U.S. Dollar Showing Weakness Against Majors

19 Mayo 2022 - 2:06AM

RTTF2

The U.S. dollar weakened against its major rivals in the

European session on Thursday on hopes that its recent rally was

overdone.

U.S. treasury yields fell, with the benchmark 10-year yield

touching 2.84 percent.

Investors fear that the central banks' attempts to fight

inflation by steep monetary tightening is likely to slow global

growth.

Overnight data showing a fall in U.S. housing starts and

building permits for April added to worries about a slowdown in the

economy.

Earnings reports from retailers showed that high inflation were

hurting corporate profits, with Target reporting bleak

first-quarter results due to higher fuel and freight costs.

On the economic front, U.S. weekly jobless claims for the week

ended May 14 and existing home sales for April are due out later

today.

The greenback dropped to a 1-week low of 127.73 against the yen

and a 2-week low of 0.9749 against the franc, down from its

previous highs of 128.94 and 0.9885, respectively. The greenback is

seen finding support around 121.00 against the yen and 0.95 against

the franc.

The greenback reached as low as 1.2407 against the pound,

following a high of 1.2334 hit at 5 pm ET. Against the euro, it

edged down to 1.0509. The next possible support for the greenback

is seen around 1.27 against the pound and 1.08 against the

euro.

The greenback was trading lower against the loonie and the kiwi

and were quoted at 1.2820 and 0.6353, respectively. On the

downside, 1.26 and 0.65 are possibly seen as the next support

levels for the greenback against the loonie and the kiwi,

respectively.

In contrast, the greenback held steady against the aussie, after

recovering to 0.6958 from the Asian session's low of 0.7024. The

pair traded at 0.6953 at yesterday's close.

Looking ahead, the European Central Bank publishes the account

of the monetary policy meeting of the Governing Council held on

April 13-14 at 7:30 am ET.

U.S. weekly jobless claims for the week ended May 14 and

existing home sales for April, as well as Canada new housing price

index, industrial product and raw materials price indexes, all for

the same month, are due out in the New York session.

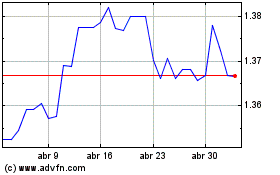

US Dollar vs CAD (FX:USDCAD)

Gráfica de Divisa

De Mar 2024 a Abr 2024

US Dollar vs CAD (FX:USDCAD)

Gráfica de Divisa

De Abr 2023 a Abr 2024