MARKET WRAPS

Watch For:

EU Flash consumer confidence indicator; U.K. Public sector

finances; trading updates from Associated British Foods, SEB

Opening Call:

European stock futures broadly advanced as technology stocks

continue to bolster indexes across the Atlantic. Asian stock

benchmarks were mixed; the dollar weakened and Treasury yields were

mostly lower; oil futures were mixed and gold gained.

Equities:

European stock futures were broadly higher early Tuesday, as

investors focus on coming economic data and corporate earnings.

U.S. stocks closed higher on Monday, with the Dow Jones

Industrial Average finishing at a record high. Investors are

watching for the first reading of U.S. fourth-quarter GDP as well

as figures on inflation and spending this week.

Stocks may still have more room to rise for the rest of the

year, according to Anthony Saglimbene, chief market strategist at

Ameriprise Financial.

"I think the outlook for this year was still pretty positive,

particularly if earnings can grow on a year-over-year basis,"

Saglimbene said.

However, some others are more skeptical.

"With forward multiples already at historic peaks and earnings

forecasts for 12 months forward ambitious, equity-market gains may

stall in 2024, as better earnings are met with lower valuation

multiples characteristic of a midcycle or soft-landing

environment," Morgan Stanley Wealth Management said.

Earlier Tuesday, the Bank of Japan kept its policy rates

unchanged as it waits for more solid evidence of improving wage and

price trends.

Forex:

The dollar weakened slightly but several developed market and

emerging market central banks meetings this week, including the

European Central Bank, should bring more action to currency

markets, said Brown Brothers Harriman's currency analysts.

The euro is likely to stay steady ahead of the European Central

Bank's meeting on Thursday but could get something of a boost from

interest rates being left unchanged amid recent talk of future rate

cuts, said Bas Kooijman, CEO and asset manager of DHF Capital.

Money markets are pricing in the first ECB interest-rate cut in

April, according to Refinitiv.

--

The yen weakened after the Bank of Japan maintained its

extraordinary easing program earlier Tuesday, which puts downward

pressure on the yen.

Investors will be focusing on BOJ Gov. Kazuo Ueda's press

conference later in the day for any cues on any future policy

shifts.

Bonds:

Treasury yields were broadly lower as markets delayed

projections for an initial interest-rate cut by the Fed.

The CME's FedWatch tool prices increasing odds that the Fed will

keep rates unchanged next week and in March, with an expectation of

a first cut pushed down to May.

Economists surveyed by The Wall Street Journal forecast December

core annual PCE slowing only slightly, to 3% from November's 3.2%,

in data due Friday.

--

High-yield and investment-grade bonds offering yields of around

8% and 5% respectively appear more attractive than equities,

CreditSights analysts said adding that in the long-term, U.S.

corporate bonds look attractive ahead of the expected interest-rate

cuts.

Energy:

Oil futures were mixed in a possible technical correction after

settling at their highest price levels in around a month.

Prices could get support from geopolitical tensions, analysts

said with Saxo Markets' APAC strategy team noting Ukrainian drone

attacks against oil facilities on Russia's Baltic coast, and

escalating tensions in the Red Sea as the U.S. and U.K. launched

fresh strikes against Houthi targets.

Metals:

Gold gained early Tuesday. There is strong physical demand ahead

of the Lunar New Year holidays, together with signs of speculative

buying activity out of China, TD Securities said.

TD Securities' tracking of the top 10 market participants in

Shanghai continues to indicate more aggressive buying than would be

expected by its tracking of gold withdrawals, signaling some

speculative buying, it said.

--

Copper prices were lower in early Asian trading, weighed by the

Chinese stock market's selloff a day earlier, Nanhua Futures

analysts said.

While China's copper demand is weak amid production halts ahead

of Lunar New Year, the overseas market will likely also be tepid in

the short term, they said.

--

Iron-ore prices gained in Asia. Demand is rising as the Lunar

New Year is approaching, CRU senior analyst Liz Gao said, adding

that prices may also be supported by a media report on a potential

two trillion yuan stimulus to stabilize the stock market.

However, ANZ Research analysts remain cautious on the outlook

with the property sector still showing signs of stress.

Beijing has ordered the most indebted local governments to delay

or halt some infrastructure projects, they noted.

TODAY'S TOP HEADLINES

BOJ Keeps Rates Unchanged as It Examines Wage, Price Trends

TOKYO-The Bank of Japan kept its policy rates unchanged on

Tuesday as it waits for more solid evidence of improving wage and

price trends.

The Japanese central bank decided to maintain short-term

interest rates at minus 0.1%. It said it would continue to set 1%

as its reference point for the upper bound of the 10-year Japanese

government bond yield. In October, the bank decided to make the 1%

level a reference instead of a hard cap.

U.S. and U.K. Launch Major Strike on Houthi Sites in Yemen

WASHINGTON-The U.S. and U.K. launched strikes against eight

Houthi targets Monday, the two countries said, in a continuing bid

to stop the Yemeni rebel group's attacks on ships transiting the

Red Sea.

