Australian, NZ Dollars Higher On Solid China Data

28 Febrero 2023 - 11:03PM

RTTF2

The Australian and NZ dollars climbed against their major

counterparts in the Asian session on Wednesday, as strong factory

activity data out of China lifted risk sentiment.

China's official manufacturing Purchasing Managers' Index rose

to 52.6 from 50.1 in January, smashing expectations after the

country abruptly lifted COVID-19 curbs.

China's nonmanufacturing activity also grew at a faster pace in

February and the private sector index from Caixin/S&P showed

factory activity rising for the first time in seven months, helping

ease investor fears over rising interest rates.

Data from the Australian Bureau of Statistics showed that

Australia's gross domestic product expanded a seasonally adjusted

0.5 percent on quarter in the fourth quarter of 2022.

This was shy of expectation for an increase of 0.8 percent and

down from the upwardly revised 0.7 percent gain in the previous

three months (originally 0.6 percent).

The aussie advanced to a 2-day high of 1.5669 against the euro

and a 5-day high of 0.9209 against the loonie, from its early lows

of 1.5783 and 0.9143, respectively. The aussie is seen facing

resistance around 1.53 against the euro and 0.94 against the

loonie.

The aussie appreciated to a 6-day high of 92.22 against the yen

and 5-day high of 0.6772 against the greenback, reversing from its

early more than 2-week low of 91.27 and near a 2-month low of

0.6694, respectively. The aussie may find resistance around 94.00

against the yen and 0.70 against the greenback.

The kiwi rose to a 6-day high of 0.6251 against the greenback

and a 5-day high of 1.7014 against the euro, off its early lows of

0.6165 and 1.7137, respectively. The currency is seen finding

resistance around 0.645 against the greenback and 1.66 against the

euro.

The kiwi firmed to more than a 2-month high of 84.99 against the

yen and a 5-week high of 1.0822 against the aussie, up from its

prior lows of 84.09 and 1.0888, respectively. Next immediate

resistance for the currency is seen around 88.00 against the yen

and 1.06 against the aussie.

Looking ahead, at 8.00 am ET, Germany's flash consumer and

harmonized prices for February are due.

U.S. ISM manufacturing PMI for February and construction

spending for January are set for release in the New York

session.

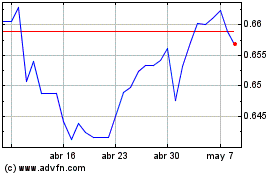

AUD vs US Dollar (FX:AUDUSD)

Gráfica de Divisa

De Mar 2024 a Abr 2024

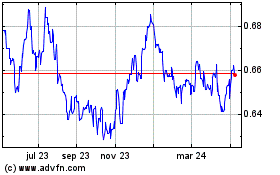

AUD vs US Dollar (FX:AUDUSD)

Gráfica de Divisa

De Abr 2023 a Abr 2024