Australian Dollar Climbs On Easing Fed Worries

02 Marzo 2023 - 9:52PM

RTTF2

The Australian dollar strengthened against its major

counterparts in the Asian session on Friday, as comments from a

Federal Reserve official eased worries about the possibility of

aggressive rate hikes by the Federal Reserve.

Atlanta Fed President Raphael Bostic said that the central bank

is likely to pause interest rate hikes sometime this summer.

Bostic's comments raised hopes that the Fed will stick with a

25-bps rate hike at its next meeting in March.

Survey from Judo Bank showed that Australia's services sector

bounced back up into expansion in February, with a services PMI

score of 50.7.

That's up from 48.6 in January, and it moves back above the

boom-or-bust line of 50 that separates expansion from

contraction.

The aussie advanced to 2-day highs of 1.5709 against the euro

and 1.0846 against the kiwi, from its early lows of 1.5751 and

1.0804, respectively. The aussie may find resistance around 1.54

against the euro and 1.10 against the kiwi.

The aussie edged up to 0.6761 against the greenback and 0.9176

against the loonie, reversing from an early low of 0.6720 and a

3-day low of 0.9135, respectively. The aussie is seen facing

resistance around 0.69 against the greenback and 0.94 against the

loonie.

The aussie touched 92.24 against the yen, its highest level

since February 23. The currency is seen finding resistance around

the 96.00 level.

Looking ahead, PMI reports from major European economies and

Eurozone PPI for January are due in the European session.

Canada building permits for January and U.S. ISM

non-manufacturing PMI for February will be released in the New York

session.

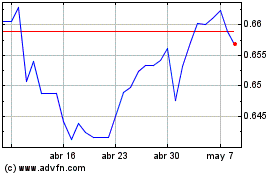

AUD vs US Dollar (FX:AUDUSD)

Gráfica de Divisa

De Mar 2024 a Abr 2024

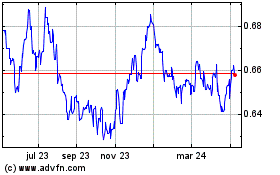

AUD vs US Dollar (FX:AUDUSD)

Gráfica de Divisa

De Abr 2023 a Abr 2024