The strikes marked the second major assault by a joint force of

the two countries and the eighth time overall that the U.S. has

targeted the group, which is armed, funded and supported by

Iran.

BlackRock Warns Markets Not Appreciating Worsening Geopolitical

Backdrop

SYDNEY-The world's largest investment manager BlackRock has

warned of further deterioration in the geopolitical backdrop for

financial markets in 2024, adding that asset markets aren't fully

appreciating the risks.

"We expect deeper fragmentation, heightened competition and less

cooperation between major nations in 2024," BlackRock said in a

note to clients.

Gucci Owner Buys Fifth Avenue Property in New York City for $963

Million

The owner of Gucci and Yves Saint Laurent is acquiring property

comprising multi-level luxury retail spaces in New York City's

Fifth Avenue for almost $1 billion, expanding its retail locations

in one of the world's most iconic avenues.

Kering said Monday that it had agreed to pay $963 million for

the roughly 115,000 square foot property in a push aimed at

securing what it called highly desirable locations for its fashion

houses. The group recently acquired property on Avenue Montaigne

and Rue de Castiglione in Paris, France.

Australia Sanctions Russian Individual for Medibank

Cyberattack

Australia has sanctioned a Russian individual for his role in a

cyberattack on health insurer Medibank, the first time that

Australia's cyber sanctions framework has been used, officials

said.

Nearly 10 million records were stolen in the 2022 attack,

including names, dates of birth and sensitive medical information,

and some of those records were published on the dark web,

authorities said.

Arab Peace Proposal for Gaza Takes Shape as Top Biden Adviser

Lands in Region

Arab countries are working on a proposal for postwar Gaza that

would create a pathway toward a Palestinian state in exchange for

Saudi recognition of Israel, according to Arab officials.

The proposal, submitted to Israel via the U.S., is the first

joint plan by Arab states to end the war in Gaza and set a pathway

toward a two-state solution. Saudi Arabia, which is one of five

Arab countries making the proposal, is offering to normalize ties

with Israel in return, a process derailed by the Hamas-led attack

on Oct. 7.

Tiny Gaza Is Home to Most of the World's Hungriest People

After more than three months of war, Gaza City resident Samir

Muhammad recently received his first bag of flour since the

conflict broke out.

His son fought off hundreds of other desperate Palestinians to

grab it off the back of an aid truck-one of only a small number

that has succeeded in reaching northern Gaza in recent weeks.

United sees bigger-than-expected first-quarter loss after 737

Max groundings. Here's why the stock is rallying anyway.

United Airlines Holdings Inc. said it expected to lose more

money than expected in the first quarter, after the government this

month ordered dozens of Boeing 737 Max 9 jets grounded following a

mid-air blowout on an Alaska Airlines flight.

But shares of United UAL rallied 6% after hours on Monday, after

the air carrier forecast a full-year profit that was better than

expected. That forecast followed a jump in fourth-quarter results

that beat expectations, helped by both United's premium-cabin

offerings and its cheaper basic economy fares.

Amazon Hopes to Dominate the World of Streaming Ads. It Faces

Some Challenges Along the Way.

The arrival of ads on Amazon Prime Video this month is expected

to upend the already crowded streaming television market in the

U.S. But it also won't be an entirely smooth transition for

Amazon.

The e-commerce giant is now the world's third-largest digital ad

seller, behind tech companies Alphabet and Meta Platforms, with ad

revenue surpassing $12 billion in the third quarter, up 26% from

the period a year earlier. Its data and insights on millions of

customers give Prime Video a long-term advantage by allowing

marketers to target ads based on variables from shopping history to

location.

Write to singaporeeditors@dowjones.com

Expected Major Events for Tuesday

07:00/DEN: Jan Consumer expectations

07:00/DEN: Dec Central Government Finance & Debt

07:00/UK: Dec Public sector finances

15:00/EU: Jan FCCI Flash Consumer Confidence Indicator

All times in GMT. Powered by Onclusive and Dow Jones.

Write to us at newsletters@dowjones.com

We offer an enhanced version of this briefing that is optimized

for viewing on mobile devices and sent directly to your email

inbox. If you would like to sign up, please go to

https://newsplus.wsj.com/subscriptions.

This article is a text version of a Wall Street Journal

newsletter published earlier today.

(END) Dow Jones Newswires

January 23, 2024 00:15 ET (05:15 GMT)

Copyright (c) 2024 Dow Jones & Company, Inc.

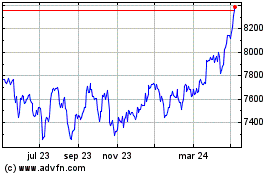

FTSE 100

Gráfica de índice

De Oct 2024 a Nov 2024

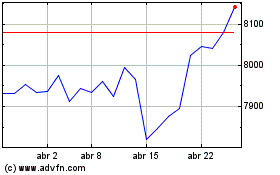

FTSE 100

Gráfica de índice

De Nov 2023 a Nov 2024