Australian Dollar Slides As Traders Remain Cautious

19 Marzo 2023 - 7:50PM

RTTF2

The Australian dollar retreated from recent highs against other

major currencies in the Asian session on Monday, as traders remain

cautious and assess the impact of the crisis in the global banking

sector, even as failing financial institutions secure a lifeline

from peer institutions and central banks to avoid a global

meltdown.

Traders also looked ahead to Wednesday's U.S. Federal Reserve's

monetary policy announcement, expecting the Fed to raise interest

rate by 25 basis points. CME Group's FedWatch tool currently

indicates a 43.2 percent chance the Fed will leave rates unchanged

and a 56.8 percent chance of a 25 basis point rate hike.

The benchmark S&P/ASX 200 Index is losing 60.90 points or

0.87 percent to 6,933.90. The broader All Ordinaries Index is down

69.90 points or 0.93 percent to 7,121.30.

In the Asian session today, the Australian dollar fell to 1.5948

against the euro and 88.26 against the yen, from recent highs of

1.5870 and 89.23, respectively. If the aussie extends its

downtrend, it is likely to find support around 1.60 against the

euro and 86.00 against the yen.

Against the U.S. and the Canadian dollars, the aussie dropped to

0.6689 and 0.9179 from recent near 2-week high of 0.6730 and near

3-week high of 0.9214, respectively. The aussie may find its

support level around 0.63 against the greenback and 0.90 against

the loonie.

The aussie edged down to 1.0697 against the NZ dollar, from an

early high of 1.0728. Earlier in the session, the aussie fell to

nearly a 3-month low of 1.0673. The next support level for the

AUD/NZD pair is seen around the 1.09 area.

Looking ahead, German PPI report for February is due to be

released at 3:00 am ET.

Eurozone trade data for January is slated for release at 6:00 am

ET.

At 10:00 am ET, the European Central Bank's President Christine

Lagarde is set for a speech.

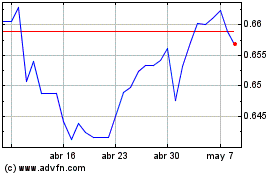

AUD vs US Dollar (FX:AUDUSD)

Gráfica de Divisa

De Mar 2024 a Abr 2024

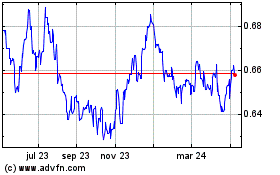

AUD vs US Dollar (FX:AUDUSD)

Gráfica de Divisa

De Abr 2023 a Abr 2024