Swiss Franc Climbs On Recession Concerns

24 Junio 2022 - 1:13AM

RTTF2

The Swiss franc advanced against its major rivals in the

European session on Friday, on growing concerns about a recession

fuelled by aggressive rate hikes from the Federal Reserve to tame

inflation.

Powell said that the Fed's commitment to curbing inflation was

"unconditional," intensifying worries about the possibility of a

recession.

Commodity prices dropped on growing concerns over a global

economic downturn.

In his Congressional testimony on Thursday, Powell acknowledged

that the Fed's monetary policy tightening may push up

unemployment.

There are no precision tools and the possibility of unemployment

moving up has risen, Powell added.

The franc rebounded to 140.96 against the yen, from a low of

139.87 seen at 4 am ET. On the upside, 141.00 is possibly seen as

its next resistance level.

The franc edged up to 0.9578 against the dollar and 1.1757

against the pound, from its early lows of 0.9632 and 1.1805,

respectively. The currency is likely to locate resistance around

0.92 against the dollar and 1.16 against the pound.

The franc recovered slightly to 1.0100 against the euro, after

falling to 1.0139 at 4:20 am ET. If the franc rises further, 0.99

is possibly seen as its next resistance level.

Looking ahead, U.S. new home sales for May and University of

Michigan's final consumer sentiment index for June are due in the

New York session.

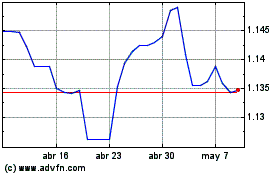

Sterling vs CHF (FX:GBPCHF)

Gráfica de Divisa

De Mar 2024 a Abr 2024

Sterling vs CHF (FX:GBPCHF)

Gráfica de Divisa

De Abr 2023 a Abr 2024