Dollar Drops As Treasury Yields Fall

04 Octubre 2022 - 2:08AM

RTTF2

The U.S. dollar fell against its major counterparts in the

European session on Tuesday, as data showing a slowdown in U.S.

manufacturing activity tempered expectations for aggressive

monetary tightening by the Federal Reserve.

U.S. treasury yields dropped after weak data, with the benchmark

yield on the 10-year note touching 3.58 percent. Yields move

inversely to bond prices.

European shares rose sharply as soft ISM manufacturing data

raised hopes for slower Fed tightening.

Investors await U.S. non-farm payrolls report due later this

week to help determine the central bank's rate hike path in the

period ahead.

The greenback weakened to a 2-week low of 1.1429 against the

pound and near a 2-week low of 0.9896 against the euro, off its

early highs of 1.1280 and 0.9806, respectively. The greenback may

challenge support around 1.23 against the pound and 1.09 against

the euro.

The greenback edged down to 0.9867 against the franc, from a

high of 0.9942 set at 10 pm ET. On the downside, 0.93 is possibly

seen as its next support level.

The greenback slipped to an 8-day low of 1.3568 against the

loonie, near 2-week lows of 0.6547 against the aussie and 0.5758

against the kiwi, from its prior highs of 1.3653, 0.6451 and

0.5680, respectively. The greenback is seen finding support around

1.33 against the loonie, 0.70 against the aussie and 0.62 against

the kiwi.

The greenback pulled back to 144.53 against the yen, from a high

of 144.92 seen in the previous session. If the greenback falls

further, it is likely to test support around the 121.00 level.

U.S. factory orders for August will be featured in the New York

session.

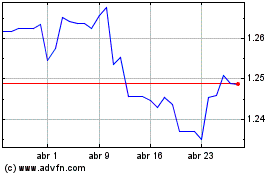

Sterling vs US Dollar (FX:GBPUSD)

Gráfica de Divisa

De Mar 2024 a Abr 2024

Sterling vs US Dollar (FX:GBPUSD)

Gráfica de Divisa

De Abr 2023 a Abr 2024