Commodity Currencies Slide Amid Disappointing China Data, U.S. Debt Ceiling Concern

30 Mayo 2023 - 9:48PM

RTTF2

Commodity currencies such as the Australia, the New Zealand and

the Canadian dollars weakened against their major rivals in the

Asian session on Wednesday, as the investor sentiment dropped after

the release of weak economic data from china and amid worries of

the U.S. debt ceiling possibly facing opposition from some

Republicans who were seeking bigger spending cuts, potentially

prolonging the process of passing the bill.

Weakness in energy and mining stocks amid tumbling commodity

prices also weighed on the sentiment.

Data from National Bureau of Statistics showed that the

manufacturing sector in China continued to contract in May, and at

a faster rate. That missed expectations for a score of 51.4 and was

down from 49.2 in April.

The bureau also said the non-manufacturing index came in with a

score of 54.5, again missing forecasts for 54.9 and down from 56.4

in the previous month. The composite index had a score of 52.9,

down from 54.4 a month earlier.

In the U.S. debt ceiling deal, the agreement in principle will

raise the debt ceiling for two years and keep non-defense spending

roughly flat for fiscal 2024 and increase it by 1 percent in fiscal

year. The deal will be sent to the full House for a vote, likely to

take place later in the day.

In economic news, data from the Reserve Bank of Australia showed

that the private sector credit in Australia was up 0.6 percent on

month in April, accelerating from 0.2 percent in March. On a yearly

basis, credit climbed 6.6 percent.

Data from the Australian Bureau of Statistics showed that the

total value of construction work done in Australia was up a

seasonally adjusted 1.8 percent on quarter in the first quarter of

2023, coming in at A$57.686 billion. That beat forecasts for an

increase of 1.5 percent following the 0.3 percent contraction in

the three months prior.

On a yearly basis, construction work done improved 5.1

percent.

Data from ANZ showed that New Zealand's business confidence

index rose to -31.1 points in May from -43.8 points in April.

Economists had expected a rise to -43.4 in May.

In the Asian trading today, the Australian dollar fell to nearly

a 7-month low of 0.6489 against the U.S. dollar, a 2-week low of

90.74 against the yen and a 5-day low of 1.6508 against the euro

from yesterday's closing quotes of 0.6517, 91.10 and 1.6464,

respectively. If the aussie extends its downtrend, it is likely to

find support around 0.64 against the greenback, 88.00 against the

yen and 1.67 against the euro.

Against the Canadian dollar, the aussie edged down to 0.8849

from yesterday's closing value of 0.8859. The aussie may test

support near the 0.87 area.

The NZ dollar fell to nearly a 7-month low of 0.5999 against the

U.S. dollar, nearly a 3-week low of 83.86 against the yen and

nearly a 4-week low of 1.7832 against the euro, from yesterday's

closing quotes of 0.6034, 84.49 and 1.7754, respectively. If the

kiwi extends its downtrend, it is likely to find support around

0.58 against the greenback, 81.00 against the yen and 1.81 against

the euro.

Against the Australian dollar, the kiwi edged down to 1.0824

from yesterday's closing value of 1.0780. On the downside, 1.09 is

seen as the next support level for the kiwi.

The Canadian dollar fell to 5-day lows of 1.3641 against the

U.S. dollar and 102.47 against the yen, from yesterday's closing

quotes of 1.3601 and 102.76, respectively. If the loonie extends

its downtrend, it is likely to find support around 1.38 against the

greenback and 100.00 against the yen.

Against the euro, the loonie edged down to 1.4612 from

yesterday's closing value of 1.4599. The next possible downside

target for the loonie is seen around the 1.48 area.

Looking ahead, German import prices for April is due at 2:00 am

ET. Half-an-hour later, Switzerland retail prices for April is

slated for release.

In the European session, Germany's unemployment rate for May and

Switzerland economic sentiment for May are set to be released.

In the New York session, U.S. MBA weekly mortgage data,

Germany's preliminary inflation rate for May, Canada GDP rate for

the first quarter, U.S. Chicago PMI for May, U.S. Dallas Fed

services index for May and U.S. Federal Reserve Beige book report

are due.

At 8:30 am ET, Christine Lagarde President of the European

Central Bank will participate in Q&A session with high-school

students at the final award ceremony of the Generation €uro

Students' Award competition 2023, in Frankfurt, Germany.

Twenty-minutes later, Federal Reserve Bank of Boston President

Susan Collins and Federal Reserve Board Governor Michelle Bowman

will give opening remarks before hybrid "Fed Listens" event to

discuss challenges and opportunities following the disruptions of

the COVID-19 pandemic, in Boston, U.S.

At 12:30 pm ET, Federal Reserve Bank of Philadelphia President

Patrick Harker will participate in fireside chat on the global

macroeconomy and monetary conditions before the Official Monetary

and Financial Institutions Forum, in Philadelphia, U.S.

One-hour later, Federal Reserve Board Governor Philip Jefferson

will deliver a speech virtually on "Financial Stability and the

U.S. Economy" to the 22nd Annual International Conference on Policy

Challenges for the Financial Sector, in Washington D. C., U.S.

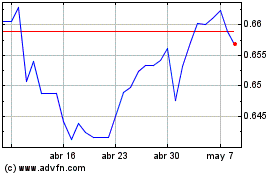

AUD vs US Dollar (FX:AUDUSD)

Gráfica de Divisa

De Mar 2024 a Abr 2024

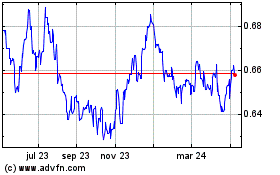

AUD vs US Dollar (FX:AUDUSD)

Gráfica de Divisa

De Abr 2023 a Abr 2024