Yen Strengthens As Traders Remain Cautious

05 Marzo 2023 - 7:12PM

RTTF2

The Japanese yen strengthened against the other major currencies

in the Asian session on Monday, as traders remain cautious ahead of

the Bank of Japan's monetary policy meeting, and Federal Reserve

Chairman Jerome Powell's half-yearly testimony due later in the

week.

The Bank of Japan's monetary policy decision is set to release

on Friday. Economists expect the BOJ to maintain its policy rate of

-0.1 percent.

Meanwhile, trader's are keenly watching the BOJ management

change. The government elected Kazuo Ueda to succeed Haruhiko

Kuroda, whose Governorship ends in early April.

Federal Reserve Chair Jerome Powell will deliver his two-day

biannual monetary policy testimony on Capitol Hill in the coming

two days. Investors are keenly watching for any hint on Fed's

interest-rate hiking path. In the Asian session today, the

safe-haven yen rose to a 5-day high of 144.15 against the euro, and

a 4-day high of 144.76 against the Swiss franc, from Friday's

closing values of 144.36 and 145.03, respectively. If the yen

extends its uptrend, it is likely to find resistance around 141.00

against the euro and 140.00 against the franc.

The yen climbed to a 5-day high of 135.36 against the U.S.

dollar, from Friday's closing value of 135.80. The yen is likely to

find its resistance level around the 133.00 area.

Against the pound, the yen advanced to 163.17 from an early

4-day low of 163.68. The yen may find resistance around the 159.00

area.

Against the Australian and the New Zealand dollars, the yen

climbed to 5-day highs of 91.52 and 84.27from last week's closing

quotes of 91.87 and 84.48, respectively. The next resistance level

for the yen is seen around 88.00 against the aussie and 82.00

against the kiwi.

The yen edged higher to 99.67 against the Canadian dollar, from

Friday's closing value of 99.85. If the yen extends its uptrend, it

is likely to find its resistance at 95.00 against the loonie.

Looking ahead, Swiss CPI for February is set to release at 2:30

am ET in the late Asian session. Economists expects the inflation

rate to ease 3.1 percent from 3.3 percent in January.

Construction PMI reports for February from Eurozone and U.K. are

due, later in the European session. Moreover, Eurozone investor

confidence index for March and retail sales report for January are

also due. In the New York session, U.S. factory orders for January

and Canada Ivey's PMI for February are slated for release.

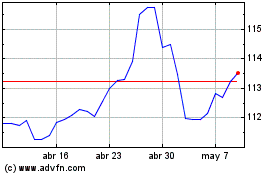

CAD vs Yen (FX:CADJPY)

Gráfica de Divisa

De Mar 2024 a Abr 2024

CAD vs Yen (FX:CADJPY)

Gráfica de Divisa

De Abr 2023 a Abr 2024