Bank Of England Chief Bailey Signals Further Rate Hikes

01 Marzo 2023 - 2:59AM

RTTF2

Bank of England Governor Andrew Bailey said further increase in

the interest rate might be required to achieve the UK inflation

target on a sustainable basis.

At Brunswick Group's Cost of Living Conference in London, Bailey

said, "Some further increase in Bank Rate may turn out to be

appropriate, but nothing is decided."

"The incoming data will add to the overall picture of the

economy and the outlook for inflation, and that will inform our

policy decisions," the banker said.

Bailey cautioned against suggesting either that the bank is done

with increasing Bank Rate, or that policymakers will inevitably

need to do more.

The BoE has raised its benchmark interest rate by 390 basis

points since the current tightening cycle began in December

2021.

The governor said that the British economy evolved much as

expected since the February meeting. Inflation has been slightly

weaker, and activity and wages slightly stronger, with emphasize on

"slightly" in both cases, Bailey said.

Data from the central bank showed on Wednesday that mortgage

approvals declined for the fifth consecutive month in January. Home

loan approvals fell to 39,600 in January from 40,500 in

December.

If the onset of the Covid-19 pandemic and the period immediately

thereafter is excluded, this was the lowest approvals since January

2009, the BoE said.

The 'effective' interest rate, the actual interest rate paid on

newly drawn mortgages increased by 21 basis points, to 3.88 percent

in January.

Mortgage lending to individuals decreased to GBP 2.5 billion in

January from GBP 3.1 billion in the previous month.

Further, consumer credit doubled to GBP 1.6 billion from GBP 0.8

billion in December. The GBP 1.6 billion was split between GBP 1.1

billion of borrowing on credit cards and GBP 0.5 billion of

borrowing through other forms of consumer credit.

The big picture remains that in the current higher mortgage rate

environment, house prices are still too high for mortgage lending

to recover, Capital Economics' economist Andrew Wishart said.

Nationwide house price data released earlier in the day showed that

house prices registered the first annual fall since June 2020,

which was also the worst in a decade.

As squeeze on household income from higher interest rates and

inflation damped demand in the property market, house prices

declined 1.1 percent on a yearly basis in February, offsetting the

1.1 percent increase in January.

Elsewhere, data published by the British Retail Consortium

showed that shop price inflation hit a new record in February. Shop

prices increased 8.4 percent year-on-year after an 8.0 percent

increase in January.

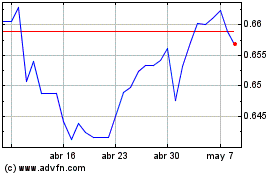

AUD vs US Dollar (FX:AUDUSD)

Gráfica de Divisa

De Mar 2024 a Abr 2024

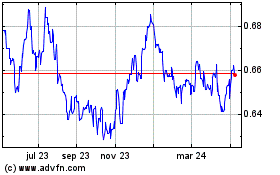

AUD vs US Dollar (FX:AUDUSD)

Gráfica de Divisa

De Abr 2023 a Abr 2024