U.S. Dollar Higher On Aggressive Rate Hike Hopes

13 Junio 2022 - 4:58AM

RTTF2

The U.S. dollar appreciated against its most major counterparts

in the European session on Monday, as hot U.S. inflation data drove

the treasury yields higher and raised expectations that the Federal

Reserve will continue to tighten policy aggressively in the coming

months.

Data from Labor Department showed on Friday that the U.S.

consumer price index rose to a four-decade high of 8.6 percent in

May, beating economists' expectations of 8.3 percent.

The data fuelled a selloff in stock markets as investors fear

that aggressive monetary tightening could cause a recession.

The Fed meeting is also in focus, as investors expect a rate

hike of 50 basis points amid soaring inflation.

Key U.S. economic data due this week include producer price

index, retail sales, housing starts and industrial production.

The greenback reached as high as 0.9945 against the franc, its

highest level since May 18. The greenback is likely to target

resistance around the 1.02 region.

The greenback touched multi-week highs of 1.0445 against the

euro and 1.2162 against the pound, coming off from its previous

lows of 1.0520 and 1.2321, respectively. The next possible

resistance for the greenback is seen around 1.00 against the euro

and 1.19 against the pound.

Reversing from its early lows of 0.7044 against the aussie and

0.6350 against the kiwi, the greenback moved up to multi-week highs

of 0.6957 and 0.6276, respectively. The greenback may find

resistance around 0.68 against the aussie and 0.60 against the

kiwi.

The greenback was up against the loonie, at nearly a 3-week high

of 1.2868. If the greenback rises further, it may find resistance

around the 1.30 level.

In contrast, the greenback pulled back to 133.83 against the

yen, from more than a 20-year high of 135.20 seen in the Asian

session. The greenback is seen finding support around the 128.00

mark.

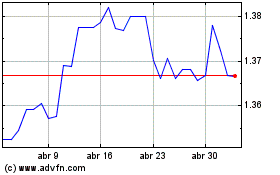

US Dollar vs CAD (FX:USDCAD)

Gráfica de Divisa

De Mar 2024 a Abr 2024

US Dollar vs CAD (FX:USDCAD)

Gráfica de Divisa

De Abr 2023 a Abr 2024