Australian Dollar Rises After Strong China Manufacturing PMI Data

31 Mayo 2023 - 10:16PM

RTTF2

The Australian dollar strengthened against other major

currencies in the Asian session on Thursday, following the release

of China's manufacturing activity that expanded for the first time

in three months in May, as strong new orders boosted

production.

Data from from S&P Global showed that the China Caixin

manufacturing Purchasing Managers' Index picked up to 50.9 in May

from 49.5 in April. The reading was forecast to remain unchanged at

49.5.

The latest reading was above the neutral 50.0 level, suggesting

the first improvement in the health of the manufacturing sector

since February. Moreover, this was stronger than the post-pandemic

average.

Investor sentiment boosted after the passage of the U.S. debt

ceiling bill by the U.S. House of Representatives by a wide margin.

The U.S. Senate must vote on the bill later this week before U.S.

President Joe Biden can sign it into law to avoid a potentially

disastrous default.

In economic news, the manufacturing sector in Australia

continued to contract in May, albeit at a slower rate, the latest

survey from Judo Bank revealed on Thursday with a manufacturing PMI

score of 48.4. That's up from 48.0, although it remains beneath the

boom-or-bust line of 50 that separates expansion from contraction.

In the Asian trading today, the Australian dollar rose to nearly a

5-week high of 1.0844 against the NZ dollar and a 2-day high of

1.6397 against the euro, from yesterday's closing quotes of 1.0788

and 1.6433, respectively. If the aussie extends its uptrend, it is

likely to find resistance around 1.10 against the kiwi and 1.58

against the euro.

Against the U.S. and the Canadian dollars, the aussie advanced

to 0.6518 and 0.8841 from yesterday's closing quotes of 0.6502 and

0.8822, respectively. The aussie may test resistance around 0.67

against the greenback and 0.91 against the loonie.

The aussie edged up to 90.93 against the yen, from yesterday's

closing value of 90.59. On the upside, 95.00 is seen as the next

resistance level for the aussie.

In economic news, the manufacturing sector in Japan climbed back

into expansion territory in May, the latest survey from Jibun Bank,

with a manufacturing PMI score of 50.6. That's up from 49.5, and it

moves above the boom-or-bust line of 50 that separates expansion

from contraction.

Looking ahead, PMI reports from U.K. and European countries for

May, U.K mortgage approvals data for April, Eurozone flash

inflation rate for May and unemployment rate for April are due to

be released in the European session.

At 5:30 am ET, the President of the European Central Bank

Christine Lagarde will deliver a speech at 27th German Savings

Banks Conference 2023 "Because it's about more than money" in

Hannover, Germany.

At 7.30 am ET, the European Central Bank is set to issue the

account of the monetary policy meeting of the Governing Council

held on May 3 and 4.

In the New York session, U.S. weekly jobless claims data, PMI

reports from U.S. and Canada for May, U.S. construction spending

for April and U.S. EIA crude oil report are slated for release.

At 8:45 am ET, the chair of the Supervisory Board of ECB Andrea

Enria will deliver a keynote speech at the 22nd Annual

International Conference on Policy Challenges for the Financial

Sector organised by the World Bank, International Monetary Fund and

Federal Reserve System in Washington, D.C, U.S.

At 1:00 pm ET, Federal Reserve Bank of Philadelphia President

Patrick Harker will deliver a speech on the economic outlook before

virtual NABE Monetary Policy and Outlook Webinar, at Philadelphia,

U.S.

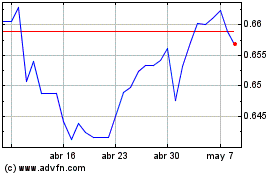

AUD vs US Dollar (FX:AUDUSD)

Gráfica de Divisa

De Mar 2024 a Abr 2024

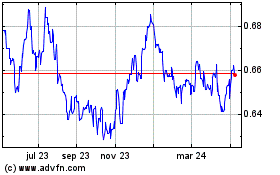

AUD vs US Dollar (FX:AUDUSD)

Gráfica de Divisa

De Abr 2023 a Abr 2024