Australian Dollar Weakens On RBA's Downbeat Signal

06 Marzo 2023 - 7:09PM

RTTF2

The Australian dollar weakened against other major currencies in

the Asian session on Tuesday, after the Reserve Bank of Australia

monetary policy statement revealed some downbeat signals on the

economy.

RBA Governor Philip Lowe said in a statement that growth in the

Australian economy has slowed.

"The monthly CPI indicator suggests that inflation has peaked in

Australia.", RBA Governor Lowe said.

Meanwhile, the policy board of the Reserve Bank of Australia

decided to lift the cash rate target by 25 basis points to 3.60

percent. The interest rate on Exchange Settlement balances was also

raised by 25 basis points to 3.50 percent.

In economic news, data from the the Australian Bureau of

Statistics that the total value of retail sales in Australia was up

a seasonally adjusted 1.9 percent on month in January, coming in at

A$35.091 billion. That was in line with expectations following the

3.9 percent decline in December.

On a yearly basis, retail sales advanced 7.5 percent.

The ABS also said Australia posted a seasonally adjusted

merchandise trade surplus of A$11.688 billion in January. That

missed expectations for a surplus of A$12.500 billion and was down

from A$12.237 billion in December.

Exports were up 1.4 percent on month to A$58.847 billion.

Imports climbed 4.6 percent on month to A$47.160 billion.

Data from China's General Administration of Customs showed that

the country's trade surplus expanded to $116.8 billion in February,

following an increase of $78 billion in the previous month.

The Australian dollar was trading steady against its major

rivals on Monday.

In the Asian session today, the Australian dollar fell to a

2-1/2-month low of 1.5964 against the euro and more than a 3-week

low of 91.06 against the yen, from yesterday's closing quotes of

1.5865 and 91.42, respectively. If the aussie extends its

downtrend, it is likely to find support around 1.62 against the

euro, and 89.00 against the yen.

Against the U.S., the Canada and the New Zealand dollars, the

aussie dropped to more than a 2-month low of 0.6693, an 8-day low

of 0.9115, and a 5-day low of 1.0801 from yesterday's closing

values of 0.6729, 0.9159 and 1.0855, respectively. The aussie may

find support around 0.66 against the greenback, 0.89 against the

loonie, and 1.07 against the kiwi.

Looking ahead, Swiss unemployment reports for February is slated

for release at 1:45 am ET.

U.K. Halifax house price index for February and German factory

orders for January are due to be released at 2:00 am ET.

At 10:00 am ET, Federal Reserve Chair Jerome Powell will testify

on the economic outlook and recent monetary policy actions before

the Joint Economic Committee, in Washington DC.

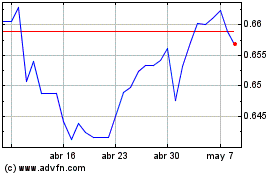

AUD vs US Dollar (FX:AUDUSD)

Gráfica de Divisa

De Mar 2024 a Abr 2024

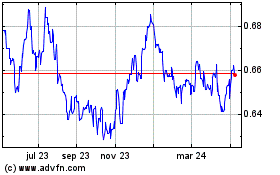

AUD vs US Dollar (FX:AUDUSD)

Gráfica de Divisa

De Abr 2023 a Abr 2024