Swiss Franc Climbs As Focus Shifts To Central Bank Meetings

08 Diciembre 2022 - 11:32PM

RTTF2

The Swiss franc was higher against its major rivals in the

European session on Friday, as investors geared up for a slew of

central bank policy meetings due next week.

A weakness in the dollar ahead of the next week's Federal

Reserve monetary policy meeting and the inflation data could be

attributed to the currency's strength.

The Fed is expected to slow down its rate hike to 50 basis

points at the meeting to be held on December 13-14.

U.S. producer inflation data for November due later in the day

could offer more clues about the health of the economy.

Economists expect the PPI to rise to 7.2 percent year-on-year,

following a 8 percent increase in the previous month.

The franc jumped to 0.9325 against the greenback, its highest

level since April 14. If the franc rises further, it may locate

resistance around the 0.89 level.

The franc was higher against the pound and the euro, at 2-day

highs of 1.1425 and 0.9855, respectively. The franc is seen finding

resistance around 1.11 against the pound and 0.96 against the

euro.

The CHF/JPY pair hovered at a 2-day high of 146.21. The currency

is likely to challenge resistance around the 149.5 level.

Looking ahead, U.S. PPI for November and University of

Michigan's preliminary consumer sentiment index for December are

due in the New York session.

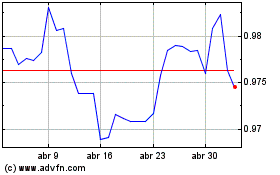

Euro vs CHF (FX:EURCHF)

Gráfica de Divisa

De Mar 2024 a Abr 2024

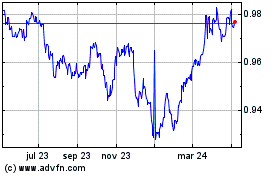

Euro vs CHF (FX:EURCHF)

Gráfica de Divisa

De Abr 2023 a Abr 2024