S.

and euro investment-grade and high-yield corporate bonds.

Read There Is Value Investing in Short End of Bond Curves

Read Investors to Face Heavy Gross and Net Government Bond

Issuance in Eurozone in 2023

Energy:

Crude futures moved higher as traders waited for an EU price cap

signal on Russian oil.

If the cap is set too high then Russian revenues and oil flows

are unlikely to be affected, SPI Asset Management said, but a low

price cap could create conditions for retaliation.

"In the meantime, an assumed cap of $65-70 a barrel continues to

ease fears around Russian supply disruption, while rising Covid

cases in China remain the interday rally capper," SPI said.

Coal

An improvement in Chinese steel profitability is helping demand

for coking coal, according to Macquarie.

"Steel margins in China improved last week, driven by an

increase in steel prices and continued steel-mill production cuts.

Chinese steel mills also lifted their coke and coking coal

inventory levels for winter, " Macquarie said.

The daily average price paid for Chinese imports of hard coking

coal rose to $266/metric ton on Thursday, from $261/ton the day

prior and $255/ton at the end of last week, according to S&P

Global Commodity Insights.

Metals:

Base metals and gold were firmer in early London trading

following a positive Asian session, with Marex highlighting news

that six Chinese banks had issued fresh funding for developers

within the property sector--something that generally boosts metals

demand.

DOW JONES NEWSPLUS

EMEA HEADLINES

German Consumer Sentiment Set to Continue Its Recovery in

December

Consumer confidence in Germany is set to continue to stabilize

in December, although remaining at a very low level.

Market research group GfK's forward-looking consumer-sentiment

index forecasts confidence rising to minus 40.2 in December from

minus 41.9 in November. Economists polled by The Wall Street

Journal forecast a reading of minus 40.0.

SSE PLC to Sell 25% Stake in SSEN Transmission for GBP1.47

Bln

SSE PLC said Friday that it will sell a 25% stake in its

electricity transmission network business SSEN Transmission to

Ontario Teachers' Pension Plan Board for 1.47 billion pounds ($1.78

billion).

The London-listed energy company said the sale of the

stake--which operates under its licensed entity, Scottish Hydro

Electric Transmission PLC--will help unlock significant growth in

both the transmission business and across the wider group, and is

expected to complete shortly.

Gucci's Next Revamp Needs a More Classic Look

Parting ways with Gucci's designer was an inevitable decision

for Kering, the luxury group that owns the brand. Finding a

suitable successor will be much harder.

The Italian brand's creative director, Alessandro Michele, is

stepping down immediately, Kering said this week, and no one is

lined up yet for his job. From his first runway show in early 2015,

Mr. Michele more than doubled Gucci's sales and tripled operating

profit in what is considered one of the most successful

luxury-brand makeovers in decades. However, the brand has looked

wobbly since 2020 as his designs became less popular.

Adidas to Probe Misconduct Allegations Against Kanye West

Adidas AG has launched an investigation into allegedly

inappropriate behavior by Kanye West while the sportswear giant was

working with the musician to develop and sell their Yeezy sneaker

line.

The company said Thursday that it would start the probe after

receiving an anonymous letter. The letter alleged years of

misconduct in the workplace by Mr. West, who goes by Ye, and that

Adidas management turned a blind eye to his conduct.

Russia Expands Shelling of Kherson, as Power Shortages Drag On

in Kyiv

KHERSON, Ukraine-Russian forces stepped up their shelling of the

southern city of Kherson, killing seven people and injuring at

least 21 others in the latest round of strikes, according to local

officials.

Two weeks have passed since Russian troops retreated from

Kherson, and residents-though still joyous at their liberation from

Russian occupation-are confronting a new set of challenges. The

city, like much of Ukraine, remains without electricity, heat or

running water. Cell signal is weak. Tents offering heat, water and

internet access have been set up around the city.

