U.S. Dollar Appreciates Amid Fed Tightening Prospects

07 Junio 2022 - 1:26AM

RTTF2

The U.S. dollar climbed against its major counterparts on

Tuesday, amid expectations that the U.S. Federal Reserve will

tighten its monetary policy aggressively to combat inflation.

Investors await U.S. inflation data due on Friday to assess the

Fed's policy tightening path going forward.

The Fed is widely expected to raise interest rate by half-point

at its meetings due this month and next.

The benchmark 10-year treasury yield rose above 3 percent

earlier in the session, before easing a bit later.

U.S trade data and consumer credit for for April will be

released later today.

The greenback touched multi-week highs of 0.9767 against the

franc and 1.2431 against the pound, up from its early lows of

0.9700 and 1.2534, respectively. The next possible resistance for

the greenback is seen around 0.99 against the franc and 1.22

against the pound.

The greenback jumped to 133.00 against the yen, its strongest

level since April 2002. Against the euro, it approached a 3-day

high of 1.0665. The greenback is likely to face resistance around

136.00 against the yen and 1.05 against the euro.

The greenback reversed from its early lows of 1.2568 against the

loonie and 0.6496 against the kiwi, hitting a 3-day high of 1.2618

and near a 2-week high of 0.6440, respectively. The greenback is

seen finding resistance around 1.28 against the loonie and 0.62

against the kiwi.

The greenback held steady against the aussie, after having

recovered to 0.7166 from a 4-day low of 0.7245 hit at 12:30 am ET.

It has touched a multi-day high of 0.7159 earlier in the Asian

session. At yesterday's trading close, the pair traded at

0.7191.

Looking ahead, U.S. and Canadian trade data for April, Canada

Ivey PMI for May and U.S. consumer credit for for April will be

released in the New York session.

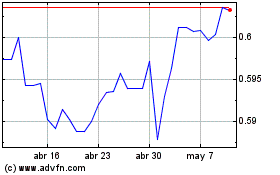

NZD vs US Dollar (FX:NZDUSD)

Gráfica de Divisa

De Mar 2024 a Abr 2024

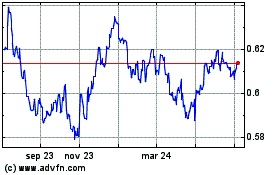

NZD vs US Dollar (FX:NZDUSD)

Gráfica de Divisa

De Abr 2023 a Abr 2024