Japanese Yen Advances Amid Risk Aversion After Weak U.S. GDP Data

28 Julio 2022 - 6:42AM

RTTF2

The Japanese yen appreciated against its major counterparts in

the New York session on Thursday, amid risk aversion as weak U.S.

GDP data sparked fears about a recession.

Data from the Commerce Department showed that the U.S. economy

contracted unexpectedly in the second quarter.

GDP decreased 0.9 percent in the second quarter, following a 1.6

percent decline in the first quarter. Economists had expected GDP

to increase by 0.5 percent.

The data ignited concerns that the Fed's resolve to tame surging

prices through aggressive monetary policy tightening is hurting

economic growth.

Disappointing earnings results from Meta Platforms also weighed

on U.S. stocks.

The yen rose to near a 2-month high of 136.37 against the euro

and a 3-day high of 163.02 against the pound, following its prior

lows of 139.34 and 166.08, respectively. If the yen strengthens

further, it is likely to test resistance around 134.00 against the

euro and 156.00 against the pound.

The yen touched a 4-week high of 134.34 against the greenback

and a 2-week high of 140.43 against the franc, up from its early

lows of 136.58 and 142.31, respectively. The yen is likely to find

resistance around 121.00 against the greenback and 127.00 against

the franc.

The yen firmed to a 2-week high of 84.24 against the kiwi, near

2-week high of 93.61 against the aussie and near a 3-week high of

104.57 against the loonie, off its previous lows of 85.55, 95.53

and 106.49, respectively. The yen may locate resistance around

81.00 against the kiwi, 90.00 against the aussie and 101.00 against

the loonie.

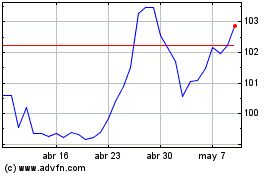

AUD vs Yen (FX:AUDJPY)

Gráfica de Divisa

De Mar 2024 a Abr 2024

AUD vs Yen (FX:AUDJPY)

Gráfica de Divisa

De Abr 2023 a Abr 2024