French McKinsey Probe Widens to Include Campaign Financing

PARIS-French prosecutors have opened probes into the role played

by consulting firms in France's 2017 and 2022 presidential

elections, widening an existing investigation into consulting firm

McKinsey & Co.

Earlier this year, French financial prosecutors opened a

tax-fraud and money-laundering investigation into McKinsey.

GLOBAL NEWS

China Cuts Banks' Reserve Requirement Ratio

BEIJING--China's central bank said Friday that it will lower the

amount of deposits banks have to set aside, releasing 500 billion

yuan ($69.91 billion) of liquidity into an economy struggling with

its worst Covid-19 outbreak since 2020.

The People's Bank of China said it will cut banks' reserve

requirement ratio by 0.25 percentage point, which will bring the

weighted average RRR level for the whole banking system to

7.8%.

Black Friday Crowds Are Back but This Year They Face

Inflation

Black Friday is back-even if many of the door-buster deals

aren't.

Millions of Americans are expected to visit bricks-and-mortar

stores on the Friday after Thanksgiving as the Covid-19 pandemic

recedes and people return to prepandemic habits. That is a reversal

of the past two years, when they were largely stuck at home and did

more shopping online. This year, however, many household budgets

are pinched by high gas and grocery prices.

Mega-Companies Messed Up America's Job Market. They're Doing it

Again.

Part of what has made America's job market so tight is that big,

publicly traded companies hired like crazy after the pandemic

struck. Now that many are slamming into reverse, it seems like

there is a wave of unemployment under way.

Amazon.com, Disney and Facebook parent Meta Platforms are all

suddenly recognizing that they overhired and are firing workers.

For the people affected, job losses are horrible. But when it comes

to the job market, rather than thinking of these layoffs as a sign

things are falling apart, they might be an indication that it could

come into better balance.

China's Xinjiang Region Has Been Locked Down for Months, Casting

Shadow Over Zero-Covid Easing

As Covid-19 cases trigger a fresh wave of lockdowns in China's

major cities, those living in towns across the country's remote

western region of Xinjiang say they have been enduring a lockdown

that has lasted months and local officials have largely kept

quiet.

Local authorities started ordering residents to stay home after

Covid clusters began spreading around Xinjiang in early August. The

region's main cities shut down transportation, trapping some summer

tourists until the start of winter. The restrictions remain in many

parts of the region as officials struggle to implement orders from

Beijing to be more precise in applying Covid controls.

Chinese Banks' $178 Billion 'Medicine' for Developers Won't Cure

All Ills

HONG KONG-China's state-owned banks are showering the country's

real-estate developers with loans and other promises of financial

support, moves that will prevent the beleaguered industry from

spiraling into a full-blown crisis following a wave of debt

defaults.

The generous aid, however, is unlikely to quickly solve a

fundamental problem afflicting many Chinese developers: A deep

slump in new home sales.

Write to paul.larkins@dowjones.com

Write to us at newsletters@dowjones.com

We offer an enhanced version of this briefing that is optimized

for viewing on mobile devices and sent directly to your email

inbox. If you would like to sign up, please go to

https://newsplus.wsj.com/subscriptions.

This article is a text version of a Wall Street Journal

newsletter published earlier today.

(END) Dow Jones Newswires

November 25, 2022 06:12 ET (11:12 GMT)

Copyright (c) 2022 Dow Jones & Company, Inc.

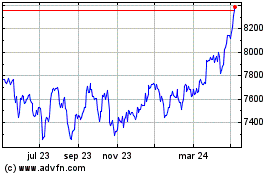

FTSE 100

Gráfica de índice

De Mar 2024 a Abr 2024

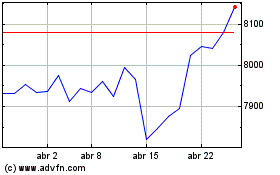

FTSE 100

Gráfica de índice

De Abr 2023 a Abr 2024