U.S. Dollar Higher On Prospects Of Larger Fed Rate Hike

13 Julio 2022 - 11:05PM

RTTF2

The U.S. dollar spiked up against its major counterparts in the

Asian session on Thursday, as red-hot U.S. inflation data fuelled

expectations about even more aggressive Federal Reserve monetary

tightening at the upcoming policy meeting on July 26-27.

Investors expect that the Fed is likely to raise rates by 100

basis points later this month to curb 40-year high inflation.

The closely watched 2-year/10-year yield curve remained

inverted, in a sign that the Fed's steeper rate hikes could push

the economy into a recession.

Following the release of the data, Atlanta Federal Reserve Bank

President Raphael Bostic signalled the possibility of a 100 basis

point increase at the next meeting.

"Everything is in play," Bostic said during a tour of Tampa and

St. Petersburg.

In a surprise move, the Bank of Canada on Wednesday lifted its

benchmark interest rate by 100 basis points to tame high

inflation.

The greenback touched 138.79 against the yen, a level unseen

since September 1998. The greenback is seen finding resistance

around the 140.00 level.

The greenback climbed to 2-day highs of 1.1824 against the pound

and 0.9841 against the franc, after falling to 1.1893 and 0.9776,

respectively in early deals. If the greenback rises further, 1.16

and 1.00 are possibly seen as its next upside target levels against

the pound and the franc, respectively.

The greenback edged up to 1.0005 against the euro and 1.3025

against the loonie, reversing from its early lows of 1.0059 and

1.2964, respectively. The greenback is poised to find resistance

around 0.97 against the euro and 1.32 against the loonie.

The greenback rebounded slightly to 0.6747 against the aussie

and 0.6108 against the kiwi, following its prior lows of 0.6786 and

0.6133, respectively. On the upside, 0.66 and 0.59 are likely seen

as its next resistance levels against the aussie and the kiwi,

respectively.

Looking ahead, the European Commission is scheduled to issue

Summer Economic Forecast at 5.00 am ET.

Canada manufacturing sales for May, U.S. producer prices for

June and weekly jobless claims for the week ended July 9 will be

featured in the New York session.

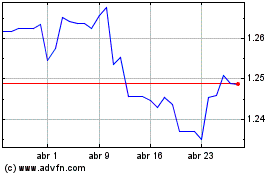

Sterling vs US Dollar (FX:GBPUSD)

Gráfica de Divisa

De Mar 2024 a Abr 2024

Sterling vs US Dollar (FX:GBPUSD)

Gráfica de Divisa

De Abr 2023 a Abr 2024