U.S. Dollar Falls On Fed Pause Hopes

01 Junio 2023 - 6:17AM

RTTF2

The U.S. dollar was lower against its major counterparts in the

European session on Thursday, as dovish comments from Fed officials

renewed hopes of a pause in interest rate hikes this month.

Fed Governor Philip Jefferson and Philadelphia Fed President

Patrick Harker supported the possibility of holding rates steady at

the meeting on June 13-14.

Money markets are now pricing in a 66.8 percent chance of a

pause at the next meeting, up from a 48.3 percent chance last

week.

Concerns over a debt default eased as the House voted Wednesday

night to approve the bill raising the U.S. debt ceiling.

The Senate must vote on the bill later this week before

President Joe Biden can sign it into law.

Data from payroll processor ADP showed that U.S. private sector

employment jumped much more than expected in the month of May.

The report said private sector employment shot up by 278,000

jobs in May after surging by a revised 291,000 jobs in April.

Economists had expected private sector employment to increase by

170,000 jobs compared to the spike of 296,000 jobs originally

reported for the previous month.

Meanwhile, the Labor Department released a report showing a

slight increase in first-time claims for U.S. unemployment benefits

in the week ended May 27th.

The report said initial jobless claims crept up to 232,000, an

increase of 2,000 from the previous week's revised level of

230,000.

Economists had expected jobless claims to rise to 235,000 from

the 229,000 originally reported for the previous week.

The greenback fell to a 2-day low of 1.0741 against the euro and

a fresh 2-week low of 1.2510 against the pound, off its early highs

of 1.0661 and 1.2400, respectively. The greenback may locate

support around 1.10 against the euro and 1.27 against the

pound.

The greenback declined to a 1-week low of 138.81 against the yen

and an 8-day low of 1.3526 against the loonie, from its early highs

of 139.95 and 1.3585, respectively. The next possible support for

the currency is seen around 134.00 against the yen and 1.33 against

the loonie.

The greenback dropped to 0.6536 against the aussie and 0.6038

against the kiwi, reversing from its early highs of 0.6484 and

0.5990, respectively. Next key support for the currency is likely

seen around 0.68 against the aussie and 0.63 against the kiwi.

The greenback remained lower against the franc, with the pair

trading at 0.9074. If it drops further, it may find support around

the 0.89 area.

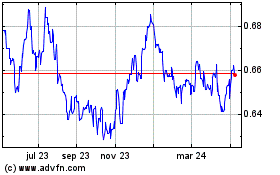

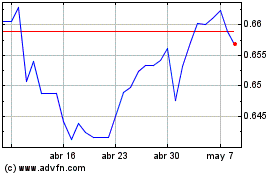

AUD vs US Dollar (FX:AUDUSD)

Gráfica de Divisa

De Mar 2024 a Abr 2024

AUD vs US Dollar (FX:AUDUSD)

Gráfica de Divisa

De Abr 2023 a Abr 2024