Australian Dollar Falls After Weak Economic Data

01 Marzo 2023 - 7:11PM

RTTF2

The Australian dollar slipped against other major currencies in

the Asian session on Thursday, after the official data showed that

building approvals tumbled in January, adding concerns about the

strength of the economy. Data from the Australian Bureau of

Statistics showed that the total number of buildings approved in

Australia was down a seasonally adjusted 27.6 percent on month in

January, coming in at 12,065. That was well shy of expectations for

a drop of 8.0 percent following the downwardly revised 15.3 percent

spike in December.

On a yearly basis, permits for overall buildings dropped 8.4

percent, while permits for houses sank 12.0 percent and permits for

other than houses declined 0.3 percent. The seasonally adjusted

estimate for the value of total building approved fell 18.6 percent

in January, following a 1.0 percent rise in December.

The Australian dollar fell to 0.67280 against the U.S. dollar

from an early high of 0.67660. If the aussie extends its downtrend,

it is likely to find support around 0.66 against the greenback.

The aussie dropped to 91.78 against the yen from an early high

of 92.09. The aussie is likely to find its support around the 90.06

area.

Data from the Bank of Japan showed that the monetary base in

Japan was down 1.6 percent on year in February, coming in at

646.440 trillion yen. That beat forecasts for a drop of 3.2 percent

following the 3.8 percent decline in January. The adjusted monetary

base was up 31.1 percent on year to 657.838 trillion yen, slowing

from 43.8 percent in January.

Against the euro and the Canadian dollar, the aussie dropped to

1.5825 and 0.9167, from early highs of 1.5763 and 0.9190,

respectively. The next possible support for the aussie is seen

around 1.59 against the euro and 0.90 against the loonie.

Looking ahead, the Eurozone is slated to release its flash

inflation data for February and the unemployment reports for

January at 5:00 am ET.

At 7:30 am ET, ECB's monetary policy meeting accounts is set to

be published.

U.S. weekly jobless claims is slated for release at 8:30 am ET.

The data is likely to provide additional clues about tightness in

the labor market.

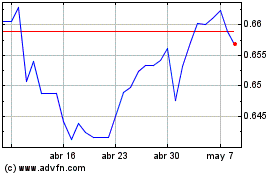

AUD vs US Dollar (FX:AUDUSD)

Gráfica de Divisa

De Mar 2024 a Abr 2024

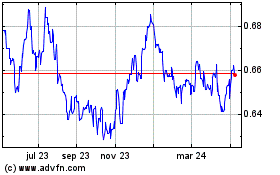

AUD vs US Dollar (FX:AUDUSD)

Gráfica de Divisa

De Abr 2023 a Abr 2024