Japanese Yen Gains Ground Following BoJ Intervention

22 Septiembre 2022 - 2:22AM

RTTF2

The Japanese yen appreciated against its major counterparts in

the European session on Thursday, after the Bank of Japan

intervened in the foreign exchange market to stem the currency's

slide amid the central bank's ultra-loose policy.

Shortly after the BoJ's decision to maintain ultra-low interest

rates, the central bank intervened in the market for the first time

since 1998.

The move was aimed to shore up the value of the yen due to the

interest rate gap between the United States and Japan.

Earlier in the day, the BoJ decided to maintain a negative

interest rate of -0.1 percent on current accounts that financial

institutions maintain at the central bank.

The bank will continue to purchase a necessary amount of

Japanese government bonds without setting an upper limit so that

10-year JGB yields will remain at around zero percent.

This was followed by a third straight 75 basis point rate hike

from the U.S. Federal Reserve on Wednesday, which sent the yen

plunging a 24-year low against the U.S. dollar in the previous

session.

The yen climbed to more than 2-week highs of 140.65 against the

greenback and 139.25 against the euro, from an early 24-year low of

145.90 and a 2-day low of 143.70, respectively. The yen is likely

to challenge resistance around 138.00 against the greenback and

136.00 against the euro.

The yen rallied to a 1-1/2-month high of 82.80 against the kiwi,

multi-week highs of 104.83 against the loonie and 93.81 against the

aussie, up from its previous 2-day lows of 85.06, 108.15 and 96.41,

respectively. The currency may face resistance around 80.00 against

the kiwi, 102.00 against the loonie and 92.00 against the

aussie.

The yen advanced to a 1-1/2-month high of 159.59 against the

pound and more than a 2-week high of 144.34 against the franc,

following an early 2-day low of 164.43 and a multi-year low of

151.47, respectively. The next possible resistance for the yen is

seen around 157.00 against the pound and 142.00 against the

franc.

Looking ahead, Canada new housing price index for August, U.S.

weekly jobless claims for the week ended September 17 and leading

index for August will be featured in the New York session.

At 10:00 am ET, Eurozone flash consumer sentiment index for

September is due.

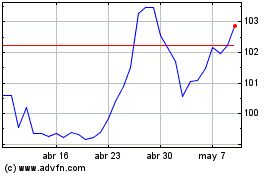

AUD vs Yen (FX:AUDJPY)

Gráfica de Divisa

De Mar 2024 a Abr 2024

AUD vs Yen (FX:AUDJPY)

Gráfica de Divisa

De Abr 2023 a Abr 2024