U.S. Dollar Moves Higher Amid Ongoing Interest Rates Concerns

15 Febrero 2023 - 10:20AM

RTTF2

The value of the U.S. dollar has moved to the upside on

Wednesday, with the greenback benefiting from its appeal as a safe

haven amid ongoing concerns about the outlook for interest

rates.

After reaching its best levels in a month earlier in the day,

the U.S. dollar index has given back some ground but remains up

0.61 points or 0.6 percent at 103.84. The U.S. dollar is trading at

134.13 yen compared to the 133.16 yen it fetched at the close of

New York trading on Tuesday. Against the euro, the dollar is

trading at $1.0690 compared to yesterday's $1.0738.

The buck has benefited from ongoing concerns about the outlook

for interest rates following yesterday's inflation data and today's

strong retail sales data.

Early in the day, the Commerce Department released a report

showing a substantial increase in U.S. retail sales in the month of

January.

The report said retail sales spiked by 3.0 percent in January

after tumbling by 1.1 percent in December. Economists had expected

retail sales to jump by 1.8 percent.

Excluding a surge in sales by motor vehicle and parts dealers,

retail sales still shot up by 2.3 percent in January after falling

by a revised 0.9 percent in December.

Ex-auto sales were expected to increase by 0.8 percent compared

to the 1.1 percent slump originally reported for the previous

month.

The sharp increase in retail sales has led to concerns the

Federal Reserve will be encouraged to continue aggressively raising

interest rates in an effort to combat inflation.

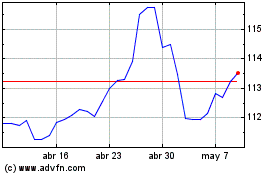

CAD vs Yen (FX:CADJPY)

Gráfica de Divisa

De Mar 2024 a Abr 2024

CAD vs Yen (FX:CADJPY)

Gráfica de Divisa

De Abr 2023 a Abr 2024